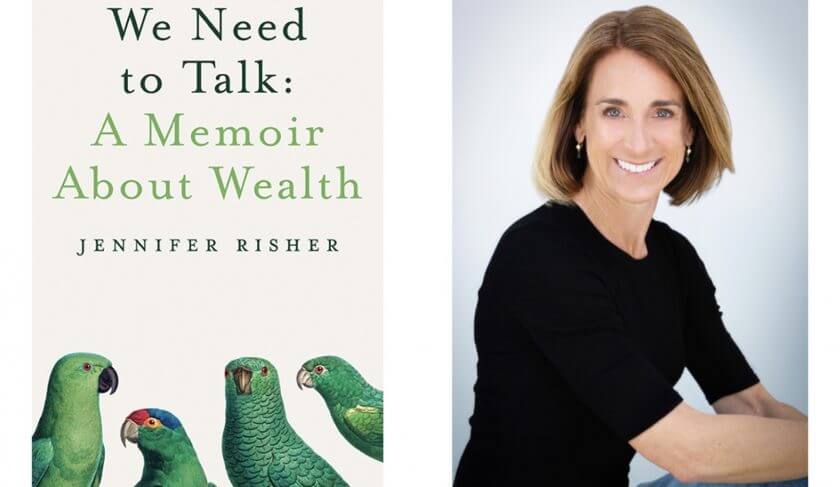

It’s no secret that income inequality is one of our country’s biggest problems, and that we need change — on a societal level, and for some of us, on a personal level, too. Today’s guest has invited the world to talk about money and what it means to have too much of it, with her memoir, “We Need To Talk: A Memoir About Wealth.”

Jennifer Risher is on a mission to start much-needed conversations about money as a way for us to connect, to learn from one another, and to shake up the status quo. In her book, she walks us through both the advantages and challenges of wealth, and tells us that “we are all 99% the same.”

Jennifer is open about the fact that she has money — a lot of it. In 1991, at 25, Jennifer took a job at Microsoft and got lucky. The stock options she was granted were worth hundreds of thousands of dollars. Years later, Jennifer’s husband David took a job at an unknown startup called Amazon, and they got lucky again. By the time the couple hit their early 30s, they had tens of millions of dollars in the bank… But since that day, they’ve also given millions of it away. Today, she and her husband run the nonprofit organization they started together, HalfMyDAF, to inspire more charitable giving.

Jennifer tells us about her middle class upbringing, and how her father raised her to be a money saver, and to never waste food. She shares how she learned to process and manage her wealth, and discuss it with her family. Jennifer also tells us about her philanthropic work, and how her foundation has inspired more than $6M in donations.

Jennifer shares some of her own experiences with having awkward money conversations, and walks us through five steps that everyone can follow when diving into talks with our friends and family. (Hint: Listen first. Then ask questions.) She stresses that we should never be embarrassed about talking about money — rather than making things awkward when you bring up finances, you’re actually opening a door for people. (A door that perhaps they wish had been opened long ago!) She shares how talking about money helps us demystify it, and why it’s so important that we have these discussions even when there are wide disparities in salaries.

“I think women can be leaders in shifting the power dynamic of money. We’re the communicators. We don’t shy away from emotions, and talking about money is uncomfortable. It’s not easy. We don’t have practice, but we, as women, have a lot to gain,” she says, highlighting the gender wage gap as one enormous concern for all women that’s gone undiscussed for far too long.

Jennifer also shares her best advice for people looking to donate this year — start by looking inside your heart. “When we give to a place we feel passionate about, we’re more likely to give again, and build a relationship with that organization. Organizations want to know who their donors are,” she says.

In Mailbag, Jean tackles a question from a listener who is debating a Roth vs. traditional IRA, and wondering what kind of life insurance to get. We also hear from a listener who is unsure if she should take steps to refinance her home, and check in with a woman who has tax questions after having bought her grandparents a house in 2018.

Lastly, in Thrive, we talk about fractional shares of stocks, and review what they are and how you can invest in them.

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Transcript

Jennifer Risher: (00:01)

I think women can be leaders in shifting the power dynamic of money. We are the communicators. We don’t shy away from emotions. And talking about money isn’t comfortable. It’s not easy. We don’t have practice. But we as women have a lot to gain

Jean Chatzky: (00:19)

HerMoney is supported by Fidelity Investments. During this uncertain market, planning for retirement is more important than ever. Not only can it make you feel better about where you stand today, but you’ll be more prepared for tomorrow. Visit Fidelity.com/HerMoney to learn more.

Jean Chatzky: (00:40)

Hey everyone. I’m Jean Chatzky. Thank you so much for joining me today on HerMoney. So today we are going to get just a little bit uncomfortable. But I promise you that by the end of the episode, you will be glad that we did. We are going to break the taboo around talking about wealth. It is no secret that income inequality is one of our country’s biggest problems. And that we need change on a societal level and, for some of us, on a personal level, too. Today’s guest has invited the world to talk about money and what it means to have too much of it, with her memoir, “We Need To Talk: A Memoir About Wealth.” Jennifer Risher is on a mission to start much needed conversations about money as a way for us to connect, to learn from one another and to shake up the status quo. In her book, she walks us through both the advantages and the challenges of wealth, and tells us, and I love this, that we are all 99% the same. Jennifer’s pretty open about the fact that she has a lot of money. In ’91, at age 25, she took a job at Microsoft and she got lucky. The stock options she was granted were worth hundreds of thousands of dollars. And years later, Jennifer’s husband took a job at an unknown startup called Amazon, and they got lucky again. By the time the couple hit their early thirties, they had tens of millions of dollars in the bank. But since that day they’ve also given millions of it away. I am so excited that Jennifer is here with me today. She is joining us from her home in San Francisco, where she and her husband live with their two daughters and run the nonprofit organization they started together, Half My DAF, to inspire more charitable giving. Hey, Jennifer. Welcome.

Jennifer Risher: (02:45)

Thank you, Jean. It’s great to be here.

Jean Chatzky: (02:47)

It’s nice to talk to you and I totally want to dive into the book, but can we start with that term first. Half My DAF? What is that?

Jennifer Risher: (02:56)

Okay. Well, yes. DAF stands for donor advised fund and without getting too technical, it’s a place where you can put your money. Usually you get your tax break, you put your money into your donor advised fund, it’s an organizing mechanism so that you can give your money away from your donor advised funds. Once it’s in there, it’s all charitable dollars. So it gives you time to kind of think through your giving and kind of have a plan. But what we found is that it’s getting stuck. Money is getting stuck in those DAFs, in those donor advised funds. In fact, there’s $120 billion stuck in donor advised funds. So our thought was, how are we going to get that money out and put it to work where it’s needed? And you know, when COVID hit, my husband and I, our hearts were going out to nonprofits. There was so much need. We wanted to do something. And we thought, well we just need to start giving. But we thought let’s hook that giving desire up with the donor advised funds and inspire others to join us. So we put up a million dollars in the form of matching grants to inspire others. And we asked people to commit to moving half of the money out of their donor advised funds to a non-profit and we would match some of those gifts. So it was really fantastic. We started in may and we ended at the end of September. And in those five months, our million dollars helped move $8.6 million out to nonprofits.

Jean Chatzky: (04:27)

That’s fabulous.

Jennifer Risher: (04:27)

So it was wonderful. Even more wonderful, I think, was the community it built around that. I mean, we had people telling us, this is the nudge we needed. Thank you. And nonprofits were so thankful. And we heard people talking about having conversations around the dinner table about money that they wouldn’t otherwise be having. They were talking about, where do we want to give, what are our values? So it really started conversations, which I think is so important.

Jean Chatzky: (04:54)

It is. It’s totally important. I want to dig in a little more to your background. You grew up middle-class and in the book you write about how becoming wealthy was a little uncomfortable. Can you talk about that?

Jennifer Risher: (05:09)

It really was. Yeah. I grew up, my father, his father had dropped out of school in eighth grade to work and his mom was a second grade teacher. So he remembers, you know, going to the dinner table worried about not having enough to eat. So he grew up kind of always feeling that there wasn’t quite enough. And that really carried over to the way I was raised. I mean, I wanted to be responsible. I wanted to, you know, we didn’t waste things. We didn’t waste food and we were very careful and very frugal. I grew up saving my pennies and wary of the rich. They were sort of them, other. And so to become something that you grew up sort of biased against is tricky. And you know, wealth surprised me. You know, having a lot of money doesn’t look or feel like what Hollywood sells us.

Jean Chatzky: (06:01)

What does it look or feel like?

Jennifer Risher: (06:03)

Well, I didn’t find myself in this sparkly, private club hanging out and sharing financial secrets. I actually found myself alone, in kind of a strange silent space where no one was really talking much about money at all. And suddenly I felt a friend’s resentment. And I was worried about raising spoiled, entitled children. And I wasn’t sure about giving to family members. I didn’t know how to approach philanthropy. I was alone. And even though these challenges are new to most people, eight out of 10 people with wealth grew up middle-class or poor.

Jean Chatzky: (06:46)

On this show, we often talk about the meaning of enough in your life, of having enough, of what that means. And there is, admittedly, a big, big gap between the experience of your grandparents wondering if there was going to be enough food on the table and having millions of dollars. But how do you define enough and how has that definition changed over the years?

Jennifer Risher: (07:14)

Yeah. This is a tough question for everyone. I think we as humans sort of tend to think, well, just a little bit more. There’s always more, but there’s also always less. And I think we can get into a struggle of, you know, the more. And I think for me, it’s sort of, you have to make this conscious decision, I have enough. I think it’s surprising how quickly a hundred dollars doesn’t feel like enough. A thousand dollars, oh, that’s not enough. Just $2,000. We’re always like kind of stretching and we can get into the bad case of just always chasing after more. And I didn’t want to do that in my life because we were incredibly lucky and we have way more than enough. And you know, when you think about enough and happiness and where’s that contentment, every dollar does make you happier, but only to a point. So, you know, research sort of shows that at $75,000, once you kind of hit that mark, once your basic needs are met and you kind of have comfort and you can go on a vacation, any incremental dollar after that, isn’t going to make you any more happy. So, you know, at $75,000, that’s probably enough in terms of finance, because if you have double that, if you have 10 times that, if you have a hundred times that, it’s not going to make you any happier. I mean, you might think, oh yeah, but I could have a bigger house. Yeah. But who are you living with in that bigger house? That’s the key to happiness. That’s the key to enough. It’s our relationships with other people and the quality of those relationships. And generosity also brings happiness. I mean, research shows that if we spend $50 on versus on someone else, we’re going to be happier if we spend it on other people.

Jean Chatzky: (09:00)

Yeah. I mean, you’re citing studies that I have looked at and have really dug into for years. That $75,000 happiness level is an interesting one. That’s Daniel Kahneman’s research. He did it about 10 years ago at Princeton. He won a Nobel Prize for it. And I have wondered a couple of things. I mean, I know there must be different levels and different places across the country. As Kathryn, our producer points out to me all the time, it costs a lot more to live in New York than it does to live in Alabama where she grew up, or wheeling West Virginia, where I grew up. But I’ve also sort of wondered if the number has grown. I think maybe it isn’t a number. It’s more of what you described of that level of lack of worry, lack of stress, knowing that you can, not only pay your bills and put food on the table, but do some fun things and not have to worry that your kids are not going to be able to go to college. I think there are things that we worry about today that we maybe didn’t worry about just 10 years ago.

Jennifer Risher: (10:05)

I think you’re right. Yeah. It’s not really that specific number. Yeah. And maybe since that was done in 2010, maybe the is a little bit bigger now. Maybe it’s 80,000. And it does depend on where you live. It’s different in, like you said, North Dakota than it is in New York City.

Jean Chatzky: (10:20)

Yeah.

Jennifer Risher: (10:20)

And I think there’s an element to kind of, you asked about a sense of enough, and it’s a little bit relative. Relative to who your neighbors are, who your friends are, kind of where you fit within kind of the community that you’re within.

Jean Chatzky: (10:35)

That’s what makes talking about it so difficult I think. Because you’re absolutely right. I mean, human beings are wired to compare. We’re wired to do two things. We’re wired to adapt to how much we have, which is why it never seems like enough, and we’re always striving, and it’s very helpful to have this conversation about how we can stop. But we’re also hardwired to look at the person at the next desk, during those days when we were actually working with somebody at the next desk, or look at the person next door, or look at our siblings, or look at our friends, and look at the car that they’re driving, and look at what they’re wearing, and look at how their house looks and make judgments about how we’re doing compared to how they’re doing. So how does talking help with that?

Jennifer Risher: (11:30)

Yeah. Those things are all so human. Yeah. And money is that taboo. And I think, you know, I realized that the more I’ve been talking about money, the more I realize it is those emotions, that judgment or the resentment or the comparisons that we do. That we all do. And it doesn’t matter how much is in your bank account. If you have friends, if you have parents, if you have siblings, it’s easy to get caught up in comparisons. And you know, the motions that come up are really universal. It’s often fear. I mean, it’s fear of hurting someone’s feelings. It’s fear of rejection. It’s fear that we won’t measure up, or that will sound unknowledgeable, if we have these conversations. But I really think, I want to invite us to get uncomfortable with those people closest to us, because on the other side, instead of being in that place of comparison and judgment, I think we can be more connected and we can also learn from each other. Let me just share a quick story. This is kind of where we are now. And this is a friend of mine who’s middle-class. She told me that she and her husband drove the same car for many, many years. And she said, you know, when that thing finally broke down, I bought an Audi Q5. She’d always wanted that car. She loved the car. And then when she was thinking of visiting her sister and driving up in the car, she started to worry about being judged. And in her mind, she was hearing her sister saying, ooh, aren’t we fancy? And then in her mind, she was telling herself, well, you know, it wasn’t that expensive. It was used. So even before she saw her sister, she was making assumptions and telling herself stories. What if she actually talked to her sister? Because when we don’t talk about something, it tends to loom large and take on a life of its own. And when we don’t talk about money, we’re giving money way too much power.

Jean Chatzky: (13:32)

I completely agree with you. A hundred percent. But I do think, if it was me driving up in that car, it would have been hard to have that conversation. And so I want to dig in, and I talk about money all the time, right? I want to dig into how we can start these conversations. How we can get ourselves over these hangups that are in our own minds that are standing in our way. But before we do that, let me remind everyone that HerMoney, and these kinds of conversations that we have every single week, HerMoney is proudly sponsored by Fidelity Investments. Whether you are just starting to save for retirement, inching closer to it, or looking for smart ways to help protect your savings in today’s uncertain market, Fidelity can help. And when life throws you changes, Fidelity’s guidance can help you keep your financial plans in check. So you will feel better today, but you’ll also feel more prepared for tomorrow. Visit Fidelity.com/HerMoney to learn more. I’m talking with Jennifer Risher, author of We Need To Talk: A Memoir About Wealth. So tactically, how do we do this?

Jennifer Risher: (14:48)

Yeah, it isn’t comfortable. It makes us very uneasy. We don’t have experience with it. And it’s very emotional. So yes. All of those things are yes. But how do we do it? We get uncomfortable. And I kind of can take us through five steps. And I want to have you think about, I mean, somewhere in your life, you probably have some sort of awkward money issue hanging over your shoulders, with a friend or with a parent or with your sibling. Or there’s those awkward money moments when you’re in the situation and you just avoid it. I want us to move through it. So let’s say it’s a friend wants to go out to an expensive restaurant that just doesn’t fit your budget. Or your mother says, oh, you’re going on vacation again. Can you afford that? Or your daughter wants to buy an expensive handbag that doesn’t fit her budget or your values. Or your in-laws give financial gifts to your spouses siblings families, but not to yours. Or you go out with a couple that are always talking about all the stuff they’re buying. So these things, you know, we tend to avoid those. But I want us to dive in and I want us to follow the five steps to kind of get to the other side. Get to more connection. So first, I think it’s really getting clear about your feelings. How do you feel? Like let’s take the example of your friends always wanting to go to an expensive restaurant. Okay. Am I feeling resentful? Am I feeling like the friendship’s not going to last? No. I actually feel ashamed. I’m ashamed that I can’t afford that restaurant. And you know, I have a good job. I feel ashamed. Okay. So you figure out what you feel, and then two, schedule a time. A time where you have time and where the emotions are neutral. And then three, I think this is the most important step. And it kind of gets back to what you were saying, Jean. It’s like this isn’t comfortable. So let’s acknowledge it. When you get on the phone let’s say, you know, this is really uncomfortable for me. I don’t know what I’m doing. Give each other permission to fumble around because you’re going to. It’s going to get messy. You’re going to make mistakes. And if you acknowledge that upfront, I think you create a safe space to have that conversation. Who knows what it’ll look like. There is an element of trust, but there’s also a safe space there. And then four, listen and ask questions. So, listen first. Maybe each of you talks for five minutes, uninterrupted. And then you really ask each other, what’s going on. So in that case of feeling ashamed about not being able to afford the restaurant, you tell your friends, I feel ashamed. How is she going to react? Maybe she says, oh my gosh. Thank you for saying that. I am in debt. I shouldn’t be going to those restaurants either. You’ve opened a door for her. Or maybe she hadn’t realized. And she says, I don’t care where we eat. It’s really about being with you. You know, you really don’t know because we do so often tell ourselves stories about what’s going on for someone else. And this is the moment where we can really connect. And I think what we’ll find is that we’re a lot more alike than different. We have a lot more in common. And step five, I think will just happen naturally. Because it’s thanking the other person. Showing your gratitude. And I think what you’ll feel on the other side of that conversation, even though you haven’t done it perfectly, is a sense of relief, a sense of connection in a new way, and this chance to learn.

Jean Chatzky: (18:13)

This is an amazing methodology. It’s really helpful. It’s really tactical. And I think you could apply it. I mean, I love that you laid out so many different scenarios. I mean, I’ve had the one where my daughter wants to buy the bag that is definitely not in her budget. And I think that this would be really, really helpful. So thank you so much for doing that. I want to just come back to where we started, which is with giving money away, particularly now with COVID. What’s your best advice for people looking to donate this year? How do we know that we’re doing good with whatever money we have to give?

Jennifer Risher: (18:55)

I think we start by looking inside our own hearts and finding what we really feel passionate about. Because when we give to a place where we feel passionate about, we’re likely to give again and find the relationship grow. I think, you know, we all want to have an impact. I think it’s trusting the organization you’re giving to. Building a relationship with that organization. That’s going to bring you a lot of joy. It’s going to help them. They want to know who their donors are. So I just, I really am an advocate of leading with passion and leading with the heart. Yeah. You want to do maybe a little research on the organization or maybe you don’t. I mean, you know, when you give to a nonprofit, you’re giving to people who are spending their lives and working towards solving a problem or helping other people. Trust that person that they’re doing their best and that this money probably will be put to very good use.

Jean Chatzky: (19:49)

How is all of this different for women?

Jennifer Risher: (19:53)

You know, I love what you’re doing to educate and empower women to be financially independent. You’re teaching us how to talk about numbers, how to talk about how much we’re earning, and how much we’re paying in rent, and where we’re investing. These are wonderful things because that’s how we learn from each other. But I think women can be leaders in shifting the power dynamic of money. We are the communicators. We don’t shy away from emotions. And like we just discussed, talking about money isn’t comfortable. It’s not easy. We don’t have practice. But we, as women, have a lot to gain. For one, women earn roughly 80 cents for every dollar a man earns. If we’re white. If we’re black, it’s 60 cents. If we’re native American or Latin X, it’s less than that. So for us, we have a concrete advantage or there’s a concrete reason we want to shake up the status quo. But it’s not only about equity. It’s also about connection. Men, their ego and their identity is so wrapped up in money. I think it’s women. We’re the ones that can talk to people closest to us. And we can take money out of the taboo category, out of the shame category, and put it in its place. Not as something bigger than us, but as a tool.

Jean Chatzky: (21:17)

And is that something again that we start just by talking about it. Is it talking about it or is it taking a more active role in the family finances? What are the pieces that we need to do to create this shift?

Jennifer Risher: (21:31)

Well, I think you’re doing an incredible piece of taking more responsibility of our finances. That’s the numbers piece. But money is emotional. And there’s so much emotional baggage and things that we make up around money that I think we need to sift through and work through and realize that, you know, it’s not bigger than us. We can put it in its place. It is just a tool for us to use. And I do think it starts with conversations and it starts with conversations with the people who are closest to us. Those are the hardest ones and that’s where we need to start. And I think as women, we have the power to do that. We can make that happen. It’s not easy, but I think if you follow those steps I outlined, you can have your first conversation. And those aren’t conversations we’re currently having. And they’re ones we need to have.

Jean Chatzky: (22:16)

You’re not going to get any argument from me.

Jennifer Risher: (22:19)

Thank you.

Jean Chatzky: (22:19)

The book is “We Need To Talk: A Memoir About Wealth.”, Jennifer Risher, where else can we find information about you?

Jennifer Risher: (22:27)

You can go to my website and it’s JenniferRisher.com. There are two Rs in that. I think that’s the best place really. Thank you.

Jean Chatzky: (22:36)

Thank you so much for being here.

Jennifer Risher: (22:38)

Thank you.

Jean Chatzky: (22:39)

And we’ll be right back with Kathryn and your mailbag.

Jean Chatzky: (22:47)

And HerMoney’s Kathryn Tuggle is joining me. Hey Kathryn.

Kathryn Tuggle: (22:51)

Hey there Jean. How are you doing?

Jean Chatzky: (22:53)

I’m okay. I’m having a day.

Kathryn Tuggle: (22:58)

Oh no.

Jean Chatzky: (22:58)

I am. I’m having a day. I don’t know. Is that okay to admit in our podcast, I am having a day. I am having a day where the words are not coming out of my mouth correctly. And I think part of it is Teddy is getting up in the middle of the night. So Teddy, for those of you who don’t know everything about my life, is my cockapoo. And he is 15 and a half years old. And he seems to have forgotten what the difference is between day and night. And so he wakes up at, I don’t know, this morning, it was three in the morning. And he needs to go out and he needs like a walk. I’m scared to let him out the middle of the night cause sometimes we have critters. So I wake up. I put on my sweats. I put on these big ugly boots. And put the leash on, grab a flashlight and take him out until he does his business. And then I bring him back. And then he wants a treat. And you know, he’s 15 years old, so I give him a treat. And then he runs around for a little while and eventually he comes back to bed and then he sleeps till 10 in the morning, which I cannot do.

Kathryn Tuggle: (24:10)

Right.

Jean Chatzky: (24:11)

Right? I cannot do that. So the vet suggested that we give him melatonin. And we think maybe the melatonin is working, but we suspect it’s kicking in when he gets back from that 3:00 AM walk and keeps him asleep till about 10. Because that’s a really, really long stretch. So we’ve been trying to juggle when we give him the melatonin. We tried really early, then we tried really late and nothing is working. But so my sleep has just off. And I think I could roll with it for a little while because I’m used to getting up really, really early in the morning. But it’s just getting to me a little bit.

Kathryn Tuggle: (24:53)

Oh man. Well, you’ve also, whenever I was out at your beach house this summer, you were giving us the caveat that you would be waking up at a crazy hour to take him out. So this has been going on for a while.

Jean Chatzky: (25:05)

It has. It has been going on for awhile.

Kathryn Tuggle: (25:09)

Maybe now exacerbated by the fact that you have to brace yourself for the frozen Tundra. Cause I don’t know if I could go back to sleep after putting all that stuff on.

Jean Chatzky: (25:17)

Yeah. I mean, I do go back to sleep. I’ve been getting through quarantine with the help of Jane Austin. Have I told you this yet?

Kathryn Tuggle: (25:25)

No.

Jean Chatzky: (25:25)

So I listened to audio books and I listen to them in my car. But I often, when I come in from walking Teddy in the middle of the night, I have to listen to something to get me back to sleep. And so I’ve discovered that the actress Rosamund Pike has read a number of Jane Austin’s novels, and they’re available on audio. So I’m using those to put me back to sleep. But as a result, you know, I sort of wake up. It’s still playing. I have to learn to set the sleep cycle.

Kathryn Tuggle: (25:59)

That sounds amazing. That sounds really soothing.

Jean Chatzky: (26:02)

It’s pretty soothing. I actually, this may be too much information for our listeners, but I actually slowed it down a little bit. You know how sometimes you, at least when we watch shows from the UK or Scotland or Ireland, we have to turn on the subtitles in order to understand them. And with these books, I’ve had to actually slow the read down to, just a bit, in order to capture all the words. But she still sounds absolutely beautiful.

Kathryn Tuggle: (26:37)

Oh. That’s such a good idea. I’ve actually heard from a couple of our listeners that they speed us up.

Jean Chatzky: (26:42)

Really?

Kathryn Tuggle: (26:43)

Because they want to like a quick, digestible, cramming in their financial advice. So yeah. I think you’ve got to do whatever works for you. I mean, we live in an era where you can speed it up or slow it down or whatever you need.

Jean Chatzky: (26:57)

Interesting. Gosh. All right. Do you think I talk too slow?

Kathryn Tuggle: (27:00)

No. I think that these are just like, these are women on a mission. They’re headed to work and they just want their Jean Chatzky as quick as they can get her.

Jean Chatzky: (27:09)

Goodness. Alright. Well, enough of that. Let’s answer some questions.

Kathryn Tuggle: (27:14)

Our first note in mailbag today comes to us from Tammy in Texas. She writes, I love the podcast and website. I’m 39 and I’ve always been smart with money, but not smart enough. I have nowhere near the amount of retirement stacked away. I was laid off in 2016 so I returned to school to finish my BS. I rolled over my work 401k into a traditional IRA that now has about $27,000. It has grown every year, but slowly. I have money, a hundred percent in mutual funds, 52% stock, 48% bonds. I’m starting a new job, making more money than ever before, thanks to that college education. And I want to be aggressive and catch up and get my money working for me. I need to add that my partner is well compensated and handles all the finances, so my money can be dedicated to wherever I feel necessary. My financial planner suggested leaving my traditional IRA as it is. He suggested I open a Roth so I can contribute to that with a more aggressive fund. I have an outside financial planner telling me to take the tax hit now, since the amount would be relatively low and roll over my traditional IRA into a Roth IRA and then max out my contributions. Lastly, this planner is also pushing whole life insurance as a supplement, but I’m not fond of this idea. Please help me.

Jean Chatzky: (28:33)

Hey Tammy. Thank you so much for writing. I think that you sound like you are absolutely on the right track. So we are going to help you catch up, so you can stop worrying. A couple of thoughts on this. Your money is a hundred percent in mutual funds, but your asset allocation, 52% stock, 48% bonds is a little conservative for somebody who’s not quite 40. I would prefer to see you with a mix of closer to 60% stocks and maybe even a little bit more, depending on how comfortable you are with that amount of risk. So the financial advisor who suggested that you open a Roth and contribute money into a more aggressive mutual fund, I think is on the right track. But my first question is what’s going to happen when you get that next job? Rather than continuing to fund a series of IRAs, which I agree is a good stop-gap measure, I’m hoping that wherever you get your next job will have a retirement plan that you can contribute to via your paycheck, and that it’ll have some matching dollars, and that you can max that out. Because that will allow you to kick in substantially more than you can put into an IRA each year. If you can, in addition to that 401k, contribute to a Roth IRA, then by all means, go ahead and do that. And even if you have too much income to qualify for the Roth, but you could fund a traditional non-deductible IRA outside that 401k, I think great. You want to maximize the amount that you are putting into retirement because it sounds like based on your relationship with your partner, you have the ability to do that. The second thing I want to encourage you to do is to look at all of your investments, no matter what account they’re in, as a whole. And asset allocate across them. So that when you look at the IRA and the Roth IRA and the eventual 401k, you’ve got an asset allocation across the whole pool of them that works for you. And again, I think it needs to be a little bit more aggressive than it is today. Whole life insurance. That doesn’t make sense to me right now as part of your financial plan, unless there is something about your life that I don’t know about. When I look at your life, it sounds like you don’t have any dependents. And generally, we buy life insurance for the people who depend on our income down the road. There are some times when an insurance policy, a whole life cash value insurance policy, can make sense as part of a retirement plan. But I’d stipulate that first, you make sure that you’re maxing out that 401k and all of the IRAs. And then if you’re looking for another place to put the money, that’s where I would start looking at life insurance as an option. But again, let’s focus on finding that new job and making sure, if possible, that the benefits are good ones so that you can do this the easiest way possible, through a paycheck deduction. I hope that makes sense.

Kathryn Tuggle: (32:15)

I love that Jean. And I love just the basic guidance to look at everything as a whole. I think, you know, sometimes it’s nice to get granular, but sometimes you need that 360 degree perspective.

Jean Chatzky: (32:26)

Yeah, absolutely. And that is often why I think that, if we find ourselves after changing jobs with a 401k over here and an IRA over there and another 401k over there, consolidating, bringing it all into one home, if not a single account, then at least a single institution, can be really, really helpful. Because that way, when you sign on to the online portal, you can see everything on one screen.

Kathryn Tuggle: (32:56)

Amazing. Thanks Jean.

Jean Chatzky: (32:57)

Sure.

Kathryn Tuggle: (32:58)

Our next note comes to us from Stephanie. She writes, dear Jean. I love your solid money advice and listened to your podcast all the time. Thank you. With interest rates at an historic low, my husband and I are trying to figure out if we should refinance our home loan or if the fees involved, wouldn’t pay out in significant savings. Our details, we purchased our home for $450,000 in August of 2019 and carry a 3.5% interest rate on our mortgage. We currently owe $400,000 on the house. Given the fact that we already have a pretty good interest rate and have only been in the home for a year, does it make sense to renegotiate the mortgage for a lower rate. Both my husband and I have excellent credit scores. What’s the formula we need to follow to figure out if this is a good move?

Jean Chatzky: (33:41)

Hi, Stephanie. Thanks so much for the question. And thanks for listening. Basically, the formula is the cost of the transaction divided by the amount of time that you plan on staying in the home. So I ran some of these numbers. I don’t know if they’ll be exactly your numbers, but I think there’ll be pretty close. Right now, according to my calculations, you’re paying $2,246 a month for your mortgage. Now I included PMI because you didn’t put 20% down on the place. I didn’t include your homeowners insurance or your taxes because I wasn’t sure what they were. Right now, if you refinance at a 3% interest rate, which is pretty easy to come by, your new monthly payment, again including PMI, would be $2,136 a month. That’s a savings of $110 a month. The cost of a refi is typically 2% to 3% of your loan balance. So we’ll just split it down the middle and call it 2.5%. At a $400,000 mortgage. That’s $10,000. So you take the $10,000 and you divide it by the monthly savings. And what it says is that if you’re saving $110 a month, you’ve got to be in the house 90 months to make it work. Now, if you can find a mortgage that’s less expensive, if you can bring the rate down to 2.75, that will lower your monthly payment to $2082 a month and bring the amount that you’re saving each month up to $164. And that brings the break even point to 60 months or five years. So if you can do that, and you know you’re going to be in the house for that long, that’s when it makes sense to do the deal and lock in these low rates. The other thing that I want to suggest, and I’m going to suggest it because you’ve only had your loan for a year, is that before you do any of this, you go back to your original lender and you ask about something called a streamlined refi, which may allow you to get away with less paperwork and less cost. You may end up with a slightly higher mortgage rate, but when you do the math, it may make sense in the balance. And I hope that that’s helpful.

Kathryn Tuggle: (36:11)

Thanks so much, Jean. That was a great breakdown. Our last note comes to us from an anonymous listener. She writes, first of all, thank you so much for all you do. You’ve made learning about money and its management exciting and interesting. I’ve shared your podcast with many people over the years. My question is about taxes. In 2018 I exercised a tender offer through my company and used the money to buy my grandmother a house in Texas. She and my grandpa are happier than ever there. And there’s no better person to take care of my investment than my very clean and well-organized grandparents. I had set aside some money for 2019 taxes, but when a bit over budget on the house, using some of my tax savings for the perfect home. I live in New York, and as you know, the taxes here can be a real downer. After applying my tax refund and money I had in savings, my tax balance is $21,000. I signed up for a payment plan with the IRS at $400 a month, with an extra $5,300 tacked on in interest and penalty fees, that began accruing in September, bringing my balance to over $26,000. I’ve gone over a few options in my head and I would love your advice. From my research, I found that I could one, stick to the IRS payment plan and attempt to pay the debt off early, throwing any extra I can at it until it’s paid as agreed with interest and penalties. Two, take out money from my Roth IRA and pay myself back slowly over time. Three, take out a HELOC or home equity loan on the house I purchased for my grandparents. I purchased the home in cash with no mortgage. Not sure if that makes a difference. Number four, take out a personal loan. I have a credit score of 800 and might be able to get a good interest rate. Number five, use a credit card with a low interest or no interest introductory offer. Although I don’t think I can pay it off before the intro offer would expire. For reference, I have about $26,000 in the Roth I mentioned, $21,000 of it in contributions, and an additional $34,000 in a separate 401k. I’m 38 years old and was recently laid off, but received a healthy severance package and I have a very optimistic outlook for better opportunities when I’m ready, I’m afraid to commit to a debt repayment plan that could cause money troubles should I get a new job that doesn’t pay as much as I’ve made in the past? Which option do you think is best? Maybe a combination of the above. If you’ve got any new ideas up your sleeve, I’m all ears. Your advice is appreciated. Thank you again for all you do.

Jean Chatzky: (38:36)

Well, thank you so much for writing. Boy are your grandparents so lucky. You are incredibly generous. And we’re also benefiting from your generosity. I love that you’ve shared the podcast with many people over the years. And I just want you to know that if you’re sharing the podcast, as well as our newsletter, we have this new ambassador program where, if you share with people, we’ll actually send you swag. So you know, HerMoney t-shirts and hats and that kind of stuff. If you go to HerMoney.com, that’s where the newsletter subscription button is. And you sign up, we’ll start sending you ways that you can share the newsletter and then the podcast with people that you know, and you love. And maybe we can send you some stuff for the holidays. Anyway, to your question. I was leaning one way until I got to the end of your question about being laid off. I think a HELOC is probably a good way to go. The problem is, you’re going to have to be employed and be able to prove income in order to get one. And the reason for this is that when we look at paying off a debt, we always want to pay it off at the cheapest interest rate possible. I’m not sure what the interest rate is on the balance that you’re paying to the IRS. I’m not sure how much is split between interest and penalty fees, but it’s pretty substantial based on the size of your debt, which is why, if you can knock it out, you might be able to bring the total back down closer to the $21,000 level, rather than that expanded $26,000 level. I’d rather not see you pull the money out of retirement if you don’t have to because at 38 years old, you need to continue to make headway toward retirement, and that money needs to continue to grow. So for right now, I would do two things. As you look for a job, I would just continue to pay on the debt at the rate that you were given. Looking forward to a time when you have an income, and you can apply for a HELOC that will allow you to pay it off cheaper and faster. The second thing is, I’m just wondering about your grandparents. It’s clear that you are really trying to help them. I think that that is fantastic. But I’m wondering if they have any room in their budget, since you’re providing them with a place to live, clearly rent free, to supplement your income with a small amount of rent that you could use to pay off this loan. It’s just thought. I don’t want to cause any sort of family strife. As we heard from Jennifer, we know that talking about money within families can be difficult. But I do think you might want to go there depending on how their financial situation stacks up. And if you have any additional questions about this as you land in a new job and as you go down the road, please send them my way. I’m happy to help.

Kathryn Tuggle: (41:58)

Amazing great advice, Jean. Thank you.

Jean Chatzky: (42:00)

Thank you so much, Kathryn. And in today’s Thrive, have you seen the price of stocks these days? A single share of Amazon costs as much as several mortgage payments. Three shares of companies like Netflix, Tesla or Apple, they can eat up your entire investing budget. You can save your money until you have enough and hope share prices don’t continue to shoot out of reach, or you can do something else. You can buy fractional shares with however much money you can afford to invest. At HerMoney.com, we’ve got a rundown on what fractional shares are and how to buy them. All you need is a spare couple of dollars and a brokerage account. Investing in fractional shares means buying partial shares of stocks based on your budget and not the stock price. If a stock is trading for $2,000 a share and you only have $50 to spare, no problem. Your $50 will buy you a fraction of that share of stock. 2.5% in this example. With fractional shares, you reap the same rewards as other shareholders, profiting from earnings, getting paid dividends, except your cut is in proportion to the amount of stock you own. Besides making pricey stocks a little more affordable, fractional shares also make it easier to build a diversified portfolio right away. You could use your 50 bucks to purchase a partial share in a single company, or you could spread the amount over several stocks to spread your risk around. To get started, you’re going to want to choose a broker that has no account minimum if you’re starting with a small amount of money. Also compare trading fees. You don’t want your dollars gobbled up by fees. Look at the selection of stocks and ETFs that are available to buy in fractional shares, because it can vary widely. And then make sure to choose a broker you can grow with. Switching brokerage firms is a little bit more of a pain if you own fractional shares, because you’ll probably have to sell those shares in order to transfer the money. There are a number of brokerages that are in this marketplace, including our sponsor, Fidelity, as well as Charles Schwab, interactive brokers, Robinhood. SoFi, Stash and Stockpile. And no matter where you get your account, the important thing is, don’t let the price of stocks keep on the investing sidelines. Buying fractional shares is a great way to ease in. Thank you so much for joining me today on HerMoney. Thanks to Jennifer Risher for her insight on wealth, on money and happiness and on philanthropy. I loved that conversation. If you like what you hear, I hope that you’ll subscribe to our show at Apple Podcasts. Leave us a review because we love hearing what you think. We want to thank our sponsor, Fidelity. We record this podcast out of CDM Sound Studios. Our music is provided by Video Helper and our show comes to you through Megaphone. Thank you so much for joining us and we’ll talk soon.