We know from previous HerMoney podcast surveys that our listeners are a nice generational mix — ⅓ millennial, ⅓ Boomer, and ⅓ Gen-X. Because of this, the questions submitted to our Mailbag are so wonderfully diverse, and the conversations that take place in our private HerMoney Facebook group are so vibrant and wide-ranging… We love watching the different generations come together, and learn from one another.

ENTER TO WIN: Speaking of our podcast surveys, we have another one open this month. Tell us what you think, and you’ll be entered to win free HerMoney t-shirts, $100 Amazon gift cards, and so much more.

But unfortunately, it’s not always so harmonious for differing age groups. Sometimes, those generational divides can be extreme. Specifically, the divide between Boomers and millennials has become so pronounced that it’s been the subject of countless memes over the last decade or so. “OK, Boomer” is one you’ve probably heard before, but this week’s guest says that it’s not just a sarcastic dismissal — it’s a recognition that millennials are in crisis, facing financial struggles that Boomers just don’t seem to understand. For example, check out these stats (adjusted for inflation):

- Millennials hold just 3% of American wealth. When they were the same age, Boomers held 21%.

- Millennials make 20% less than Boomers did at the same age.

- The average older Millennial holds $15,000 in student loan debt. The average Boomer at the same age had just over $2,000 in today’s dollars.

- Millennials are paying almost 40% more for their first homes than Boomers did.

- And American families spend twice as much on healthcare as they did when Boomers were young parents.

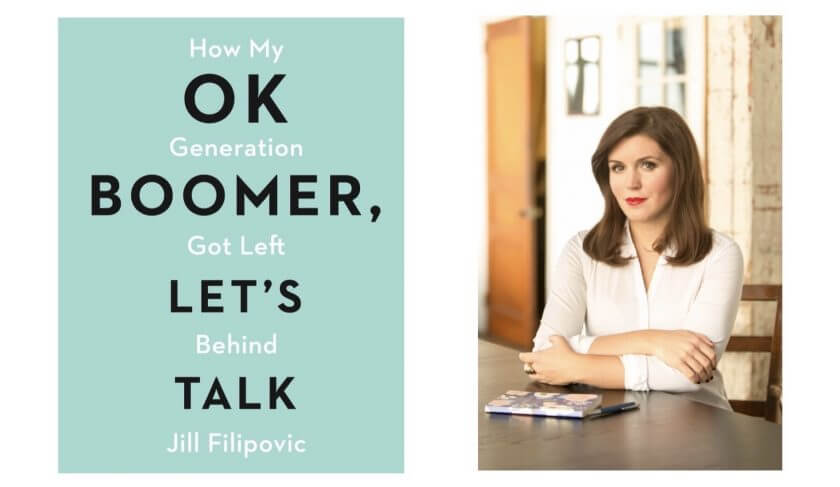

All of these great stats come from the research of Jill Filipovic, author of “OK, Boomer, Let’s Talk: How My Generation Got Left Behind.” In her new book, Filipovic shows that Millennials are not actually blowing all their disposable income on Instagrammable avocado toast — they are, through social and economic circumstances beyond their control, the first American generation that will do worse than their parents — and will even do worse than their grandparents.

Listen in as Jean and Jill talk about a path forward for millennials, and ways that millennials and Boomers can better understand one another. She also shares why the barriers to communication between these two generations are so great — their life paths and experiences have been vastly different.

“For Millennials, “there’s been a shift in our understanding of marriage, parenthood, and what it means to be an adult. Millennials very much grew up with the idea of marriage as kind of a capstone, so you get married once you have all your other ducks in a row: When you’re financially secure, when you have a job, when you have a college degree,” Filipovic says. So it should come as no surprise, with Millennials shouldering the amount of student debt that they are, that they’ve been forced to delay both home ownership and marriage.

Jill walks us through some of the policy changes and economic structures that have defined millennials as a generation. Debt is, of course, a big one. Millennials hold more educational debt than any previous generation – and unlike Boomers, had no option as young people to discharge this debt in bankruptcy.

The pair also touch on racial disparities — In Jill’s book, she highlights that the average white family is worth $700,000 more than the average black or Hispanic family. Also, while 1 in 4 white families will get an inheritance, just 1 in 10 black or Hispanic families do.

Jill also offers some concrete suggestions for how Millennials can work to improve their lives. “One of the things they can do is engage politically and understand what is it that set them on this course, right? No man is an island. None of us have just made these choices and wound up here out of sheer circumstance,” she says. “There are a series of political decisions that went into carving this course that many millennials have walked down, and so I think, asking, ‘Okay, what were those decisions, and how can we make different ones in the future?’ is frankly the best way for Millennials to shift their prospects… And you can buy the avocado toast. It’s okay!”

In Mailbag, Jean tackles a question from a listener who is wondering how best to loan money to her brother-in-law, and offers advice to a woman who is considering a career in finance and is looking for guidance on becoming a CFP or CPA. We also tackle a question from a listener who is pregnant and concerned about qualifying for FMLA, since she is a contractor at a temp agency who has been employed for less than one year. Lastly, in Thrive, Jean shares a mind trick that can help you save more money.

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Transcript

Jill Filipovic: (00:02)

If Millennials want to see their lives improve, then one of the things they can do is engage politically, and understand what is it that set them on this course, right? No man is an Island, right? None of us have just made these choices and wound up here out of sheer circumstance. There are a series of political decisions that went into carving this course that many Millennials have walked down. And so I think asking, okay, what were those decisions and how can we make different ones in the future, is frankly the best way for Millennials to shift their prospects. And you can buy the avocado toast. It’s okay.

Jean Chatzky: (00:39)

HerMoney is proudly sponsored by Fidelity Investments. We can all use a little help reaching our financial goals, especially during uncertain times. That’s where investment advice from Fidelity comes in. They’re here to help you make smarter, more informed decisions. And you can visit Fidelity.com/HerMoney to learn more.

Jean Chatzky: (01:03)

Hey everyone. It’s Jean Chatzky. Thank you so much for joining me today on HerMoney. One of the things that makes this show so interesting is that you, our listeners, as we know from previous surveys, are kind of a perfect mix demographically speaking. About a third of you are Millennials. A third of you are Gen Xers. A third of you are Boomers. And because of this, the questions that you submit to our mailbag are wonderfully diverse. And the conversations that you have in our private HerMoney Facebook group are incredibly wide ranging. And I love being part of all of it. I love watching the different generations come together and learn from one another. But unfortunately, it’s not always so harmonious for differing age groups. Sometimes those generational divides are extreme. Specifically, the divide between Boomers and Millennials has become so pronounced that it’s been the topic of countless memes over the last decade or so. Okay, Boomer is probably one that you’ve heard before. But today’s guest says, that’s not just some sarcastic dismissal. It’s a recognition that Millennials are in crisis – that they are facing financial struggles that Boomers just haven’t seemed to understand. For example, and I’m not going to throw out all the stats, but let me give you just a few. Millennials hold just 3% of American wealth. When they were the same age, Boomers held 21%. Millennials make 20% less than Boomers did at the same age. The average older Millennial has $15,000 in student loan debt. The average Boomer at the same age had just over $2000 in today’s dollars. And Millennials are paying almost 40% more for their first homes than Boomers did. I got all these great stats, by the way, from the extensive research of our guest, Jill Filipovic. She’s the author of, “OK, Boomer, Let’s Talk: How My Generation Got Left Behind.” In her new book, she shows that Millennials are not actually blowing all their disposable income on Instagrammable avocado toast. They are, through social and economic circumstances beyond their control, the first American generation that will do worse than their parents and even worse than their grandparents. Jill, who works as an attorney and a journalist, is joining us today from her home in Brooklyn to talk about a path forward for Millennials, and ways that Boomers and Millennials and those Xers like me in between, can really understand each other. Hey, Jill, welcome.

Jill Filipovic: (04:04)

Hi. Thanks for having me.

Jean Chatzky: (04:06)

Thank you so much for being here. Let’s dive right in. In your book, you paint a portrait of what it’s really like to live and work as a Millennial. You spoke to gig workers, to economists, to policy makers. You are a reporter after my own heart. You also spoke to dozens of struggling Millennials who are drowning in debt. Tell me about what you learned.

Jill Filipovic: (04:29)

So what I heard overwhelmingly from Millennials is that there was a path that many of us were told was kind of the key to a middle-class life. You know, you work hard in school, you go to college, maybe if you don’t go to college, you get the kind of blue collar job that can support a family. And if you do all of those things right, then you can have the kind of trappings of adulthood that your parents probably had. So, you know, a marriage, children, a home you owned. And what many of us are realizing is that for us, the landscape is so different, that that isn’t necessarily true. And so, Millennials have come of age in an environment where the wages have really fallen out of blue collar work. So, a college degree is kind of the new high school diploma. It doesn’t necessarily give you a huge leg up. What it does is it kind of helps you to maintain your toe-hold on the middle class, which is very different than it was for Baby Boomers, where a college degree came with a huge pay bump. For Millennials, a college degree is now just kind of the baseline of what you need to survive. Those degrees also got more expensive. I think we all very well know at this point, the student lending industry exploded. Millennials and younger folks, and some Gen Xers as well, of course have taken on tremendous amounts of student loan debt. And so, Millennials are entering adulthood – many of us saddled with debt, increasingly concentrated in expensive cities, because that’s where the jobs are and so that’s where many of us have to move, where rents are much, much higher than they were when Boomers were young adults. So, we have much more financial output, right? We’re paying more for rent. We’re paying more for basic services. We’re paying more on our debts. And then we have less money coming in. And all of that creates this universe in which Millennials feel like we just haven’t hit adulthood yet. We’re delaying marriage. We’re delaying parenthood. We can’t afford to buy a home. And then what we hear from many mainstream, and particularly conservative, but not exclusively conservative media outlets, is that this is all a result of our own individual bad decision-making. If only we wouldn’t spend $4 a day on a latte, we could own a house by now. And all of that I think has culminated in real Millennial frustration. At why do our lives look so different? And when we look at the political history of why, it’s not exclusively Boomers that are to blame, but it is often conservative politicians elected by Baby Boomers who have created these circumstances.

Jean Chatzky: (07:02)

I want to get to that, but before we get to these Reagan-era policies that I think many people don’t exactly understand how they changed the landscape over the next 30, 40 years. I want to talk a little bit about some of those statistics that define this generation. I remember the first time I read a study that linked student loan debt to kind of a delayed adulting. And my eyes opening wide realizing, well, of course, if you’ve got this massive student loan debt, you aren’t going to feel like you can get married. You aren’t going to feel like you can buy a house. You aren’t going to feel like you can have a kid. How much is it delaying adulthood? How much is it setting Millennials back.

Jill Filipovic: (07:54)

Tremendously. There have been two parallel trends going on. One is a financial shift and the other is a cultural shift. So, financially, Millennials, Gen Xers too, Gen Zers probably to a larger extent, although many of them are so quite young so we’re not sure, have a huge amounts of student loan debt. And of course, when you have that much money in the hole, you’re less likely to say, well, I’m going to put myself further in debt by buying a house. You may not even be able to qualify for a mortgage, right? So, that’s one thing that is obviously delaying people. The other thing is a shift in our understanding of marriage, parenthood, what it means to be an adult. So, for Millennials, we very much grew up with the idea of marriage as kind of a capstone, right? So, you get married once you have all your other ducks in a row. When you’re financially secure, when you have a job, when you maybe have a college degree, but at least you feel like the basics of an adult life enable you to make that decision for. For Boomers, and certainly for Boomers parents, marriage was much more of a cornerstone. So, as part of an adult life. You didn’t have to be able to own a home before you got married. There was a sense of, okay, you can get married at 22, you know, right out of college, if you were one of the minority of Boomers who went to college. But you didn’t have to have every other aspect of your life kind of right in place before you got married. And the same with parenthood. So, those have both been really significant shifts for Millennials. And I think those two dynamics, in tandem, has meant that many Millennials and, you know, you see this from public opinion polling and I think Pew has done some good surveys on this. And when you ask Millennials and younger folks why they aren’t married, overwhelmingly, they do say it is because of this lack of financial stability, all of which has now been made much, much worse by the pandemic. I just saw some numbers yesterday that more young people, 18 to 29, are living at home today than ever have since we started reporting those numbers. Right? So, we started reporting them, I think, pre-World War II. So, a huge number of young people were already in tremendously difficult financial straits that have now been hit much, much harder. And I think we’re going to see the reverberations of that down the road in terms of marriage rates, in terms of childbearing.

Jean Chatzky: (10:12)

I think you’re right. And I think it’s not just buying a home that gets delayed. When you look at renting an apartment, the hurdles that you have to clear, particularly in cities, in order to do that are tremendous. I have a 23 year old daughter. She is back home because of the pandemic, but she did rent an apartment in New York for about a year. And the co-signing requirements were that you had to prove that you could produce 40 times the rent. And I’ve seen 80 times the rent. And I know that’s not national. I know it’s not everywhere. Maybe if you can go rent an apartment from a mom and pop landlord. But you know, I remember renting my first apartment in Brooklyn, when I moved to the city in 1986. My rent was $400 a month. I was making $11,000 a year. You do the math on that. It doesn’t work right. You can’t pay that rent and eat. So, my parents were definitely helping me. But I didn’t need a co-signer. I rented this walk-up apartment from this guy who owned a famous bar called CBGBs. And that was it. You know, I wrote him a check every month and that was the transaction.

Jill Filipovic: (11:26)

Yep. And you’re right that New York city is obviously a very extreme real estate market. But it’s also a city that’s a draw for thousands upon thousands of young people. And it’s not totally unique in the way that rents have skyrocketed and all of these attendant costs have skyrocketed as well, right? So, the cost of living in a big city, which more Millennials do than Boomers did, isn’t just about what’s my monthly rent, although that’s also much more expensive than it to be. But it is these things like, okay, what’s the security deposit? How much more do I have to make than the rent? Do I have to have a co-signer? How much is a cup of coffee? How much is a meal out? How much is parking or a ride on public transportation? All of those things, when they’re concentrated in these big urban areas, are much more expensive and are these kind of slower drains on Millennial finances?

Jean Chatzky: (12:15)

So you are not just a writer. You’re an attorney. What happened in your life that made you write this book?

Jill Filipovic: (12:22)

That’s a great question. I think part of it was that, my dad’s an attorney as well. And I don’t practice law anymore. I got off that train. But I do have a law degree and technically still a lawyer. But I look at my life, I’m 37, compared to where my parents were at my age. And they had two kids. They owned a home. My dad worked in the Chicago steel mills over the summer to pay for his law degree. And there’s just, there’s no job I could have had over the summer, other than something highly illegal, that would have paid for my law school. And so, I graduated and I did go to an expensive private law school, so that was a different choice as well. But I graduated close to $250,000 in debt, and I’m still paying that down. I’ll be down until I’m 60. And the degree to which my life, in many ways, I have more choices and more freedoms certainly than my parents had. But I’m also in a very financially different circumstance than them. And when I looked around my cohort, which again, is college educated folks in Brooklyn, so some of the most privileged people on the entire planet, many of us still felt this way. Like, we had somehow personally failed. And that compared to our parents, we were these kind of perpetual adolescents. And grateful as we were for the freedoms and opportunities we had, there was also a sense of like, well, when, I’m almost 40, when am I going to be an adult? And so, that was the kind of general sensibility that I think was behind wanting to write this book and start to make some of these connections that no, this isn’t a series of individual, selfish, snowflake, Millennial failures. These things are systemic and they’re generation wide and nationwide.

Jean Chatzky: (14:07)

Yeah. And we should just stop perpetuating the myths that not buying the coffee can fix any big financial problem. It can fix a little financial problem. It can help you fund an emergency cushion. It can help you pay off a credit card. It can’t pay off all your student loan debt and it can’t buy you a house. So, let’s just retire that one. I want to talk about how we can help Millennials and Boomers better understand each other. Your book has been described as an olive branch that will help the generations communicate more empathetically. And before we get there, I just want to remind everyone that this conversation and HerMoney in general is proudly sponsored Fidelity Investments. Whether you are looking for guidance to help you through the uncertain market or working on your long-term financial plans, Fidelity can help you meet your goals. In addition to investment advice, Fidelity also has online tools, like financial checkups, that can help make you smarter, help you make more well-informed decisions every day. So, visit Fidelity.com/HerMoney to learn more. I’m talking with Jill Filipovic author of “OK, Boomer, Let’s Talk: How My Generation Got Left Behind.” So, the olive branch. What do we need to understand about each other in order to really start talking to and listening to each other?

Jill Filipovic: (15:35)

Well, I think Boomers need to understand that Millennials did not grow up in the same circumstances that they did. In many ways we had, of course, more opportunities. But in many ways, the ladder that allowed so many Bloomers to climb into the middle class was pulled up behind them. And so, Millennial resentments, Millennial frustrations, the ways in which Millennials have delayed these sort of traditional markers of adulthood, those are real. Those are not just selfish Millennial complaints. And I think it’s really important for Boomers to understand the political and policy choices that went into shaping the landscape that they walked into as adults, and the different policy choices that were later made that shaped what Millennials walked into.

Jean Chatzky: (16:19)

Yeah and it’s interesting. I looked into talking to you at the same time that my husband finished reading Kurt Andersen’s new book. You both talk about these Reagan-era policies and how they very much shaped the world that we are living in today. So, let’s talk about it. It’s not purely a Republican thing. These policies were continued by democratic administrations along the way. But what happened and what were the ramifications?

Jill Filipovic: (16:50)

So, very broadly, there was this big shift in 1980, across a variety of sectors. That was a move toward privatization and away from kind of government funding and intervention in the public good, right. So, you saw that in healthcare. You saw it in education. We saw it in housing. So, when Boomers were coming of age, there had been huge public investments in things like affordable, suburban housing, in things like highways to connect those suburbs to cities. And you know, much of that happened even before Boomers were born. You also saw significant investment in public education that really benefited Boomers. And Boomers went to college in record numbers. And part of that was this cold war effort to shore up information workers that were seen as necessary to fighting back against the Soviet threat. But whatever the justification, there was that huge investment, which Boomers were able to take advantage of. And you really saw a pretty big retreat from that in the Reagan eighties. Right around 1980, when you look at healthcare systems in Europe versus in the United States, you see this really distinct shift in how each country thinks about healthcare. And you see this shift toward privatization in the US and a shift toward healthcare as a public good in Western Europe. And so, you see, if you look at charts of where healthcare costs and healthcare outcomes go in both places, in the US, costs go up and outcomes go down. And in Western Europe outcomes go up costs go down. And obviously everybody has paid the price for that. But as that’s built, Millennials have born a significant cost there. So across all of these areas, right, this privatization, this move toward sort of an American individualism, has left those at the very, very top, who have quite a few resources, more or less doing. Okay. And it’s made a bigger bottom of people who have less. And Millennials are now the largest adult American generation in history. And there are many, many, many more of us who have less and are struggling as a result.

Jean Chatzky: (19:01)

We haven’t talked much about union membership on this show at all. But I do think that, basically, the gutting of the union system made a tremendous difference in the wage inequality that you talked about at the top of the show,

Jill Filipovic: (19:20)

Certainly. Gutting of union membership has been one really significant, of several factors, that have led to the decline in wages for blue collar jobs. And when you look at why Millennial finances are so poor, one of the big reasons, and I know I mentioned this earlier, is that wages for blue collar jobs have totally dropped out, right? So, you can no longer support a family working a blue collar job. You’re not going to be able to have two kids and live in middle-class comfort, working most of those jobs. And that’s very different than what Boomers face. And then at the same time, you have, everything you have to do to have the kind of job that will allow you to support a middle-class lifestyle, costs much more than it used to cost for Baby Boomers.

Jean Chatzky: (20:09)

It’s interesting to me, and this is a bit of a tangent, but when bringing back some of those employee protections has been on the ballot, and I’m thinking of California in the past election, where there was a proposition to make gig workers treated like employees or into defacto employees, it was roundly defeated. Why do you think people voted that down?

Jill Filipovic: (20:36)

It’s a good question. I do think there was, for that particular proposition, there was a very monied opposition to it, right? That the Ubers and the Lyfts of the world, certainly did want to see that pass. And so it spent an enormous volume of resources fighting it. I do think there is also as, I think I said this earlier, there’s both financial trends and there are broader cultural trends, and both of these things have kind of created a perfect, pretty bad storm for Millennials. And there is this cultural mythology in the US of individualism that often does fly in the face of workers’ rights. And the sense of like, well, I can strike out on my own, and I should have the right to negotiate my working contract however I want. This sort of idea of like worker freedom, which is, I think, a pretty Orwellian way of talking about it and thinking about it. But those ideas of individual freedom, I think, have been quite perverted to convince a large swath of the population that the fewer rights you have as a worker, the freer you are.

Jean Chatzky: (21:42)

Interesting. Interesting. You know, we talk about generational disparities, but there are huge racial disparities as well. What did you learn about how that juxtaposes with this picture?

Jill Filipovic: (21:55)

Yeah, so the racial disparity conversation, I think, is absolutely necessary to understanding the dire straits that Millennials, as a generation, are in. Millennials are also the most racially diverse adults in America. And that racial diversity means that over sort of generation-wide, you see worse outcomes, right? Because in the US, African-Americans in particular, have been excluded from building wealth and housing, have been excluded from certain neighborhoods, have often been excluded from education. And you see how that builds generationally, right? You see that white families are able to kind of hoard resources and pass those resources down to their children. And when you systemically and historically exclude black families from being able to do the same, of course, you see their children and grandchildren winding up much worse off. So, it’s really hard to tell the story of Millennial ill outcomes, without also telling the story of the fact that Millennials are just over 50% white. Whereas Boomers when they were younger were more like 80% white. So, this history and this continued presence of racial discrimination is really hurting younger generations across the board much, much more than it hurt older ones by virtue of the fact that younger generations are more racially diverse generations.

Jean Chatzky: (23:20)

So, what do we do? What do Millennials do to get ahead, to carve out the lives that they want? I mean, I know from research, they want to buy houses. They want out from under this student loan debt. They want to have children and families, maybe not immediately, but eventually. What do we do, and what are you doing?

Jill Filipovic: (23:45)

So, to me, the biggest takeaway from researching this book is that it’s really hard to come up with individual solutions to these big systemic problems. And that the solutions that we need are going to be political solutions. So, things like some sort of student loan debt forgiveness, plus a plan, so that we don’t put Gen Zers in the same cycle all over again, right? So, making education more affordable, reigning in the student loan industry. That’s one big step. Millennials are now, the oldest of us are, pushing 40. So, we’re the parents of today’s young children. So, creating family policies that will enable Millennial women, who are in the workforce in record numbers, to continue staying in the workforce, right? So, that would be things like universal pre-K. It would be things like paid parental leave. Those basic policy decisions, I think, would enable more Millennials to either have children in the first place or have their desired number of children. You hear a lot of Millennial women saying that they either don’t have kids or don’t have as many as they want, because they feel like they don’t have the money or they don’t have the time. So, that would be, I think, really, really significant. On an individual level, we often hear many, many complaints that young people are not politically engaged and that we don’t vote. And that was true of Boomers too. Young people generally are just not great at being involved in politics for a whole slew of reasons, many of which have to do with the fact that young lives are quite busy often with work and kids and all of that. But I think if Millennials want to see their lives improve, then one of the things they can do is engage politically and understand what is it that set them on this course, right? No, man is an Island, right? None of us have just made these choices and wound up here out of sheer circumstance. There are a series of political decisions that went into carving this course that many Millennials have walked down. And so, I think asking, okay, what were those decisions and how can we make different ones in the future, is frankly the best way for Millennials to shift their prospects. And you can buy the avocado toast. It’s okay.

Jean Chatzky: (26:00)

And the latte. We had record turnout in this election. So, hopefully that is a good step forward. Jill, where do we get more information about you about your work?

Jill Filipovic: (26:10)

So, the book is “OK, Boomer, Let’s Talk: How My Generation Got Left Behind.” I would love it if you would buy it from your local bookshop. It’s important to keep those places thriving, especially in these tough moments. I’m on Twitter at @JillFilipovic and my website is JillFilipovic.com.

Jean Chatzky: (26:28)

Thank you so much for this conversation. Thanks for being with us today.

Jill Filipovic: (26:31)

Thanks so much for having me.

Jean Chatzky: (26:33)

And we’ll be right back with Kathryn and your mailbag.

Jean Chatzky: (26:38)

And HerMoney’s Kathryn Tuggle joins me now. Hey Kathryn.

Kathryn Tuggle: (26:43)

Hello, Jean. How are you?

Jean Chatzky: (26:44)

Are you a Millennial?

Kathryn Tuggle: (26:46)

I am a lot like you. I’m right on the cusp between Xer and Millennial. And I understand you’re on the cusp between Xer and Boomer, right?

Jean Chatzky: (26:55)

Yeah. And when I look at my own behavior, sometimes I feel like an Xer and sometimes I feel like a Boomer. It’s interesting.

Kathryn Tuggle: (27:04)

I feel like I always skew a little more towards Xer because I grew up in rural Alabama. I didn’t have internet or a cell phone until I hit college. And I feel like one of the hallmarks of the Millennial generation is technology, is that you grew up with technology and I very much did not have that experience.

Jean Chatzky: (27:23)

Interesting. What did you make of what she was saying in terms of your friends, your social set? I mean, are you surrounded by a lot of people who are feeling these same stresses?

Kathryn Tuggle: (27:37)

Yes and no. I feel like I have an interesting social group because I do have so many close friends from rural Alabama. And having lived in New York since 2004, I have a set of close friends who are city dwellers or perhaps from London. And there doesn’t seem to be much of a common thread tying their struggles together. But I did definitely see my friends from Alabama were all able to enter into home ownership in their twenties. And that was something that I didn’t accomplish until I was 38.

Jean Chatzky: (28:13)

Well, and that’s the difference between New York and Alabama.

Kathryn Tuggle: (28:15)

Right. Right. I think that these struggles are generational, but they’re also demographic. You can’t paint any generation as a monolith, right? You can’t say Millennials are this, Xers are this, Boomers are this, because everybody just has their own struggle.

Jean Chatzky: (28:31)

Yeah. And I know that I am definitely coming to this conversation from a place of privilege. So, I just want to acknowledge that. But I’ve been thinking more about what Boomers and parents like me, who are not struggling, can do to help our kids when they’re young. I mean, I went through the process recently of revising beneficiaries on some of my investment accounts because I was moving them from one place to another. And I just was thinking about the fact that, I carry some life insurance and what good is it really going to do my kids when hopefully I die at 90 and they’re 60. Right? And if they haven’t figured it out by then, they’re not going to figure it out. You know what I mean? And my money is probably not going to make the difference. And so, I mean, maybe it will have they factored into their retirement plan. But would it be better to give money now to help with that down payment on a house. Or to yes, help if you can avoid the student debt. And I know not everybody can do that. But I think this leaving a legacy discussion is part and parcel of this and we have to have it all over again.

Kathryn Tuggle: (29:51)

What do you mean have it all over again?

Jean Chatzky: (29:53)

I think it’s changed. I think leaving a legacy when you knew you were going to die at 60 or 70 is totally different from trying to leave one when you know you’re probably not going to die until, you know, mid 80 or 95 because we’re just living so much longer. And so, that was a way of helping your kids. And if they’re no longer going to be kids, if they’re going to be grandparents themselves by the time these assets change hands, it’s not going to help the Millennials get a leg up on life. I mean, a lot of people, my parents, were in their twenties and thirties when they lost their parents. Mostly. Not all across the board, but they inherited a little bit of money at that point. And that helped with certain things in life. And so, I think it’s all a little bit of the same scenario.

Kathryn Tuggle: (30:50)

This is such a great point. I hadn’t thought about how longer life expectancies would inspire a need to have those leaving a legacy conversations in a different way.

Jean Chatzky: (30:58)

And you know, we’re in the middle of a pandemic. We have so many people who are unemployed and struggling. And I definitely do not mean to put pressure on anybody to think about these things right now, when you’re just trying to right your ship. But I think down the road, when we’re all back to normal. Maybe we think about that. Maybe we do a show on that.

Kathryn Tuggle: (31:19)

I would love that. And this whole thing makes me think of my grandmother saying to my mom, whenever my mom started claiming social security, my grandmother narrowed her eyes and said, don’t you dare tell anybody that I’ve got a daughter old enough to get social security.

Jean Chatzky: (31:37)

Yes, yes, absolutely. I think my mother will feel exactly the same way. Although it’s far off. It’s far off. Let’s take some questions.

Kathryn Tuggle: (31:47)

Our first note comes to us from Julia. She says, hello, ladies of HerMoney. Big fan here. I will cut to the chase. My brother-in-law’s in his early thirties with two children. He and his wife recently filed for divorce. They currently on a condo a few hours from our hometown and plan to sell it soon. They hope to come out even on the sale. They’ve owned the home for about two years and financed it with a 0% down USDA loan. My brother-in-law is a super hardworking, reliable guy. He’s planning to move back to our hometown for a little more family support. With his solo income, he can afford to pay a mortgage of up to $1300 a month. However, with the divorce and lack of equity in his current home, he doesn’t have any savings to contribute to a down payment. My husband and I are considering lending him the 20% down payment for a single family home at 0% interest so that he’s able to avoid PMI. My question is this. What are our options for structuring this loan? We fully expect to get paid back. It’s also okay if we don’t, for some reason. Family comes first. But we’d like something official, so that the terms are clear for all involved parties. Thank you.

Jean Chatzky: (32:54)

Julia. So, this is a lovely, lovely gesture. A lovely question. Your brother-in-law is certainly very, very fortunate to have you. I am going to go into this and answer this assuming that you and your husband and your brother-in-law have talked through the basics involving the rent or buy decision – that either renting in your area is just not very possible because of lack of options or not financially beneficial. And that you’ve also pretty much satisfied the question that he will, if he buys something, be there for at least five years. Because if he’s not planning on that, or if his plans are so up in the air that he’s just not sure, then I don’t think buying makes sense. But assuming that buying does make sense. If you go online and you Google simple family loan agreement, you’ll come up with a lot of them. You can print one out. You can fill in the blanks. You can lay it out and lay out your terms. But I think, more important than that piece of paper. Although I do like the idea of a piece of paper, I like that everybody has acknowledged that this is what they’re in for. I think a conversation is really important. How is he going to pay you back? What has to happen in his life in order for him to be able to pay you back? On what schedule do you believe he’ll be able to pay you back? How are you going to feel? And this may be just a conversation that you have with your husband. But how are you going to feel when you see him spending money on Christmas or on wants instead of needs? And perhaps he’s not paying you back at the rate that you expected. Loans among family are complicated, which is why it’s good that you acknowledge it’s okay if you don’t get paid back. But it sounds like you actually really do want to get paid back, and I think that that is a fair right move. I just think you have to have conversation after conversation until you get to the point where every bit of this transaction is pretty buttoned up and you all know where your expectations lie.

Kathryn Tuggle: (35:24)

I love that advice. I also think, if you don’t get paid back, it might potentially cause more problems than you are expecting.

Jean Chatzky: (35:32)

Absolutely. And we’ve heard that over and over again. I mean, that’s one of the reasons that co-signing becomes such a problem. Because if the person who you co-sign for walks away from the loan, you mess up their finances. I mean, family and money gets really complicated, really fast. And so, the more clarity you can bring to the conversation, the better.

Kathryn Tuggle: (35:55)

Absolutely. Our next note comes to us from Charlotte. She writes, hi Jean, thank you for making an excellent podcast that makes money and investing accessible and unintimidating for women. I listen every week and have learned so much. I value your advice and perspective so I wanted to get your thoughts on careers in the financial industry. I’ve been considering a career in finance because I love helping people become empowered with money, but I don’t know where to get started. I don’t know if I should look into becoming a CFP or a CPA or another area of finance. I’m not great at math and the super-technical aspects of investing in taxes aren’t as interesting to me, but I love helping my friends and family plan their budgets, understand credit, and focus on their retirement and savings goals. Is there an area in finance that I haven’t considered? How do you recommend I start researching and planning for this career transition. I currently work in HR and I love a lot about my job, but it’s not my passion. I’m mostly happy working in any job because I’m interested in so many things, but I don’t currently feel fulfilled and want to help people more directly regarding something I’m passionate about. I appreciate any advice you can give. Keep up the good work.

Jean Chatzky: (37:02)

So, I have two suggestions for you, Charlotte. First of all, thanks for the nice words about the podcast. Thanks for this question. So, one of my suggestions is more broad and the other is more specific. There are HR departments, all over the place, where they are now focusing on financial wellness. It’s become a big part of employer wellness programs for big companies, medium-sized companies, even some small companies. And I know this because I’ve had the opportunity to moderate a couple of benefits summits recently, and have had the chance to hear leaders in these HR departments talk about what they’re doing. And so, I would suggest that you maybe take your HR resume and fine tune it to look for a job in financial wellness, where you could help an entire employee population with their budgets, and with credit and retirement and other savings goals. That might be an easier switch to make while you contemplate getting another degree or getting more education. It might also be an area where you find more satisfaction because it sounds like it’s a little bit more in tune with your needs. The second, more specific example is that you look for a job at Fidelity or at a place like Fidelity. So, we had Kathy Murphy, the President of Fidelity Personal Investing, on the show recently, and she told us they’re hiring 4,000 people across the country. And many of those people are going to be in jobs very much like you describe. People who help their employee and investor population. Now, there will be, I’m sure, in these jobs, some certifications required. There’ll be some tests that you have to take – some more complicated than others. But I have absolutely no fear that you would be able to pass them, to wrap your hands around them, and to move forward. I think the math involved in them is not all that complicated. You mentioned a CFP, certified financial planner, or a CPA, certified public accountant. I don’t think CPA is where you want to go. CFP down the road absolutely might be. But I would look at financial wellness jobs first.

Kathryn Tuggle: (39:46)

I love that advice, Jean. Thank you.

Jean Chatzky: (39:48)

Sure.

Kathryn Tuggle: (39:49)

Our last note comes to us from Hannah. She writes, hello HerMoney. I have concerns about possibly qualifying for FMLA and I have a few questions. I’m a contractor for a temp agency and have been on assignment for less than 12 months. When is the best time to notify employers of my pregnancy? If I’ve been on assignment for less than 12 months, can I be fired for becoming pregnant because I am a temporary employee or contractor? Are there laws to protect me in keeping my job security, even though I’m a temp worker. If I don’t qualify for FMLA, what else is there?

Jean Chatzky: (40:23)

First, Hannah, congratulations. Having a baby is very, very exciting, but I definitely understand the worry. And I just want you to know, I’m not a lawyer, and I’m certainly not a labor lawyer, but I did research an answer to your question with the help of Becca Cohen, who is one of our reporters, and here’s what I found out. So, in answer to the first question, when should you notify employers of the pregnancy? You should definitely wait until after the first trimester. But after that, tell your boss as soon as possible. If you’re worried about keeping your employment, ask other women who work there what they think. Have there been any others in your position? And if so, what did they do? The short answer to your second question, whether or not you can be fired, is that no, you can’t be fired for being pregnant alone under the Pregnancy Discrimination Act. Your boss can choose to terminate you for other reasons, but they can’t cite pregnancy as one of them. But you may not qualify for the Family Medical Leave Act depending on how long you’ve been there. FMLA kicks in with a certain number of restrictions. You have to work for a covered employer. I’m not sure if you do. You have to work a 1,250 hours during the 12 months prior to the start of leave. You have to work at a location where there are 50 or more employees at that location or within 75 miles of that. I am not sure how COVID has impacted that, but I would probably talk to HR about it. And you have to have worked for the employer for 12 months, although they don’t have to be consecutive. To your third question, are there laws to protect you in your job security even though you’re a contractor or a temp worker, I haven’t found any. And finally, if you don’t qualify for FMLA, what else can you qualify for? That actually varies state by state. State disability programs have packages for pregnancy. So, call your specific state office to find out if they have protections for residents who don’t qualify for FMLA. It sounds to me, boiling it all down, that based on how long you will have been there when you actually give birth, you may have a decent shot of qualifying. But again, I would look at all of the different options once you have talked to your employer. And again, do that after the first trimester. And thanks so much for the question.

Kathryn Tuggle: (43:22)

Amazing Jean. Thank you so much for the great advice.

Jean Chatzky: (43:25)

Oh, you’re welcome. It is very complicated. Isn’t it?

Kathryn Tuggle: (43:28)

Yeah. It’s never easy, unfortunately, for new parents,

Jean Chatzky: (43:31)

Clearly, Hannah, it is complicated, which is why my final piece of advice would be, if you are at all confused after listening to my answer to the question, and maybe even if you’re not, it would not hurt you to reach out to an employment lawyer for an hour of their time, to get this question answered by somebody who works in the field.

Kathryn Tuggle: (43:55)

Yeah, totally agree. I think having that up to the minute guidance from somebody who you can turn to if there is a problem is really worth a lot.

Jean Chatzky: (44:05)

No question. No question. Thank you so much, Kathryn.

Kathryn Tuggle: (44:07)

Thanks Jean, as always.

Jean Chatzky: (44:09)

In today’s Thrive, a simple mind trick that will help you save more money. How you perceive the amount you have to save determines how likely you are to stick to a savings goal long enough to achieve it. Think about it this way. If you want to lose 10 pounds, you need to consume 35,000 fewer calories over the course of a couple of months. Sound intimidating? Of course it does. But what if it were framed like this. To lose 10 pounds trim 500 calories a day from your diet for a couple of months. Same goal. Same timeframe. Same results. The only difference is the level of granularity in which the goal is expressed. According to a new study from UCLA, the way you frame a goal, in this case, smaller is better, can dramatically impact the likelihood that you’ll achieve it. The researchers tested this approach with 2000 Acorns customers. Acorns is an app that allows consumers to save and invest small amounts of money. New users who signed up for Acorns recurring deposit program were randomly offered the choice of committing to monthly deposits of $150, daily deposits of $5, or weekly of $35. Here’s what happened. Savers were more likely to commit to and stick with a personal savings regimen focused on smaller daily amounts over the large intimidating per month goal. In fact, quadruple the number of customers chose to enroll in the recurring deposit program when given the $5 a day option versus the $150 a month savings goal. It’s not a huge stretch to see why this works. Big numbers, like saving a million dollars for retirement are discouraging, even when we fully know that amassing enough money for retirement is supposed to take us decades. If you’re facing a savings goal that seems insurmountable, cut it down to a less intimidating size with some simple math. It takes just $11 a day if you want to amass a $2,000 emergency fund over six months. Do $11 a day from now until April. You’ll have your cash. If you save a little over $5 a day, you’ll get there a year from now. And it takes $16.50 a day if you want to max out your IRA. The IRS allows you to kick in a maximum of $6,000 a year into Roth or traditional. You do that $16.50 a day and start in January. You will be there by December 31st. Finally, all of these things are easier to achieve if you set them and forget them. So, if you’re going the daily route, try to set up automatic transfers of the money, so that you don’t have to make a good decision to transfer it every time you want to do it.

Jean Chatzky: (47:16)

Thanks so much for joining me today on HerMoney. Thank you to Jill Filipovic for the great conversation on the Millennial condition, the generational divide in our country and our world, and how we can all take steps to bridge it. If you like what you hear, I hope you’ll subscribe to our show at Apple Podcasts. Leave us a review. We love hearing what you think. We want to thank our sponsor, Fidelity. We record this podcast out of CDM Sound Studios. Our music is provided by Video Helper. And our show comes to you through Megaphone. Thank you so much for joining us and we’ll talk soon.