We are now halfway into 2021, which is hard to believe, but in many ways, June of 2021 feels more like a fresh start than January did. We’ve got summer that’s finally here, more of us are able to travel and see our families and friends, we’re heading back to the office, and in so many ways, we’re returning to “real life.”

And while this is so wonderful and so welcome, that return to “normal” may also represent an opportunity for us to slide back into old habits that we really, really want to change. Maybe that habit is overspending, and it’s much more of a reality now that we can stroll our favorite department stores… Maybe it’s drinking to excess, and now that invitations to happy hours are turning up in our inboxes, we’re worried we’re going to slip back into a routine that can negatively impact our health. The truth is that we ALL have habits that we’d probably like to change. Think about your big goals for your life — maybe it’s buying a house, taking a big vacation, or simply eating healthier day-to-day… What changes could you make today that could help you reach those goals faster?

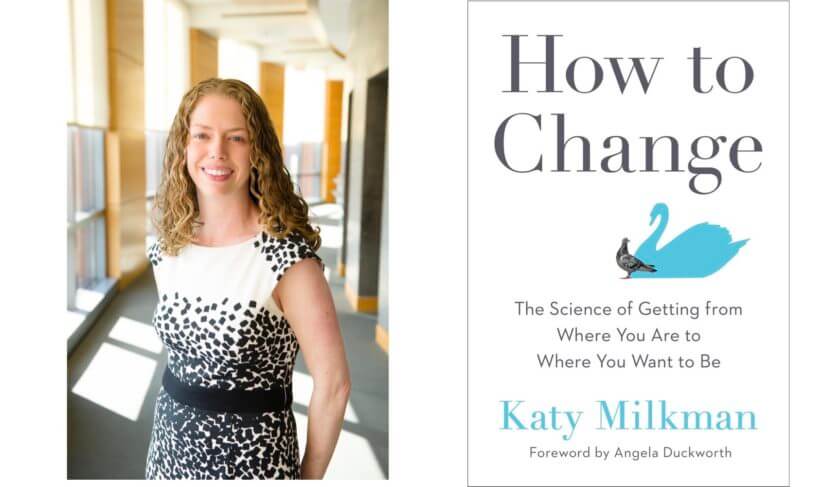

Over the course of the last year, it seems change happened all around us — but this week’s episode is for those who are aspiring to change themselves. We sit down with Dr. Katy Milkman, an award-winning behavioral scientist and professor at The Wharton School of the University of Pennsylvania. She’s also the co-founder of The Behavior Change for Good Initiative, and her new book: How to Change: The Science of Getting from Where You Are to Where You Want to Be, just hit bookstore shelves.

Listen in as Dr. Milkman tells us what inspired her to write her book — her path to dissecting how our daily decisions affect our prosperity and our happiness. She also discusses why “timing can be everything when it comes to making a change,” and the most important things people can do now if they’re looking to affect real and lasting change in their lives.

“We often make the mistake of trying to pursue change in a way that we think will be really effective, and don’t focus on a way to make change actually fun… And that leads us to persist less than we would if we tried to find a way to make it enjoyable to pursue our goals,” Dr. Milkman says. “If it’s not fun, we aren’t going to stick to it. So try to find a way to make whatever change you’re trying to make fun. Maybe that’s by making it social or by rewarding yourself in small ways as you make progress.”

We know that getting people to save more money is difficult. Dr. Milkman breaks down how we can make permanent changes with our money, when it’s so easy to slip back into the habit of simply not saving enough. (HINT: Her thoughts on “commitment devices” may change your world!) We also talk about simply starting with our decision-making, since sometimes that’s the hardest part. Where do we start when there’s something nagging at us, that we know we should do? How do we turn that “should” into ACTION? And within that framework, Jean and Dr. Milkman discuss tricking yourself into thinking that NOW is the time. People are more open to changing when they feel they have that “fresh start.”

We also talk about women and work and some of the big decisions that many of us are facing now. For example, we have to decide what we want our new working lives to look like as we emerge from the pandemic. Somehow, many of those decisions have gotten harder. (No, you’re not just imagining things. We’re all feeling it.) If we’re on the cusp of a career transition, where do we go from here?

Then, in Mailbag, we hear from a woman who is receiving SSI but who also received a small inheritance from her grandfather and doesn’t want to do anything with the money that could put her benefits at risk. We also hear from a listener who is upset about a corrective distribution on her 401(k) and is wondering where else she should invest. Lastly, in Thrive, it’s time to reassess your financial goals.

MORE ON HERMONEY:

- 17 Tax Filing Tips for Women Who’ve Had A Life Change

- How I Stopped Scrolling And Brought About Genuine Life Change

- The Best Self Care Gifts That Will Actually Help You Reach Your Goals

SUBSCRIBE: Own your money, own your life. Subscribe to HerMoney today to get the latest money news and tips!

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Transcript

Dr. Katy Milkman: (00:01)

We often make the mistake of trying to pursue change in a way that we think will be really effective and don’t focus on a way to make change actually fun. And that leads us to persist less than we would if we tried to find a way to make it enjoyable, to pursue our goals. If it’s not fun, we aren’t going to stick to it. So try to find a way to make whatever change you’re trying to make fun. Maybe that’s by making it social or by rewarding yourself in small ways as you make progress.

Jean Chatzky: (00:31)

HerMoney supported by Fidelity Investments. You work too hard for your money to let it sit on the sidelines. Fidelity can show you how to demand more from your money every day. Visit Fidelity.com/HerMoney to learn more. Hey everyone, I’m Jean Chatzky. Thank you so much for joining me today on HerMoney. We are now halfway into 2021. Can you believe it? I know, it feels so strange. But I also think that in many ways, June of this year feels a little bit more like a fresh start than January did. We’ve got summer that is finally here. More of us are able to travel. See our families, see our friends. We’re heading back to the office, maybe. In so many ways we are returning to real life. And while this is wonderful and welcome, that return to normal may also represent an opportunity for us to slide back into old habits that we really, really would rather change.

Jean Chatzky: (01:39)

Maybe that habit is overspending. And it’s much more of a reality now that we can actually stroll into our favorite stores. Maybe it’s drinking a little too much. And now that invitations to happy hours, real ones, not just zoom ones are turning up in our inboxes. We’re worried. We’re going to slip back into a routine that can negatively impact our health. And the truth is we all have habits that we would like to change. Think about your big goals for your life. Maybe you want to buy a house, take a big vacation, eat healthier on a day to day basis. What changes could you make today that could help you reach those goals faster? Of course, over last year, it seems change really did happen all around us. But this episode is for those who are aspiring to change themselves. Today, I am sitting down with Dr. Katy Milkman. You know, her she’s been here before. She is an award-winning behavioral scientist and professor at the Wharton school at Penn. She’s also the co-founder of the behavior change for good initiative and her new book, “How to Change: The Science of Getting From Where You Are to Where You Want to Be” is now a best seller. Katy. Hi, it’s so great to see you.

Dr. Katy Milkman: (03:02)

Hi Jean. Thank you so much for having me. I’m really excited to be here again.

Jean Chatzky: (03:05)

Yeah. You’re such an inspiration and I’m thrilled that you put it down into book form. Tell me a little bit, and for those people who didn’t hear our first show with you, tell us a little bit more about you and your decision to focus on change as your life’s work.

Dr. Katy Milkman: (03:26)

Yeah. I had a very circuitous path to studying this topic. I was actually trained as an engineer and it was only midway through graduate school in a PhD program in computer science and business that I started thinking about the topics that are now the focus of my life’s work. I was in a microeconomics class and learned about this burgeoning new field of behavioral economics, which was documenting all the ways that people make mistakes and acknowledging that they’re systematic and predictable. Mistakes we make like overvaluing instant gratification, overspending in the moment, and undervaluing the long-term rewards from things like saving or exercising. So those were the kinds of things that really captured my attention because they describe my own life and I thought it would be really fun to study this. But initially, I was frankly just doing what I would call “me-search” just casual studies of things that, wow, this quirk is weird and I have it and I wonder if there’s a way to fix it.

Dr. Katy Milkman: (04:25)

And it wasn’t really until I actually got to the University of Pennsylvania as an assistant professor and ended up in a seminar over at the medical school, that my focus became much clearer. And, this is very nerdy, but I have to own my nerdiness. It was a graph I saw that really changed my life. It was a graph showing the percentage of premature deaths in the United States that are caused by different sources. And what boggled my mind is that I learned 40% of premature deaths in the U S are caused by behaviors that we could change. So decisions we make about whether or not to drink or smoke, what to eat, whether or not to be physically active, whether to be safe when we get into vehicles. They accumulated in a way that I couldn’t have imagined, frankly, I would have been off by an order of magnitude if you’d asked me to estimate that.

Dr. Katy Milkman: (05:14)

And it’s a bigger portion of premature deaths that’s explained by this than by any other cause. And that made me realize, wow, there is a huge opportunity here. If I focus to make a really positive impact. And I should say, I study not only health decisions. I also study decisions about savings, decisions about education. And the reason really is that it was easy to make the leap from that graph to other walks of life. Other areas that I was interested in and see that if things accumulate so much, when it comes to health, they must accumulate elsewhere too.

Jean Chatzky: (05:48)

I remember having that similar revelation. I think I had it twice, actually. It’s really fascinating. The first time that I realized how these small choices really impact us, I filled out a longevity questionnaire. And I remember being just surprised at the questions like, do you buckle your seatbelt every time you get into a taxi cab, right? These little things that we think don’t matter at all matter so, so much. And then when I was writing “AgeProof” with Dr. Michael Roizen from the Cleveland Clinic, he too made this point that 75% of chronic conditions, and this is his research, are based on these behaviors that we can control. And they’re the ones that you are talking about. They’re the eating, right? They’re the avoiding the bad fats. They’re the exercising, just getting up and moving and the stress reduction, which is so tied to money. So I’m really excited that we’re going to dig into these decisions. What inspired you to put it down into book form at this point?

Dr. Katy Milkman: (06:57)

That’s a great question. The truth is I always knew I wanted to write a book when I had enough to say. As soon as I got interested in this topic, it was clear that the impetus for doing the work was to communicate it to a large audience, to impact as many lives, as positively as possible. It’s part of the reason that Angela Duckworth and I co-founded this research center, The Behavior Change for Good Initiative half a decade ago now. It was because we wanted to figure out how could we accelerate the science and then also translate it for a large audience. So it was really just a matter of time. And the moment felt right. A couple of years ago, I realized I had accumulated enough knowledge. The team of scientists we work with, we have about 150 scientists on our interdisciplinary team at the behavior change for good initiative, had accumulated enough knowledge that it felt like I could really put something out there that would help people. So that was the impetus.

Jean Chatzky: (07:46)

Amazing, amazing. All right. Let’s dig into the money because we know getting people to save more money is really, really hard. Getting people to make the right decisions about our investments in the moment is really, really hard. How do you recommend that we approach it?

Dr. Katy Milkman: (08:04)

Well, one thing I want to highlight is a research study that I find absolutely fascinating that was published in the last couple of years. That highlights how important it is to have a really bite-size way of thinking about your goals when it comes to savings. So this is research that was led by Hal Hirschfeld at University of California at Los Angeles. And it was in partnership with a tech company that helps you set aside savings and what they did as an experiment where they randomly assigned people to either be invited to save $5 a day or $35 a week or $150 a month. And those are all the same offer because if you multiply five by the number of days in a week, or the number of days in a month, you get the same outcome. But what they found is a dramatic increase in the number of people who raised their hand said, Oh, yes, I want to start saving when they framed this as $5 a day.

Dr. Katy Milkman: (09:00)

So what’s going on there, there are a number of things, but one thing that’s going on is it doesn’t feel like a huge amount of money. It doesn’t feel like a huge goal. It doesn’t feel like it’s going to chip away at your ability to spend on other indulgences that you enjoy. And by thinking about our goals, in terms of those bite size, rather than massive components in general, we get further, we’re more motivated. We’re more likely to dive in. So that’s one piece of advice for anyone who’s thinking about saving is frame it for yourself and your family in terms of what is the cost per day, because you’ll recognize you really can make it work. And you’ll see it as doable. When you think about it in those terms, before

Jean Chatzky: (09:42)

We leave the $5 a day, because I’m a believer in this, I’m a believer in micro transfers. You mentioned that a technology company was involved in this research, but for people who aren’t customers of that technology company, it’s possible now to automate your way to success like this, right? I mean, you can just have your bank, make these micro transfers for you. You can set this and forget it, right?

Dr. Katy Milkman: (10:10)

Absolutely, essentially, every bank now offers these kinds of automatic transfer programs. And I love that you use the set it and forget it terminology. It’s so beautiful and simple to be able to use that technique to help set yourself up for success, because you just have to feel the motivation and take the action once. And then you can be lazy from there on out. You don’t have to do anything. You don’t have to lift a finger. And that is one of the most wonderful things, frankly, about saving. It makes it actually easier in many ways than a lot of the other small things we need to do that can accumulate, like eating, right? Unfortunately you can’t just default yourself in one click into eating the right meals at every opportunity, but you can with savings. And so I, I highly recommend taking advantage of those auto transfers.

Jean Chatzky: (10:54)

Yeah. I mean, Dr. Roizen actually suggested that you just decide that you’re going to eat the same thing for breakfast and for lunch every day. And then you only have to decide about dinner, but I did that for a little while. And then I got really, really sick of the same yogurt. And now I’m lost again when it comes to breakfast and we’ll have to find a new way. So I get everything that you’re saying. In your book, you talk about commitment devices for making these lasting changes in our lives, specifically cash, commitment devices. I know my audience and my audience really likes cash. So what are these and how do we do this?

Dr. Katy Milkman: (11:30)

Yeah. Cash commitment devices are a really interesting tool for motivating yourself to change a behavior. And they’re really valuable. What it does is essentially sets up a fine that you’ll impose on yourself. If you do something that deviates from your goals. So we know about fines, we’re familiar with fines when someone else imposes them on us, right? You know, you get a speeding ticket. If you drive too fast, that’s someone telling you, I’m trying to protect you and protect the other people around you. You might be tempted to go too fast. You’re going to get a fine if you do it. But a commitment device is actually setting up that kind of a fine for yourself. And there are websites that will let you go put money on the line that you will have to forfeit. If you fail to achieve a goal, you care about like getting to the gym at a certain frequency or spending a certain amount of time each week on practicing Spanish.

Dr. Katy Milkman: (12:21)

If you’re trying to learn a new language, for instance. So whatever your goal is, you can set these commitment devices up, declare a referee who will hold you accountable to the site and report on you. Or it can be a device, right? If you’re doing something like step counts, you can actually hook up your Fitbit, say to collaborate with the website and their sites like Beeminder and stickK.com that let you do this. One of my favorite features is that you can actually send the money to a charity you hate, if you want to make sure there’s no silver lining in case you don’t fulfill your goal and make sure that it will really sting. So they have charities on either side of hot button issues. So think the NRA or a gun control group, and you can pick your poison if you want to make sure that the penalty would be so harsh, you’d never allow yourself to deviate from your goal.

Jean Chatzky: (13:11)

Does it actually work? I wonder if I was going down this road and I realized I wasn’t going to make my goal. If I would just like, can you cancel the contribution or is it really like once you’re in your in?

Dr. Katy Milkman: (13:23)

Yeah. That’s a great question. It’s set up to be once you’re in your in, obviously there are always ways to cheat, but they do a pretty good job. I think of making that difficult. And since ultimately your goal is to stay motivated. I think few people in the end are, are trying to get out of it. They’re trying to actually just achieve the goals. It does work. I will tell you about my favorite study is actually a study of smokers who are trying to quit smoking. And they were either given a standard or this was a random assignment study. They’re either given a standard smoking cessation program or that standard program, plus access to a cash commitment account where they could put money for up to six months. And if they failed a urine test for nicotine or cotinine at the end of those six months, the money they’d put into that account would disappear, but they could keep it if they pass the test. And what the researchers found who did this study is that it increased quit rates by 30%. To have this commitment cash account. And so there is evidence that this can be quite effective. That’s my favorite study. There are other studies as well.

Jean Chatzky: (14:28)

I mean, what’s so Interesting and I’m thinking I’m doing a little me-search and I’m, I’m totally gonna borrow that term. I’m doing a little me-search in my mind as I’m talking to you, and it seems like the value of this money in that account, we give different weights to different pools of money, right? I mean, I play games with myself. Like I can sign merchandise, clothes and stuff that I’m no longer wearing to consignment sites, like the RealReal. And I let the money add up in my account. And then I use that money to buy a handbag that I would never allow myself to buy because it’s more expensive, but because it’s play money that I’ve accumulated in this way, then I can allow myself to do it. What is that all about?

Dr. Katy Milkman: (15:15)

That is a wonderful description of something called mental accounting, which was first written about by Nobel Laureate, Richard Thaler. And it’s, I think one of the most fascinating things that we do is that we, we don’t think about money or time, by the way, time has the same characteristic. We don’t think about it as fully fungible. Instead as if we were a business, we think about money as if we have these separate accounts, like right. A business has a budget for marketing and for sales and so on for rent, we do the same thing in our minds with money. So we create these different mental accounts, the money I’ve set aside for my commitment device, the there’s the money that I’ve set aside for rent. There’s the money that I’ve set aside for spending on entertainment this month. And because we label money and we treat it as if it’s in these categories, we do some really weird things with it.

Dr. Katy Milkman: (16:05)

So money in a certain category inflows and outflows we’ll treat as if they’re only going to affect our spending in that category. For instance, I have one paper where we analyzed data on how people behave when they get a $10 off coupon to the grocer they shop at every week. And what we see is that instead of treating that $10 is just 10 extra dollars in their overall life budget, which is what they should do, because if you go there every week, you’re going to spend $10 there. Instead they act like they’re richer because it feels like a shock to this narrow mental account that they use for their groceries. So they buy lobster and fresh fruit that they wouldn’t usually buy. They spend extra on their next purchase, which I find absolutely fascinating. So mental accounting is this very quirky thing we do, but it has a function, right? It can help us think about a complicated concept. If you get that gift certificate and you have to sort of reanalyze your whole budget, it’s more complicated than if you get a gift certificate and you say, Oh, I see I’m wealthier in my narrowly defined grocery account. I don’t have to recalibrate everything. It’s sort of a rule of thumb, but it can lead to some peculiar behaviors.

Jean Chatzky: (17:10)

Wow, I’m a classic case study. There we go. I want to dig into when is the best time to try to change. But before we do that, let me remind everyone that HerMoney is proudly sponsored by Fidelity Investments. It is no secret that women are on a different financial journey than men. So it’s important to plan for those differences. When thinking about retirement, social security investing and more. Fidelity can help. They’re taking steps to help women demand more from their money because you have worked way too hard to get where you are to keep your money on the sidelines, get the skills and investment advice you need to put it to work for you. Visit Fidelity.com/HerMoney to learn more. I am talking with Dr. Katy Milkman, behavioral scientist, and author of the new bestseller, how to change the science of getting from where you are to where you want to be. Can we talk about just starting with our decision-making and starting with our changes? It’s really interesting that that can be the hardest part, that it’s just hard to put yourself in motion. And you’ve written at timing is really everything. So talk me through that.

Dr. Katy Milkman: (18:25)

Yeah. I got this great question that led me to study the topic of timing and getting started about a decade ago when I was presenting some of my work to HR leaders at Google. Google was really interested in what they could do to improve their employee’s financial security, to improve their employees, retirement savings, specifically, also to help ensure that they were doing all they could for their health and wellness and for their productivity. And so I gave this presentation about a lot of the research I’d done on how to change behavior for the better in those domains. And an HR leader said, okay, Katy, we’re completely sold that we should be using all of the science to improve people’s outcomes, but is there some ideal time to be offering programming, to be nudging people towards opening a retirement savings account? For instance, do we know anything about that?

Dr. Katy Milkman: (19:15)

And it was a light bulb moment because I realized, wow, what an incredibly important question I certainly could introspect and say, I know my motivation ebbs and flows over time. Sometimes I’m willing to start pursuing a goal leap right in, and other times I’m not. And there almost certainly is something systematic about that. So I started studying this topic and what my collaborators and I have found is that there are these moments that actually it ties back to what we were just discussing related to mental accounting. There are moments in our lives when we feel like we’re opening a new mental account, we’re opening a new chapter. And those moments feel like new beginnings. So we don’t think about time linearly. Instead. We think about the college years, the Boston years, the parenting years, the Coronavirus year, right? The pandemic year. We’ve, we’ve all got that mental account, but whenever we open a new chapter, it feels to us like a new beginning.

Dr. Katy Milkman: (20:10)

And it comes with a sense that we have a clean slate, a fresh start. And yeah, last year I didn’t really hit my savings goals last year. I didn’t quit smoking. Last year I wasn’t cooking the fresh meals for my family. I meant to be cooking, but that was the old me. And this is the new me. And so we have this renewed optimism and we’re also more likely to step back and think big picture. And so we’ve shown in our work that at these moments, people just naturally are more likely to do things like they go to the gym more frequently at these fresh start moments. And by the way, I should say that we’ve linked them to calendar dates that Mark the beginning of new cycles, like the start of a new year, which you know about everybody knows the new year’s effect, but we’ve shown it’s broader than that.

Dr. Katy Milkman: (20:47)

It’s, it’s also the start of a new week, a new month following holidays that feel like fresh starts. So think more Labor Day than Valentine’s Day or the start of spring. It also happens after birthdays. And so we see that naturally there’s this increase in motivation. People are more likely to go to the gym. As I said, they’re more likely to search for the term diet on Google. They’re more likely to create goals on popular goal-setting website that we analyzed around these dates. And those goals are about everything from health and wellness to their financial goals, to educational goals or environmental goals. So it happens naturally, but I think what’s even more exciting is that we can actually create fresh start moments and, or highlight fresh start moments and create change.

Jean Chatzky: (21:30)

So we can basically decide this is going to be a first start moment. I mean, to me, this feels like a fresh start moment for all the reasons that we were talking about at the top of the show. And if people are looking for a little bit more on fresh starts, I wrote about Katy’s fresh starts in a recent edition of the, HerMoney newsletter. And so you can pull that up on HerMoney.com. But basically what you’re saying is I can choose, right. And if I choose that it’s right now, then this’ll be a good time for me to dive into a goal.

Dr. Katy Milkman: (22:02)

We haven’t had success in telling people, “wave your hands and tell yourself today is a fresh start.” So we don’t know if that’s possible. But what we have found is that we can highlight fresh starts that are naturally occurring on calendars, because there are many of them, right? Every Monday is a fresh start. And we can use that as a moment to encourage change. So one of my favorite studies that we did showing this was actually in the domain of savings, where we encouraged people to sign up for a 401k plan with their employer, people who weren’t yet saving or were saving at a very low rate. And we sent them mailings, inviting them to either sign up, to start saving right now, because that would be first best, but we knew many would want to delay. And so we had a second option, which is you could sign up to start saving in the future.

Dr. Katy Milkman: (22:45)

And we did this with four employers and about 2000 people were included. They send a postcard back where they check a box and sign their name, and they’re automatically enrolled. What we did that was interesting with fresh starts is that future date that we were highlighting when they could start saving. And we randomized how we described it. So say two people both have a birthday coming up in three months, we’d flip a coin. One of them would get an invitation to start saving in three months, which corresponds to their next birthday. The other would get an invitation to start saving after their next birthday. And it’s exactly the same invitation, but in one case, we’re labeling the date as a fresh start. And we did this with birthdays and also with the start of spring. And what we found is that inviting people to start saving after an upcoming birthday or after the start of spring, compared to just at a, an equivalent time delay was far more motivating.

Dr. Katy Milkman: (23:35)

And we saw people saved about 30%, more, 20 to 30% more depending on the model and the estimation strategy we use in our analysis over the following eight months, just from this change where we’re highlighting a fresh start. So studies like that suggest we have an opportunity to capitalize on fresh starts, that we may be able to do this for ourselves by just circling them on the calendar and thinking more carefully about them. But we can also certainly do it for others by calling out fresh start opportunities that might otherwise go unnoticed and focusing attention on them as opportunities to begin making a change.

Jean Chatzky: (24:11)

So interesting. Can we talk for just a moment about women and some of the big decisions that I know many of us are facing right now, particularly when it comes to work, many of us have to decide what we want our new working lives to look like as we’re coming out of the pandemic. To me, it seems like these decisions have gotten harder, not easier throughout the course of the last year. What’s your best advice for women who are on the cusp of a career transition, who may be unsure of where they go from here to maximize their health, their sanity, their happiness, their choices, as they choose.

Dr. Katy Milkman: (24:53)

Yeah, that’s a fantastic, fantastic question. I’ve been thinking a lot about this moment we’re in which is causing us all to feel like we’re at a new beginning, a chapter break, if you will, in the way we think about our lives. It’s causing a lot of extra reflection, a lot of extra change. People who are switching jobs, who are moving to new communities, who are stepping back from work. So many changes that we’re making here are a couple of things that might be useful about this moment. One thing that I think is really interesting is research suggests, in general, that we’re too hesitant to make change because we’re very nervous about losing things that we have the relationships with colleagues at a certain company or the current situation we have in terms of our commute, whatever it is, we’re, we’re nervous about losses. Losses tend to loom larger than gains.

Dr. Katy Milkman: (25:44)

And so we tend to be what a scientist would call inertial or unlikely to make that pivot, even when it really is the best thing for us. So one piece of advice is to try to be honest with yourself about whether or not a change could truly be better. And if the reason you’re not doing it is just that you’re nervous about those losses. And overweighting those losses, an interesting study that was done by University of Chicago economist Steve Levitt looked at what happened when he flipped a coin and gave people advice on whether to make a change or not. And this was motivated, he’s a bestselling author of the book “Freakonomics,” and he was getting all of these questions from people about whether or not to make a change in their lives. And he felt really unqualified, even though, yes, okay, he had won some big awards and had written a best-selling book, but he didn’t really feel like he knew how to advise people on this particular question, you know, should I change jobs?

Dr. Katy Milkman: (26:39)

Should I change careers? Should I change my marriage partner? He’s getting all these questions and he’s a scientist. So he wanted to know. So he did this experiment where he invited people to as popular Freakonomics blog who were thinking about making a change. And he said, I’m going to flip a coin. And I’m going to tell you to make a change if it comes up heads and not to, if it comes up tails, and I’d be grateful if you’d play along. And of course, lots of people didn’t, but some people did. And that’s where he could identify. Cause people who were randomly assigned heads are now more likely to change slightly than the people randomly assigned tails. And he surveys them all in their happiness, in a follow-up period. And what he finds is that when it was a small change, it didn’t really matter.

Dr. Katy Milkman: (27:18)

But when it was a big change, people were happier if they got the coin flip telling them to go forward with it. And so that suggests in combination with rate this large research body on loss aversion, the fact that we are too likely to stick to our guns, to stay where we are, that it probably could make us happier and better off if we take more leaps. So that’s, that’s my first piece of advice and maybe most important one is just that it probably is a good idea if you’re contemplating it, if you’re feeling like you can’t decide and you’re torn, probably you should take a leap and make a change because everything we know about psychology is actually pushing you in the other direction.

Jean Chatzky: (27:57)

I love that advice and I love it for a hundred personal reasons right now, because as you know, and as our listeners know, we are in the process of moving to Philadelphia. I live right now in the house that I have lived in longer than I have lived in at any time in my whole life. I moved a lot as a child. I’ve been in this town for 26 years. I’ve been in my house for 16 years. I am definitely having trouble with the fact that I made this decision and there’s no going back and I’m really happy that I’m going forward, but I’m going to just remember your words as I pack my boxes and, and try not to cry.

Dr. Katy Milkman: (28:33)

Well, I’m really excited that you’re coming to my community. So selfishly, I know that you’ve made the right decision.

Jean Chatzky: (28:39)

Well, thank you, Katy. I have one more question and then we’ll leave it and let everybody just pick up this wonderful book and read it for themselves. I am just wondering you work in sort of the rock star Pantheon of behavioral finance, right? And happiness. I mean, you are there with Angela Duckworth and Adam Grant and Marty Seligman. And what do you guys talk about when you go to lunch?

Dr. Katy Milkman: (29:07)

Oh my gosh. I love that question. And by the way, my job is so much fun and I am absolutely the luckiest person in the world. I absolutely love that. I get to go to lunch with, not so much in the last year, but with these brilliant people and talk about ideas, we talk about exactly what you think we’ve talked about. Well, you know, we talked about the weather first, like everyone else, and how’s your family doing, but, but most of the time we’re talking about an interesting insight from research that we just read or a study that we think it would be really fun to run and a hypothesis we have and how could we test it and who do we know who might be able to help us actually get that launched? So it’s super fun. My job is amazing and I feel so lucky to be surrounded by brilliant people who have all sorts of creative ideas that are constantly making my thinking better about a problem. It’s the best part of being an academic.

Jean Chatzky: (29:56)

I lied. I have one more last question, three things that our listeners can take away with them right now. If they are looking to make a change, a big one or a small one.

Dr. Katy Milkman: (30:07)

Okay, three quick tidbits. One is we often make the mistake of trying to pursue change in a way that we think will be really effective and don’t focus on a way to make change actually fun. And that leads us to persist less than we would. If we tried to find a way to make it enjoyable, to pursue our goals. If it’s not fun, we aren’t going to stick to it. So try to find a way to make whatever change you’re trying to make fun. Maybe that’s by making it social or by rewarding yourself in small ways as you make progress. The second thing is it’s really important to make concrete “if then plans.” So, you know, if it is a paycheck day, I will go increase my savings contribution slightly. Or if I get a raise, I will increase my savings contribution. Or if I pass Starbucks, I will walk by because I don’t want to spend my money on Starbucks coffees, whatever it is that your goal is, you break it down into small bite size chunks and then make really clear concrete.

Dr. Katy Milkman: (31:07)

“If this happens, then I will do the following” type plans so that you’ll follow through. And you won’t forget. And my final piece of advice, which is going to sound counterintuitive, but research supports is that it can be really valuable when you want to make advice to actually advise other people, coach others on how to achieve the very same goal. And so the reason that works is that if you coach someone else who has a goal on how to achieve it, it can lead you to dredge up insights. You might not otherwise have about what could work for you. And you’ll feel hypocritical if you don’t take the advice yourself. So consider coaching and talking to your friends about the same things that you’re trying to achieve. Having those conversations, you may get wisdom from them, hopefully, uh, that you can copy and paste, which is I I’m sneaking in a fourth tip is try to emulate other people achieving those goals, but also you will feel more confident once you realize you can give good coaching and you may come up with insights that you’re more likely to follow through on. If you offer some advice to others.

Jean Chatzky: (32:08)

You are amazing. Katy Milkman. Thank you so much. Thank you so much for having me. Absolutely come back anytime. And we will be right back with Kathryn and your mailbag. And HerMoney’s Kathryn Tuggle joins me now for our mailbag. Hey, Kathryn.

Kathryn Tuggle: (32:29)

Hey Jean. I love conversations about making changes and building habits. So I love that conversation.

Jean Chatzky: (32:37)

I do too. And I love the research, I mean, she said she was leaning into her nerdiness. It makes me realize how much of a nerd I am myself. I think this stuff is fascinating because it’s not like we don’t know the right things to do. We just don’t do them. So all of these tips and tricks and insights are just so interesting to me. I hope they’re interesting to our listeners too.

Kathryn Tuggle: (33:08)

Yeah. I mean, I feel like I first learned about all of the various mental tricks that you can do to trick yourself into saving money. I feel like I learned a lot of those from you. And I know you’re a big fan.

Jean Chatzky: (33:21)

I’m a big fan. I like this kind of research. I think it’s because I see myself in it. I mean, when she was talking about giving others advice and then you benefiting from that, that’s my life. When people ask me about how I learned about money, I learned about money by doing the research, telling other people to do these things and then doing them myself, because I realized like, Oh my God, if I don’t do this, what a hypocrite, you know, and fixing my own financial life along the way. And I think so many people fall into that bucket.

Kathryn Tuggle: (34:03)

Yeah. I’ve definitely noticed that with myself before too. You know, I teach yoga sporadically and I feel like after every class, I feel like I got a little better because when I’m giving people instruction in a yoga class, I’m thinking about the proper muscles to use and the way to go deeper into a pose. So it works.

Jean Chatzky: (34:22)

Yeah. I’ve also seen the evolution. Every time we hire somebody new to be on the team at HerMoney of seeing the same evolution in their personal finances. And that makes me feel good. Yeah.

Kathryn Tuggle: (34:35)

I’ve even heard that from some of our freelance writers that they weren’t personal finance writers to start, but then after writing for us a few times, they started thinking more critically about their budget or saving for a house or what have you.

Jean Chatzky: (34:49)

Amazing. All right. Well, let’s help some of the people in our community.

Kathryn Tuggle: (34:53)

Absolutely. Our first question comes to us from Mariana. “Hi, my name is Mariana. I’m 20 and going into my junior year of college. My great, great grandpa passed away a few years ago and left me a cashier’s check in my name for $15,000. I’m first generation and low income. So this will be very helpful for me when I graduate college. It’s been kept in my great grandma’s safety deposit box. She passed away last year and my grandma had to go through lawyers for probate to get it out. She has it for me, and I’m wondering how to handle the funds. My mom and siblings don’t know because they did not receive anything from him. And I’m worried about how that drama might unfold. If they were to find out I’m blind and receiving SSI, and I don’t want to lose because of the amount of money that is on that check.

Kathryn Tuggle: (35:39)

I’m not sure if I should put it in my bank account or leave it in a safety deposit box. My plan is to take out 1500 and use it for bills and things that I need to pay off now and put the rest in a safety deposit box where it will be safe until I graduate. And I can have a head start out of college. I was thinking of doing a few things. I could put it into retirement, into savings, to accrue interest, or use it as a down payment on a house one day. I could also split it up and use the money for several different things. I don’t want to do anything illegal because if the social security administration finds out, they could make me pay all of the money back. I also don’t want this to affect my financial aid for college because I received the full government Pell Grant and scholarships, since my EFC is zero. What is your best advice?”

Jean Chatzky: (36:28)

Mariana, thank you so much for writing. And thanks for being 20 years old and tuning into this podcast to know that there are resources like this available for you, that’s impressive in and of itself. So there are a couple of things going on here. The first is that that check has been sitting in that safe deposit box long enough to worry me. It’s not that cashier’s checks expire, but it is that after 90 days, the payout, at least as far as I understand, becomes more complicated. So I want you to move on this advice quickly. The second thing I want you to do is to talk to an attorney. You may be able to find an estate planning attorney through legal aid in your community. But the question to ask is how do I move this money from a cashier’s check into an account where it’s not going to impact my SSI?

Jean Chatzky: (37:29)

If it was SSDI, the rules are a little different. You are allowed to receive gifts, but with SSI, a gift of any size can really impact your ability to continue to receive funds from social security. I don’t really believe that an amount of this size would have an impact on financial aid, but it could with the calculation. So I, I don’t want to guarantee that. A lawyer should look into what’s called a special needs trust for you or an able account. And both of these are ways that the money can be used for your benefit, but without it impacting your SSI. So I know this is a, a little more complicated answer to the question than you were probably anticipating. Call the lawyer first, then go through the process of trying to cash that check and move the money into one of those accounts.

Jean Chatzky: (38:35)

And make sure that you do it in a way that is all buttoned up. As far as how to use it, I would probably just hold it in savings at this point, you could invest it if you’d like, but it sounds like you’re not exactly sure where life after college is going to take you. And I agree with you. This money is a big opportunity, so I wouldn’t necessarily want to see you use it for something like a down payment on a house only to find that your first job takes you somewhere across the country that you weren’t expecting to go. And you’re involved in a real estate transaction that becomes more of a headache than a blessing, but I’m so glad you wrote. I’m so glad that you are ready to move on this. And I think that you should be able to do all of these things with the help of your grandma and keep it quiet rather than get into a mess of family drama. I agree with you. That would be more hassle than it’s probably worth. Good luck. And if we can help you with more questions or more answers, please reach out again. Let us know how it goes.

Kathryn Tuggle: (39:42)

Yeah. Good luck. And Jean, I love the advice to move quickly on that since that check has been sitting for a while.

Jean Chatzky: (39:48)

Yeah. Yeah. It’s complicated and it’s worrisome, but hopefully it’ll be fine.

Kathryn Tuggle: (39:52)

Yeah. Our next question comes to us from Heather. She writes, “Hello, I’m 51 years old and earned $163,000 a year. I contribute the maximum $7,000 to a backdoor Roth, and participate in my employer, sponsored 401k to the max at $26,000. There is no match. The company I work for is very small and recently several senior members left. After that, I received a notice of corrective distribution for $11,000. I’m angry about the whole idea of corrective distributions. I’m not a millionaire here, just trying to stay off the Dole in my dotage. To whom does one advocate to change this stupid law. It doesn’t benefit the people in my company that make less than me or who don’t take advantage of the 401k. I’m not where I want to be with my retirement. And this setback is affecting me emotionally. I find that I’m very angry about it.

Kathryn Tuggle: (40:46)

My mother died in April of 2020, and I saw how fast retirement money can go when there’s a serious illness. This is likely to happen again this year. I’m thinking of stopping my 401k halfway through the year, and then putting the same amount of money into my Fidelity brokerage account. Is that a good idea? I’m looking for a new job and noticing that some small to medium-sized companies in my field don’t offer a 401k at all. How should I weigh this as part of my compensation? Aside from the immediate tax deferral of a traditional 401k, not a Roth, what is the benefit versus a brokerage account? I’ll eventually be taxed on all the money plus earnings in both scenarios, just now versus later. Isn’t that right? I’m really happy I found your show. Thank you.”

Jean Chatzky: (41:32)

Well, I am really happy that you found our show too, and I really understand how frustrated you are right now. Let’s just take a step back and explain to everybody who’s not familiar with this what’s going on here. So 401k plans have a form of what they refer to as fairness testing. And it’s basically a mechanism to make sure that the higher paid employees of the company can’t shove so much more money into a retirement plan than the lower paid employees of the company. When the higher paid more senior employees left that fairness testing got thrown out of balance, and that’s why this corrective distribution happened. And basically they kicked back your contribution to you and basically said, you’re not going to get a tax deduction on this money. And it really messes with your planning. And it really seems unfair. And I love that you would like to advocate to change this quote unquote, “stupid law.”

Jean Chatzky: (42:51)

I totally get it. I would start with your representatives, from your state, your congressmen and your senators, and see where it goes from there. But in the meanwhile, I would work on just solving your own problem and trying to wrest control back from your company. The first thing to do is to talk to the benefits department. So you write that this is likely to happen again this year. I take that to mean they have not replaced the senior members of the company, but talk to benefits if they are going to replace it. And if they are going to replace those higher salaried people. And if, as a result, this isn’t going to happen to you again this year that I would continue to put money into the 401k. You asked, what’s the benefit to a 401k over a traditional brokerage account. And the benefit is in the way that the money is available to grow.

Jean Chatzky: (43:47)

When you have a 401k, without a company match, the real benefit is that you don’t pay taxes on the growth of your money as it happens, it grows tax deferred. And that means you have a larger base on which to grow because taxes are not being taken out along the way. And there is a benefit to that, no question, but you’re right. You will have to pay taxes down the road on that money. And if they tell you that this is likely to happen again, I would go the route that you’re suggesting, and I wouldn’t stop contributing overall, but I would stop contributing at some point and just put the money into a taxable brokerage account. When you look for a new job, the two big benefits to having a retirement plan are the matching dollars. If they’re on the table, because that is free money and that does add to your compensation, and the automation in play. We know that people are 15 times more likely to make a contribution to a retirement account. If that money comes out of their paycheck automatically, and they don’t have to just do it on their own. And clearly you’re motivated clearly you’re organized clearly you’re on top of these matters. So my guess is that this statistic doesn’t apply to you, but it is easier if you can do it through a 401k. So I would definitely put the retirement plan, the 401k on the top of my list as I was looking for a new job and just understand the larger the company you end up in, the less likelihood that these corrective distributions are going to be an issue in the future. Finally, I just sort of want to address the anger. I get it.

Jean Chatzky: (45:56)

There are so many things in the world of money that we can’t control, right? We can’t control the markets. We can’t control taxes. We can’t control interest rates. We’re entering an environment where we can’t control inflation. Not that we could ever control it, but it just hasn’t been an issue for a very long time. And I hear that you are frustrated and angry, and I want to encourage you to deal with this and let it go. There are enough things in this world to be angry about and frustrated about, and to let it really eat you up when it’s something that is completely outside of your control, I think, sounds to me like energy that would be better spent somewhere else. So channel it into a really strong, good letter to your congresspeople, to your representatives, to your senators, and then just allow yourself to really take pride in the fact that you are socking away a ton of money toward your retirement. And you are likely to be just fine.

Kathryn Tuggle: (47:09)

Thank you, Jean. Yeah, the first time I heard of a corrective distribution, I thought, Oh my God, that is so grossly unfair, but you’re right. In terms of just her perspective, because she has other avenues to save and she’s doing all the right things.

Jean Chatzky: (47:25)

Yeah. I mean, I’ve got to say, you know, I think it’s where I think small should really be stepping up, right? We have a 401k here at HerMoney and we just contribute for the benefit of our employees so that even if they don’t contribute, we meet those levels for fairness testing. And I feel like that is the responsibility of companies. I know companies are struggling. I know we’re doing the best that we can, but we all have to chip in a bit and make sure that everybody can put some money away for retirement. And in today’s Thrive, it’s time to reassess your financial goals and get ready to thrive financially post pandemic. Our experience over the past year and a half has given everyone a whole new perspective on their personal and financial lives. And now, now is the time to think about what you really want from your future and the financial steps you need to take to readjust your course. If you’re ready to make some major changes to where you live, how you work, what you do for fun.

Jean Chatzky: (48:33)

As Katy was describing, you can start taking steps now to reach these goals and financially thrive in the post pandemic life. You now envision for yourself. Consider your new goals and how you plan to reach them over the next 10 to 20 years. Ask yourself, what do I want from my housing? Do you want to buy a larger house downsize or just change your environment for the next few years? Do you want to move closer to family or explore life in a new city? Think about what you really want from a home and start setting specific goals, decide on a timeframe and how much you want to save for a down payment and then break it into monthly pieces. If you want to focus on paying off your house early, so you don’t have to worry about those expenses later on, consider refinancing your mortgage to today’s low interest rates and pay a little extra each month.

Jean Chatzky: (49:23)

So you can accelerate your payoff schedule. Ask yourself, have my retirement goals changed? Has the experience from the pandemic made you appreciate having some time away from work. Did it accelerate your interest in retiring earlier than you expected? If you have a 401k or another retirement savings plan contribute at least enough to take advantage of any matching contributions from your employer. Also think about saving in a Roth IRA, which is a great way to have your money do double duty. You build tax-free savings for the future, but also have the money available in case you need it earlier. Ask yourself what’s my dream job. Did the pandemic make you realize that your job is just too stressful or unengaging to keep up longterm. Rather than working in a stressful environment, maybe you’ve become more interested in charitable work. Maybe you want to start your own business.

Jean Chatzky: (50:18)

As many people lost their jobs or refer load, they started to reconsider what was most important to them. It’s time for you to do the same, thinking about your timeline for making these changes and the steps that you can take now to help you make those moves. Like networking, getting certified in a new field, starting a freelance side business that could eventually grow into a full-time job. As we just heard from Dr. Katy Milkman, it is never too late to make a change. And right now is as good a time as any to reset your goals and habits, to get where you want to go. Thanks so much for joining me today on HerMoney. Thank you to Katy Milkman for the education on how we can all work toward creating lasting change with our money and in our lives. If you like what you hear, please subscribe to our show at Apple Podcasts, leave us a review because we love hearing what you think we’d like to thank our sponsor Fidelity. We record this podcast out of CDM Sound Studios. Our music is provided by VideoHelper and our show comes to you through Megaphone. Thanks so much for joining us and we’ll talk soon.