This week’s episode was recorded during a week that saw Black Lives Matter protests in all 50 states, and in most major cities worldwide. Our nation is hurting right now, but it’s also being educated, as we seek to listen and have the kinds of conversations that have been so very long in coming.

Yet people may often be afraid to start some of those conversations — many white people may worry about saying the “wrong” thing to a Black colleague or friend, but our guest this week says that it’s so much worse to not say anything. In order to be a true ally, individuals have to voice that they want to help, show that they are supportive, and then back up words and actions with education and genuine efforts to elevate voices of color in every avenue.

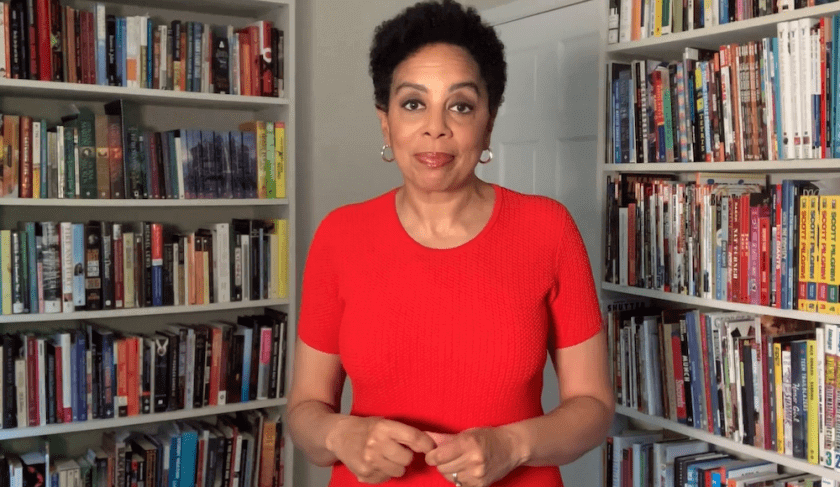

Sharon Epperson is the Senior Personal Finance Correspondent at CNBC, and the lead contributor to CNBC’s “Invest In You.” Sharon is also an adjunct professor at Columbia University and author of the book, “The Big Payoff: 8 Steps Couples Can Take To Make The Most Of Their Money And Live Richly Ever-After.” This week, Sharon and Jean dive into a heartfelt conversation about the anguish that Black people are feeling right now, and what others can do to offer support. Sharon even offers a script for anyone worried about how to broach the topic:

“I just want you to know that I’m thinking of you and I’m checking in to see how you’re doing. I know I can’t imagine how you’re feeling right now — and how these issues have affected you your entire life — but I want to tell you that I’m here. Please let me know if there’s anything I can do.” When Sharon hears those words from a white friend, she says, “Now, I know that you thought enough to think, ‘How am I doing?’”

The truth is that non-Black people have no way of knowing how the Black community is feeling right now, Sharon says, but hearing “I’m here and I care,” goes a long way.

“That opens the door for me to say how I’m feeling, and maybe to share something with you that gives you a little more insight on why this is so traumatizing,” she says.

Sharon gets personal with instances of microaggressions that she’s encountered over the years, both at work and in her personal life, and she and Jean get real about the fact that women of color are behind white women by almost every financial and career measurement. For example, Equal Pay Day — the date in the calendar year that marks how far the average woman must work to earn the same amount the average man did during the previous year — fell on March 31 this year for all women. For Black women, Equal Pay Day won’t come around until August 13. Black women, on average, make just 61 cents for every dollar a man earns, compared to the 82 cents-per-dollar wage gap for women of all races. In pay equality forecasts, white women are expected to reach pay parity with men by 2055, but Black women aren’t expected to get there until 2119. There are so many gaps — so many slights, and all of this is happening at a time when Black women are far more essential to the wellbeing of their family than white women. (Black women are twice as likely to be the primary breadwinner in their family than white women.) Sharon and Jean discuss all of this, and what allies can do to spur change.

The best place to start is with education, Sharon says — white women must start by educating themselves on how big the gaps are, and why those gaps exist. And this education might not be easy — “It can shine a light on what you may or may not have done in your own life,” she says. Sharon and Jean also discuss the meaning of structural racism, and how and why we’re seeing coronavirus impacting Black and Latinx communities more — it all boils down to inequalities with housing, healthcare, health insurance, and jobs. “The pandemic is highlighting major areas of crisis for the Black community,” she says.

In closing, Sharon offers up recommendations for where non-Black women can begin to educate themselves. First, there must be an understanding of what microaggressions are, and how they may contribute to racial trauma. There are infographics here and here that offer a good place to start. Second, she recommends a trip to the National Museum of African American History in Washington, D.C., which is part of the Smithsonian. (Even though they’re closed now, they have myriad online multimedia tools where people can begin to learn during the pandemic.) Lastly, she recommended this article by her CNBC colleague Courtney Connley, all about how to be a better ally for our Black co-workers.

Now is the time that everyone has to act, Sharon says. “Just check in, speak up, just let people know that this is angering you, too, that you didn’t realize it was exactly like this, but you’re seeing it, and you’re just speechless. You’re sharing that you want to make a difference and you want to try to make a change… And also understand that when you don’t say this, your silence can be deafening to your friends of color, to your colleagues of color, and parents of color.”

In Mailbag, Jean and Kathryn talk through the best ways to start saving for a house while continuing to save and pay down debt. They also hear from a listener who has $40,000 to invest but who is unsure if she should put the money in the market now, given the current volatility. Lastly, Jean advises a woman who is curious how best to support her aging parents who have historically made poor financial decisions.

In Thrive, we look at why it may be time to check your junk mail for your stimulus check — some people aren’t getting a “check” at all, rather a prepaid debit card that could be popping up in your mailbox in an unmarked envelope.

Own your money, own your life. Subscribe to HerMoney to get the latest money

news and tips!

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Transcript

Sharon Epperson: (00:02)

There’s no way for you to exactly know how that feels and what the conversation might be like. But just to say, I’m here, I care, that opens the door for me to say how I’m feeling and maybe to share something with you that gives you a little more insight on why this is so traumatizing.

Jean Chatzky: (00:21)

HerMoney is brought to you by Fidelity Investments. Fidelity is committed to helping clients through any market conditions with financial planning and advice when you need it most. Learn more@Fidelity.com.

Jean Chatzky: (00:43)

Hey everybody, I’m Jean Chatzky. Thanks so much for being here with me today on HerMoney. I want you to know no, we are recording this episode during a week that has seen Black Lives Matters protests in all 50 states and in many major cities worldwide. Our nation is hurting right now, but it’s also being educated as we try to listen and have the kinds of conversations that have been way too long in coming. And so today I am really, really happy to be sitting down for a conversation with Sharon Epperson, Senior Personal Finance Correspondent at CNBC, lead contributor to CNBC Invest In You. Sharon is also adjunct professor at Columbia University and author of the book, “The Big Payoff: 8 Steps Couples Can Take to Make the Most of Their Money–and Live Richly Ever After.” You have heard her on this show before. She is also for many, many years, a friend of mine. Sharon, thanks so much for taking the time to be with me today.

Sharon Epperson: (01:57)

Thanks so much Jean, for having me. It’s great to be on HerMoney.

Jean Chatzky: (02:00)

So where am I getting you today?

Sharon Epperson: (02:03)

You’re getting me at my new studio. It’s called my home office, which was recently remodeled to have these wonderful bookshelves and a great little setup. Didn’t really have a great desk before this all happened. So I’m kind of working on, I think it was like a childhood desk or something. But I have a TV set up with up with lights and I have a padcaster which is basically an iPad with a lens on it that I use to live report for CNBC. So it’s a new day. But I’m actually enjoying kind of learning it. I’ve learned so many different platforms in the last couple of months and now I realize I actually can do TV from my house. So it’s kind of awesome.

Jean Chatzky: (02:42)

It is. It is kind of awesome. It has been a week. It has been a couple of months. And I want to dig into it because this is one of those times when I know we all are, so many of us, I am feeling like I just need an education. I need the right words to have conversations about Black women and money about all women of color and money about minorities and money. And sometimes like so many people, I feel like I’m going to say the wrong thing at the wrong time. So let’s just level set for a second to where we are. Today’s the day that we know the unemployment rate fell actually. It fell from April’s record of 14.7% to 13.3%. The markets rallied, but this was yet another example of things that are true for the white community that are not true for the Black community. Unemployment for white workers fell to 12.4%. Unemployment for Black workers rose to 16.8% – the highest that it’s been in more than a decade. And it reversed actually what had been historic declines. I mean, African-Americans had record low unemployment rates just back last August. So in the scheme of things, when you look at the landscape, how do you think Black women are doing right now?

Sharon Epperson: (04:29)

I think Black women are angry. I think Black women are frustrated. I think, and let me back up. I will say, I think this Black woman is angry. This Black woman is frustrated. This Black woman is in anguish as a mother and as a wife, of what her 18 year old son and her husband will be going through, or go through on a daily basis, but will be going through now watching and seeing over and over and over again, images that are replayed of what they know has been happening for decades, hundreds of years. But now seeing it every day on the news in every social media feed, many people are having trouble sleeping. Many people are feeling extremely anxious. Many people are feeling extremely fearful. And it’s a very, very difficult time.

Jean Chatzky: (05:22)

You and I are friends, right? I mean, we’ve been friends for a long, long time. What are the words that I should be using to support you? What can I say? I mean, I have nothing in my privileged life to put myself in the shoes that you are walking in right now. I can pull on experiences that I might think might be something like that. But I know they’re really not. What helps to hear? What helps to do?

Sharon Epperson: (05:57)

It is so simple Jean. It is so simple. I’m thinking of you, I’m just checking in to see how you’re doing. The news is so upsetting to me. I know I can’t imagine how you’re feeling, but I just want to let you to know I’m here. And let me know if there’s anything that I can do. Now I know from a message like that, there’s really nothing you can do, but you thought enough to think, how am I doing? And as you are coping with going through this pandemic of dealing with whatever issues this brings up of trials, you’ve had in your own life, with your own family, dealing with healthcare, dealing with different issues, dealing with hospitals. That kind of trigger, imagine the trigger that I have when I’m watching on television, someone who is a consummate professional, Black male reporter, be handcuffed for doing his job. And I’m sitting next to my 18 year old son who may one day want to go to this college that this young man went to, may one want to have a job like that. And in doing his job, just doing his job, he could be arrested. There’s no way for you to exactly know how that feels and what the conversation might be like. But just to say, I’m here, I care, that opens the door for me to say how I’m feeling and maybe to share something with you that gives you a little more insight on why this is so traumatizing. Because that is what’s happening right now. What’s happening right now is, it is a scientific, psychological issue that has the same ramifications or similar to any other type of trauma. This is racial trauma and the racial trauma is not just seeing that image of police brutality or the stories and the families telling the stories of what happened to their loved ones in their own home or jogging, which my son and daughter also do every day in our predominantly white neighborhood. It is the fact that when I go to work where I’ve been for 23 years, people are constantly asking me for my ID or having to, not only that cause that I understand that that needs to be done, but looking at my name because they don’t really recognize me. But they’re not very many other people on the air at CNBC who have been there for over 20 years. The microaggressions of colleagues saying, you know, this is not changing. We’ve been in business a very long time. This isn’t really like our story, right? I mean the protest, we’re not going to cover that because unless it impacts the stimulus check, why are we talking about it? So it is, I’ve answered your question and then some, but I think the first step is to just acknowledge that this is a tough time.

Jean Chatzky: (08:28)

Yeah. Well, I think we can all do more of that. But I also want to help us all do better. Right? We dug in and we did a story on HerMoney.com. Not a piece of service journalism, because there was no real service to be done at this point. But just a look at how Black women are really, really doing financially. And the picture is just awful. We know that on equal pay day this year, the day in the year that the average woman has to wait to earn the same amount that the average man did during the previous year. This year equal pay day fell on Tuesday March 31st, 2020, unless you’re a Black woman. And then it’s not coming around until August 13th. And when we look at pay equality overall and the forecasts, white women will get there by 2055, which is way too long. Black women are not expected to reach it until 2119. You know, stated another way, there’s so many gaps. There are so many slights. And all of this is happening at a time when Black women are far more essential to the wellbeing of their family, then white women. They’re twice as likely to be the primary breadwinner in the family. I mean, these statistics are everywhere. There are so many of them. And I know that we could talk about other women of color and they face similar situations. When we are talking about creating change, and I acknowledge change is going to be a long process, what do you think we need to do in order to help Black women along?

Sharon Epperson: (10:39)

I think the place to start Jean is to start with educating yourself. And the fact that you’ve written about this, and I’ve written about it extensively on CNBC.com as well, about this disparity in income, in wealth overall and job advancement, I think is really important. And so start there of knowing how big the gaps are but then you have to also educate yourself as to why those gaps exist. And that can be harder because that’s actually shining a light perhaps on what you may or may not have done. If you are a manager and you had the opportunity to interview someone who was your college friend’s son or daughter and that friend did not happen to be a person of color, or you had an opportunity to try to connect with the alumni office at your alma mater and specifically request, can you send me some people, some women of color I’m looking to hire for this position or something like that. There are, I think, opportunities to talk about, having the discussions about money and personal finance and being frank about that is not something that a lot of people want to do regardless of their color. But I think that having those kinds of discussions and making sure they’re inclusive will also help people to realize that when we’re talking about trying to understand how to save or how to spend wisely, the perspective is very different for someone who has such a wide pay gap, who is maintaining a household. Is the first in the family to have gone to college and be able to have the particular job that they have, or that has more student loan debt because didn’t understand exactly how it worked and didn’t have someone to advise them. Or someone who maybe even had a similar socioeconomic background, but also had an education background or a mentoring background to know the right way to approach the student loan environment. So I think it’s great that stories are coming out establishing what the gaps are and how big they are. But I think that many people of color have known that our whole lives. So we’ve seen those statistics. We live those statistics. Again, it’s important that everyone knows them. The next step is the service journalism needs to include perspectives that are very broad. So we are talking about some of the basic things that you need to do to just get yourself on the right financial footing, you know, keeping a record of all the money that’s coming in and all the money that’s going out. Making sure that you’re saving and using tools that are cost effective or a tax advantage like a Roth IRA. But you have to really start at the very beginning for some people who may not have had the education and the exposure to this, to explain exactly how this works, who do I ask to do this? And what helps I find also is, that you’re calling on experts that represent the people that you want to make sure are reading the material or listening to the material so that it could be a story that’s just about what is a Roth IRA and how does it work and why does it make sense for me for a number of reasons. But the money manager or the financial advisor that you talk about this has to do so from the perspective of a person of color. Who is saying, particularly if you are a single woman and you are wanting to save for retirement, but you’re worried about your kids’ college education and you don’t have enough of an emergency fund, here’s a one-stop shop. You know, you have this account for five years, you can now dip into it. You can use it for emergencies if you have to but it really should be for retirement. But guess what, if you have to use it for college savings, you have that too, but at least you start the discipline of saving. But tell the story. It’s a story about Roth IRAs, but it’s told from a perspective of someone who’s juggling a lot, and happens to be a person of color. I think that could be very helpful.

Jean Chatzky: (14:24)

Yeah. I think you’re absolutely right. We had a long talk during our editorial meeting this week about the fact that it’s not enough just to present correct information. That we have to be more diverse and more inclusive in our sourcing and in the examples of the women and the stories that we tell, because otherwise people can’t find themselves in the copy. They can’t find themselves in the story. And even if you’re trying to be correct, you’re not being as welcoming as you should be.

Sharon Epperson: (15:01)

And I think it’s important for people to realize, when there are stories that they see or they’re hearing things about, even going back to before the unrest and the focus was on the coronavirus pandemic. And there were reports that were, when you just look at the numbers, that it was impacting Black and Latino communities, more so than white communities. And why is this happening in terms of the number of cases and the number of deaths? Even in my case, I wanted to try to find some preexisting condition that perhaps contributed to this happening. But the doctors that I was talking to and the research that I then looked into, of course, it’s not that. It’s structural racism, it is housing issues where you’re living in very close proximity. It’s going to work every day outside of your home. Not sheltering in place because you’re an essential worker. It’s not having access to healthcare and to proper health insurance and healthcare coverage, because you don’t have financially the capacity to have that until you haven’t been doing preventative care, perhaps. And there’s just the fact that we’re not exactly sure why this is happening at such a rate. There is that uncertainty as well. But I think we have to get beyond, and this is why this is such an interesting time now, that things that have been happening that were happening in my parents’ generation and their parents’ generation, now we have an opportunity because I think people want to know more about why is it happening? And I think maybe that’s because they’re actually seeing it. They’re actually seeing videos. And they’re actually seeing stories on social media about people that may be people that, if they don’t know them personally, they may be in the workplace with someone kind of like that, or they may have just seen them on TV. And so that helps a lot. I want to share with you one thing that I found this week from a really great study that was done by McKinsey about looking at kind of the opportunity gap for not just Black women, but Black Americans. And it found that 65% of Black Americans live in 16 States that score well below the national average in terms of healthcare access, public health and economic opportunities. And all of those are areas that have been shown to accelerate wealth generation. So it’s not an isolated incident. It’s not, you know, this is just a pandemic. And, you know, we don’t have to look broadly at what the ramifications of this are. It’s all tied together. And I think there’s no coincidence that this is happening in the midst of a pandemic. I don’t believe that there’s a coincidence. I think this is highlighting three major areas of crisis that we’ve had in terms of public health, in terms of healthcare access, in terms of the lack of economic growth. And it’s all coming to a head and now we have to address it.

Jean Chatzky: (17:52)

I agree with you. I think that some of the smartest people that I have been paying attention to over the past week or so have been saying, you really have to take a breather and get an education at this point. You have to understand why this exists, how long these problems have been brewing and how they go back for, not just decades, but centuries back to Abraham Lincoln. And I got a bit of an education when I wrote “Women With Money” and dug into why the salary gap was so much greater for Black women and learned about how Lincoln had set up the Freedman’s Savings and Trust Company, the Freedman’s Bank. And that was supposed to allow Blacks to save and learn about money after slavery. And they did such an amazing job at that saving what would be worth $6 trillion today. And the money was just stolen. It was stolen. It was used to build the treasury annex building in DC. The people who saved this money were never, ever reimbursed. And on top of that, you had 90 years of Jim Crow laws and redlining, and that was just the tip of the iceberg. And so I’m wondering for all of our listeners who do want to just take a breather this summer and get an education and really get smarter about why this exists so that we can do better. What would you have them read?

Sharon Epperson: (19:42)

Jean, I’m glad you asked me that because I’ve been thinking, and I know in my whole approach trying to get people some strategies, I try to do my tips. So my three tips of what could help you read today, cause it’s not a lot. At least to bookmark and no where to go. The first thing I would say was to figure out what racial trauma is. Educate yourself about what that is. And there’s a really great infographic that maybe you can link to you on the site from the Boston college that looks at what the microaggressions may be, what some of the things that are fueling and causing this feeling of racial trauma. What are some of the feelings of it in terms of feeling anxiety or fear, hopelessness, sleeplessness. And then what are some ways to cope? And you know, whether that is disconnecting from everything. Whether that is, you know, breathing meditation, those types of things, or whether it’s connecting with other groups to kind of talk about how you’re feeling, including talking to mental health professionals, because this is a significant psychological event. Then the other thing I would suggest reading is or going to, is to go to the National Museum of African American History. It’s part of the Smithsonian. And there is no way to g, of course we can’t go to that museum in person anyway, but there’s no way to go through that museum in a day. In two days. It is just so comprehensive and it’s a wonderful, wonderful museum. But they have provided multimedia tools online to talk about ways to figure out how do I start the conversation with my children? How do I start the conversation with my colleagues, with people that want to be my ally? So I would urge people to go to that link with the Smithsonian’s National Museum of African American History to educate themselves about race and also think about how to have the conversation. And then I would suggest an article that one of my CNBC colleagues, Courtney Connley wrote this week about how to be an ally to your Black coworkers, or that could be your Black friends or the Black parents that are in your child’s school. And you started from the very beginning Jean, doing exactly what you have to do. Recognize your privilege, own it. I didn’t ask for it, but I know I have it. I have this privilege and I need to understand that that makes me a little bit different and requires that I have to go to this next step which is to educate myself. And that is to go and look at certain books and also look at certain websites and do some research to find out what more I need to know. And then those simple words I was telling you to just check in. Just check in. Speak up. Just let people know that this is angering you too. That you didn’t realize it was exactly like this, but you’re seeing it. And you’re just speechless. And you’re not, in that way, asking for someone to validate your feelings necessarily, but just to make sure that in your own way, you’re sharing that I want to make a difference. I want to try to do something and create some change. And also understand that when you don’t say this, that silence can be deafening to your friends of color, to your colleagues and parents of color. It almost is seen sometimes as being, that kind of silence as being complicit in allowing this to continue to go on. So you want to make sure that you’re aware of that. And when it comes time to come together on different issues, whether that’s in your workplace, whether that’s coming together to make the best type of virtual graduation possible for your fifth grader or your eighth grader or your high school student or your college student, that you’re including parents that are representative of all of the children in your child’s school. Or if there are no children of color at your child’s school, I know of, in this neighboring community or in this place, they don’t have those resources, but we have this great idea to put graduation on Minecraft. Is there some way we could supply this school with some of the tools to help them do a virtual graduation? Maybe some of the kids don’t even have the proper internet access, but there’s something that I can do. So I think those five steps are really important. Recognizing your privilege. Educating yourself. Making sure that you speak up and you check in. Understanding that your silence, if you are silent, is complicit. And then figuring out ways that you’re able to promote and support the Black people in your life, in your workplace, or where you live, or in your schools, or people that you see that you don’t know. So now you’re going to have to do more research and figure out how do I want to help? Do I want to help an education? Do I want to help in finance? Do I want to help in my spiritual growth and make sure that’s inclusive? However you want to do it. But now it’s the time everyone has to act.

Jean Chatzky: (23:55)

Absolutely. Thank you so much for talking to me today. Thank you for telling me that it’s okay to say, are you okay? Because you know, sometimes we just don’t know. But I will continue to check in and not just with you, but with everybody that I know personally, who is suffering right now and with all of the members of the HerMoney community as well. Sharon Epperson is Senior Personal Finance Correspondent at CNBC. She also has a wonderful Twitter feed. You can follow her there. And she is lead contributor to CNBC Invest In You. Sharon, thanks.

Sharon Epperson: (24:35)

Jean, thank you so much for reaching out, for being my friend, for understanding on many levels, different things that we both have gone through. And this may be something that is definitely unique to my experience and not yours, but I know that you care. And just sharing that means the world. And so thank you very much and thank you to HerMoney for all that you’re doing to really bring awareness.

Jean Chatzky: (24:57)

We’re all just doing our best. I will talk to you very, very soon. And hopefully see you in person when we can social distance.

Sharon Epperson: (25:05)

Can’t wait. I look forward to it. Take care.

Jean Chatzky: (25:07)

Thanks. Bye.

Sharon Epperson: (25:09)

Bye.

Jean Chatzky: (25:17)

Before we move on to your mailbag, I want to just take a moment and remind everybody that HerMoney is supported by Fidelity Investments. For more than 70 years, investors have relied on Fidelity to help plan for their financial futures. And as always, when the unexpected happens, Fidelity is there to help you work through it with financial planning and advice for what you need today and tomorrow, helping to make it all clear. To see how Fidelity can help you and your family on the path forward, visit Fidelity.com. And we are back with Kathryn and your mailbag. Hey Kathryn.

Kathryn Tuggle: (25:55)

Hey there, Jean.

Jean Chatzky: (25:56)

So one of the things that has been suggested to me this week is that everybody needs to go toward the deep South. That we should all, at some point when we’re out of lockdown, make a trip to Birmingham and the surrounding areas and really immerse ourselves in that history if we’ve never done it before. And it made me think about you because that’s where you’re from.

Kathryn Tuggle: (26:24)

I couldn’t agree more with that. The Civil Rights Museum in Birmingham is just one of the crown jewels of the South, I think. And you can really feel the history, you know? In Selma, you can walk over the Edmund Pettus Bridge. You can see the bus where Rosa Parks took her stand. And there’s nothing quite like that.

Jean Chatzky: (26:47)

Yeah, it made me realize. I mean, I’ve visited many, many states. I’ve been to the South, but I’ve never been to Birmingham. I’ve never been to Selma. Closest I think was Jackson. And I think that’s a trip that I would like to do when we are cleared to do it. And I echo Sharon’s recommendation to go see the museum in Washington. I mean, what’s inside is remarkable, but it’s also one of the most beautiful buildings that I have ever seen.

Kathryn Tuggle: (27:20)

It’s so true. It is stunning. And you know what we’re talking about with all this is not necessarily traveling to a place. It’s about education. It’s about exposing yourself to everything that is out there, whether that’s the documented history, whether that’s a blog post from a friend, whether that is a document that you want to pour through because a friend from book club recommended it. It’s just about listening and opening your mind right now if you haven’t been diligent about that before.

Jean Chatzky: (27:54)

And I think it’s about doing it on a continuing basis. You know, this can’t be a flash in the pan. This can’t be something that we feel better about because we’ve had one conversation. This is something that we all have to be better about from now on.

Kathryn Tuggle: (28:14)

Yeah, absolutely. That’s the hope right? That this is a sea change for a nation and a world.

Jean Chatzky: (28:21)

No question, no question. I want to get to our mailbag because I know that we have a lot of questions. But I just, again, I want to thank Sharon for having this conversation with me this week when I know it’s been a tough time for her all around. So I really appreciated that.

Kathryn Tuggle: (28:40)

Yeah. So thankful she was here.

Jean Chatzky: (28:42)

Okay. What do we have?

Kathryn Tuggle: (28:44)

Our first question comes to us from Maria in Gibsonia, Pennsylvania. She writes, hi Jean and Kathryn. First, thank you so much for the podcast. I have learned so much from it and it’s truly changed my life as I’ve been listening over the past three years. Thank you also to everyone on the HerMoney team for all the work that you do. Here’s my question. What’s the best way for me to start saving for a down payment on a house. I’m 24 and after finishing graduate school in April, I’ve just been offered my first full-time job in which I’ll be making $45,000 a year. I feel incredibly grateful for this opportunity, especially in this time of economic hardship for so many. I would like to start saving for a down payment for a home while continuing to save and pay down debt. I have about $4,000 in an emergency savings and $600 in a high-yield savings account. I contribute to a Roth IRA that has about $2,500 in it at the moment and plan to contribute to a Roth 401k after I start working. I also have about $21,000 left in student loans. I would like to continue to contribute to all of these accounts and pay down my debt while also starting to save money for a down payment. Where in your opinion is the best place to put this money. Should I just add it to the Roth IRA or high-yield savings account contributions I’m already making? Should I set up a separate brokerage account solely focused on the down payment? Or should I focus on completely paying off my debt and building up my emergency savings first, before I even begin saving for a down payment? I don’t think it would be realistic to see myself in a position to buy for at least the next 10 years. I live in the Pittsburgh suburbs and tentatively plan to buy a house in this area. I would greatly appreciate any thoughts and advice you have for me. Thank you again for all you and your team do.

Jean Chatzky: (30:31)

Hey, Maria. Thank you so much for a great letter. Congratulations on your graduation. So there’s a lot of moving pieces here. I have to say. I’m like trying to think about what comes first, what comes second because you’re absolutely right that they have to be prioritized. Let’s talk about the student loan debt first. As long as you are not planning on taking advantage of federal repayment provisions, as long as you’re not planning on going into an income-based repayment program, it might be good time to look at refinancing those student loans down to an interest rate that is lower than you have now because interest rates are historically low. And that’ll lower your payment. I’d try to keep yourself on the same 10 year time schedule, if possible, because stretching out your payment means you’re going to pay more interest over the long term. After that, I would focus on making sure that you are capturing any matching dollars possible in your Roth 401k while simultaneously trying to expand that emergency cushion a little bit over time. You want to get to the point where you’ve got a full six months worth of fixed living expenses in that emergency cushion. Just the expenses that you’d absolutely need to spend money on rather than those things you want. Because when we’re in an emergency, we go to an austerity budget. And then I would either think of that Roth IRA as my house down payment fund, or I would open a second account for it, and here’s why. There’s this phenomenon in behavioral finance called mental accounting. And what it says is that when we have separate pools of money for separate things, it actually helps us focus on them and reach our goals faster. And so, I like the idea of using the Roth IRA for this purpose, because you can get the money out of the Roth IRA anytime you want to, without penalty, if it’s money that you’re going to use to buy your first home. I also like for the administrative ease of your life, the fact that it’s already going, you’ve already got money flowing into it. And you then have a way to sort of separate your Roth, 401k for retirement, and know that this Roth IRA becomes the fund for your housing. Because you are not thinking of buying so long into the future. I mean, you’re, you’re saying you’ve got a decade. That tells me you actually can invest this money. If you were saying to me, I want to buy a house in the next two to three years, I would say that money just goes straight into your high yield savings account. Because at that point you don’t want to put it at any risk, but because you are thinking 10 years down the road, you can invest a good portion of it in equities, and you can take a little bit more risk. And then as you get closer to your goal, you take less risk over time. I wouldn’t stress a whole lot if you can’t put a ton of money toward that down payment out of your paycheck every single month as you’re just getting started. But what I will tell you having put money aside for two kids who I put through college over well over a decade, is that little bits of money really do add up. And so do what you can. Think about padding the down payment fund with windfalls along the way, like tax refunds and other things. And my guess is that you’ll get to your goal sooner than you think.

Kathryn Tuggle: (34:42)

That’s great advice, Jean. I love the idea of the separate accounts. It really does make a big difference.

Jean Chatzky: (34:47)

It does. I mean, we’ve talked about this before. I’ve used separate accounts for vacations, right? I mean, sometimes we just want to click on a number and say, oh, that’s my house fund.

Kathryn Tuggle: (34:57)

Right. Right. I mean, we did that. My husband and I did that when we bought our house. We had a separate account and it made it almost more exciting to watch it grow.

Jean Chatzky: (35:07)

Exactly. Well, I think that’s the mental part of the mental accounting. Yeah, absolutely.

Kathryn Tuggle: (35:12)

Our next question comes to us from Kat. She writes, hello. Thank you for a wonderful podcast. It’s keeping me focused and sane during this crazy economic time. My question is this. I’m in the fortunate position of having approximately $40,000 to put into the stock market right now. I’m wondering if it’s best to put it all in now diversifying it, of course, or given the erratic nature of the markets. If it’s better do it in smaller chunks, a little background if needed. My job is secure. I have a one year emergency fund set aside. I have no debt other than a solo 401k with $30,000 in it. This will be my first time investing and it is the start to my retirement fund. My employer does not offer any retirement plans. I am 41 years old self-partnered with no kids. Thank you for any and all advice.

Jean Chatzky: (36:04)

All right, Kat, I’m going to tell you what I would do. In fact, I’m going to tell you what I am doing. And I’m telling you this, I had a conversation with my financial advisor yesterday. Yes, I have a financial advisor and I am sending a contribution to him for my retirement account for 2019. And it’s a lump sum of money like yours. And we just basically had this same back and forth question because you’re right. The markets do look frothy right now, but I thought the markets looked frothy 5,000 points ago. So what do I know when it comes to that? And this is why we don’t try to time markets. This is why we tend to just invest over time. And so what he and I decided, and yes, my financial advisor is a he. What we decided together is that this money will be divided up into chunks of money and invested over the next six months. You could do it over the next 12 months, but I would set a schedule for yourself. I would pick the investments that you want to put it into, whether it is a diverse portfolio of funds, whether it’s a diverse portfolio of stocks, whether it is a single target date sort of a fund. And then I would just put it to work on the same day of the calendar each month. That’s how I would do it. There are other people who have other philosophies. One of the first books that I wrote was a series of interviews with people who were experts in various types of money management. And I remember a couple of people telling me that they always buy, when things have dropped 5%. Or they buy when things have dropped 10%. We don’t know that that’s going to happen. We don’t know when that’s coming our way. What we do know from history is that the markets are likely to be higher 10 years from now than they are today. And higher 20 years from now than they are 10 years from now. And because you’re 41 years old and you’re not looking at retirement for a good two and a half decades, you’ve got a lot of time for this money to work. So that’s what I’m doing. I hope that that strategy works for you as well. But I also am prepared that in the short term, things could go down and I may just have to turn off the television or stop looking at Yahoo Finance and wait for things to come back.

Kathryn Tuggle: (38:59)

Right. Having that time is so key.

Jean Chatzky: (39:02)

It’s so key. And it’s so, you know it was interesting, this conversation. I’m emotional about this, you know? And it’s one of those things that I’ve learned about myself over the years. I’m emotional about this. And emotion can lead you to wanting to make decisions about your money based on the volatility in the market. And those are generally not the good decisions to make. And so we need to figure out a way to be more rational, to come up with a methodology that we can stick with in good times and in bad,

Kathryn Tuggle: (39:38)

Absolutely. Something we can feel good about no matter what’s going on.

Jean Chatzky: (39:42)

Feel good about or at least don’t feel terrible about.

Kathryn Tuggle: (39:46)

Or panicky. Yeah.

Jean Chatzky: (39:47)

Yes. Panic is the word I was looking for.

Kathryn Tuggle: (39:51)

Our last question today is from Stephanie. She writes, hi Jean. I’ve been a fan since watching you on the Oprah show after school. I look forward to every episode of the HerMoney podcast. I’ve learned a lot about personal finance on my own since my parents have made detrimental financial decisions for over 20 years. Building a house they couldn’t afford on an inconsistent self-employed commission-based income, going into significant debt and not altering their lifestyle choices when they did have income. In my twenties, I regularly lent them a huge portion of my entire savings to pay their mortgage and groceries. I’ve since put a stop to the lending and I’m in my thirties. My parents recently sold their home and sent me a check for $12,000, which they still owed me. They’re past retirement age with zero retirement savings. I’m an only child. I’m nervous about what trouble they could get into assuming they continue to make bad decisions in the future and how I’ll keep financial boundaries while still trying to be a helpful daughter. I’d like to set aside this $12,000 for future expenses related to my parents. I’m not willing to jeopardize my own financial goals if they get into trouble again, but I am willing to sacrifice this amount in the future if needed. I know it’s not enough for a long-term care policy or a meaningful annuity. I have offered to pay for a financial planner in the past, but they are stubborn and have never been interested. I know I could keep it liquid in a high yield savings account and spend it as the occasion arises. But is there anything else I should be considering here? What do you think would be the best way to prepare to help aging parents with this amount? Thank you so much.

Jean Chatzky: (41:25)

Wow. Your parents are incredibly lucky to have you, Stephanie. I cannot imagine what it feels like to be put in this position where you are asked to be the parent from a financial perspective from such a young age. And I know you are not the only one who’s been asked to do that. I would probably go the high-yield savings account route. The only question that I have about the concept of an annuity or investing this money for them rather than saving this money for them is their age. So you are now in your thirties, which makes me think they could be anywhere from mid fifties to mid sixties. And I’m wondering, if they are on the younger side of that equation, it is possible that you could invest that money for them if you knew that the sale of their house would tide them over long enough to give you a longterm time horizon. I might try one more time with the financial advisor or see if they have perhaps an accountant who could sort of step into the role of financial advisor and help put them on some sort of a budget. My fear is that this sale of their house is a one shot opportunity for them to really get their act together. And I suspect that’s what you’re thinking as well. And you don’t want to see them blow it. So survey the landscape. Park the money right now in a high-yield savings account. Just park it for a little while while you suss this out a little bit. Survey the landscape to see if there’s anyone in your parents’ life that they will listen to more than they listen to you when it comes to getting some objective personal finance advice. Unfortunately, sometimes our parents view us as children long after we stopped being children. And they are willing to listen to outsiders, even almost strangers, more than they’re willing to listen to their smart kids. Hope that is helpful. I’m going to think about this one some more. And if I come up with anything better, I will send it to you.

Kathryn Tuggle: (44:04)

It’s really so amazing that she is being so proactive about this in such a loving way. I mean, how amazing at that age to be thinking this far ahead.

Jean Chatzky: (44:12)

I agree with you. It is amazing to think so far ahead, but I also get the fear here. The fear is her parents will run out of money. They will need some sort of medical care or something else that even though she has the right instincts, which is to protect her own financial situation, she’s going to be up against a situation where she feels she can’t say no. And the goal is to avoid that at all costs. I got to say, I’m angry at these parents for putting her in this position and for not being willing to allow somebody who clearly knows better to step in and give them some much needed advice.

Kathryn Tuggle: (45:02)

Me too.

Jean Chatzky: (45:03)

Now on that note, Stephanie, please keep us posted, okay? Send me another note. Tell me if you had any luck with the financial advisor. Let me know where it is. And, you know, I write this column for AARP magazine. It’s called Chatzky To The Rescue. And by the way, I did not name it. But, every month I deal with a problem where it is a problem of people who are facing some sort of a financial situation where they need a plan, or they need an answer or a solution or some help. And so if you think they would be willing to accept help from me, I am willing to step in and see if I can get my editor to bite on this one. And maybe we could do it that way.

Kathryn Tuggle: (45:56)

That sounds amazing. Thank you, Jean.

Jean Chatzky: (45:58)

Thank you so much. And in today’s Thrive, it may be time to check your junk mail for your stimulus check. Seriously. Over the past couple of weeks, the treasury has been sending stimulus checks in the form of prepaid debit cards. They’re coming in unmarked envelopes, which means you could literally be throwing away money if you don’t go through your mail carefully. The plain white envelope may say money network card holder services in the return address window and inside you’ll find a prepaid visa debit card loaded with your CARES Act stimulus payment. Up to $1,200 per individual. Nearly 4 million payments are going out this way. So who’s getting these debit cards? They are being distributed to qualified individuals without bank information on file with the IRS and whose tax return was processed by either the Andover, Massachusetts or Austin, Texas IRS service centers, according to the us treasury. Included with the stimulus debit card, you’ll get instructions on activating the card, setting a pin and how to see your balance. And to set it up, you can either call the number on the back of the card or register the account at eipcard.com. Now note, there is no activation fee. There’s no monthly maintenance fee. But if you do use your card at an ATM, you may have to pay fees for each withdrawal. Hang onto your card. Treat it like cash. If you lose it, there’s paperwork to file along with a $7.50 replacement fee. And if you’re among those people who don’t use debit cards or who only use them so sporadically that it’ll take you way too long to use this money, or if you have parents who received cards that they are just perplexed about using, there is a process to transfer the money back into their brick and mortar bank accounts, where they can just use it to pay their bills, whatever way they pay their bills. If you go to eipcard.com, you will find those instructions as well. I have a friend who did this for his parents because they are not debit card users. Said it took him about 15 minutes, but it really wasn’t all that difficult. Thanks so much for joining me today on HerMoney. Thank you to Sharon Epperson for joining us and for sharing her insight and helping us to have the kind of conversation we need to be having right now. If you want to do more, we have a list at hermoney.com of non-profit organizations of all kinds that are aiding Black protestors, elevating Black entrepreneurs, promoting Black women’s voices and careers and so much more. And we hope you’ll join us in giving however, and whenever you can. If you like what you hear, please subscribe to our show at Apple Podcasts. Leave us a review. We love hearing what you think. We want to thank our sponsor Fidelity. Our music is provided by Video Helper and our show comes to you through Megaphone. Thanks so much for joining us and we’ll talk soon.