My neighbor, a grade school teacher, was watching the video grid of his pupils when a student hopped off of his chair and started to run out of the virtual classroom. Immediately a parent’s arm swooped into the frame, guiding the child back to his seat.

Welcome to the new school year! And say goodbye to productivity, parents.

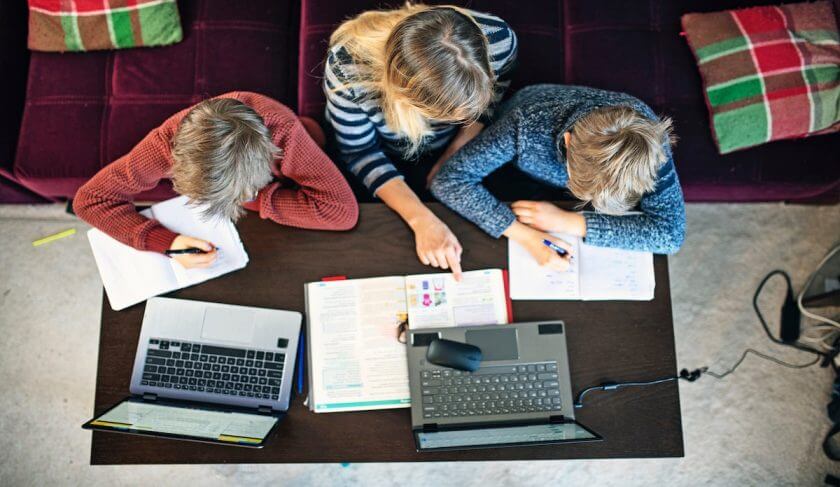

This atypical back-to-school season has required a lot of adjustments — especially for parents trying to be as quick-on-the-draw as the one just mentioned. But of course stress isn’t the only response parents are feeling: The unconventional schooling situation is also creating more financial strife for families.

Half of parents with children under the age of 18 say the pandemic has added to their financial concerns, according to a brand new survey from COUNTRY Financial and research firm Ipsos. To accommodate the changes in the 2020 school season, many have had to cut back their workload (read: earnings). And some have even had to quit their jobs altogether.

Here’s a look at how the COVID-19 school year is affecting family finances.

Schedule changes = job loss fears

One of the biggest changes parents have had to make is rearranging their days to accommodate school and childcare. The COUNTRY Financial survey found that 21% of parents have changed or reduced their work hours to homeschool or help children with remote learning. Another 19% say they are relying more on family and/or friends to help out with childcare.

Changing or reducing one’s work hours to take care of children comes with an additional worry: Losing a job due to performance issues. Parents with children under the age of five feel this most acutely, likely because the youngest children require the greatest amount of supervision.

For some parents, continuing to work during the pandemic school year wasn’t even an option: 7% of respondents said that they had to leave a job altogether due to a change in school or childcare options.

>> RELATED: How to Stay Solvent In a One-Income Household

Back to school = back to spending

The need for new clothes, backpacks and sports equipment may be less than in past in-person new school years. That doesn’t translate into additional monthly savings. In fact, other school/childcare-related expenses have replaced those costs:

- 32% of parents will spend an additional $101 to $249 per month

- 26% will spend an extra $250 to $499 per month

- 14% don’t know

- 11% expect to spend $500 to $998 per month

- 7% will spend $1,000 to to $2,499 extra per month

The leading financial concerns about heading back to school are increased food costs, especially for parents of children attending virtual-only classes. The need for new technology (including equipment needs and internet access costs) is also putting a new burden on parents’ budgets. The third biggest school-related financial worry is paying for additional childcare needs.

>> RELATED: 9 Things (Most Of Us Don’t Do) to Save $100 or More on Groceries

Additional strains on parents

During extreme times, it’s not just the school age children who have to rely more on their parents for help. The COUNTRY Financial survey shows that parents of adult children (18 or older) are not exempt from kid-related financial strains.

Sixty five percent of parents say they’ve helped their child out financially during the pandemic, with 40% of parents providing a moderate to considerable amount of additional support compared to before the pandemic. One in five report that they’ve had an adult child move in with them.

Many people are feeling the financial squeeze from the pandemic. But when compared to the general population (including parents and non-parents), the survey found that parents are disproportionately impacted.

Twenty two percent of parents say that the pandemic has negatively impacted their ability to pay bills a “great deal” or a “moderate amount” versus 17% of Americans overall. And 70% of these parents (versus 65% of the general population) say they’ve had to delay payment on at least one of their monthly bills.

>> RELATED: 6 Ways to Save Big On Your Monthly Bills

MORE ON HERMONEY:

- How to Negotiate (Almost) Any Bill Successfully

- 8 Numbers That Show the Real Cost of COVID-19 For Women

- Who Gets the Additional $300 Weekly Stimulus Benefits?

SUBSCRIBE: Get behind-the-scenes financial insights from our own Jean Chatzky. Subscribe to HerMoney today.