One of HerMoney’s many goals is to help to reduce our anxieties around money. This means removing the shame and guilt, and turning off the negative radio too many of us play in our heads when it comes to taking control of our finances. That’s why when we learned from the 2019 LGBTQ Money Matters Survey that more than half of all LGBTQ+ adults (52%) associate money with anxiety, compared to 41% of straight, cisgender people — we knew we had to turn this into a bigger conversation.

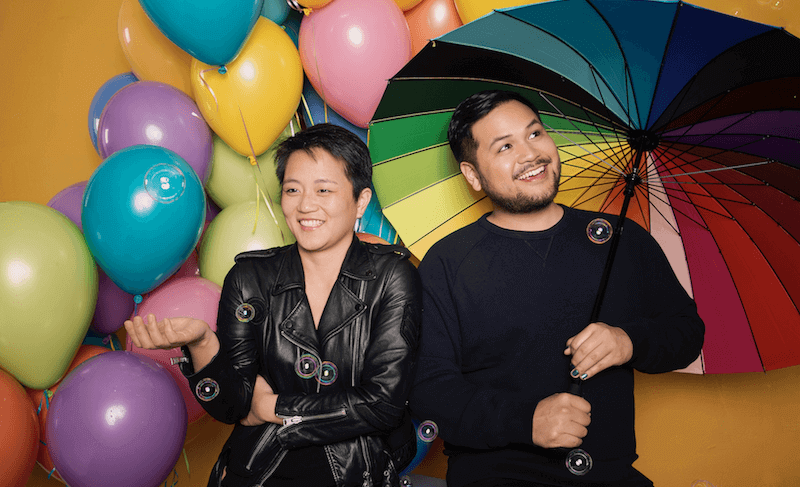

Enter Kathy Tu and Tobin Low, hosts of the podcast “Nancy,” which they like to call, “the gay This American Life.” They partnered with Morning Consult to conduct the aforementioned survey, and, with it, they released a special series called: “Queer Money Matters.” An important note: Both Tu and Low identify as “queer,” and use the word as shorthand for the LGBTQ+ community. “It’s a little bit harder for me to say that [LGBTQ+] fast,” says Tu. (We agree.)

They join us on Episode 157 of the HerMoney with Jean Chatzky podcast to discuss their findings, their stories and the increased costs members of the queer community often face when it comes to careers, parenthood, healthcare and more: “At every financial milestone, it feels like people in the queer community have to find a way around what the general recommendation or guideline is,” says Tu. “It’s more costly to be a queer person trying to make it in this economy.”

Here are a few reasons why:

The Costs Of Coming Out

Many LGBTQ+ individuals lose their financial safety nets after coming out. Thirty-five percent of queer folks say they could rely on family and friends for financial support before coming out, while only 20 percent could say the same after. “It’s something anecdotally we were aware of, but to see some of the numbers was really sobering,” says Low. “Part of the philosophy of the series — or the idea behind it — was to trace how some of these early financial moments can show up later in life.” If you start off at a financial disadvantage, like not having support from your family, then you’re more likely to live your life at a disadvantage, financially, they explain.

Why Workplace Culture Is A Bigger Priority

When sizing up a job opportunity, we often focus on factors like pay, benefits, proximity to where we live and perhaps growth opportunities at the company. And while “culture” has risen the ranks for considerations in recent years (i.e., it’s defintiely proven to be more than just a buzzword), for members of the queer community, it’s a chief concern, especially with their security—emotional, physical and financial—in mind.

For example, “If you’re a trans person, you have to make sure your employers are trans-friendly or they have policies that will protect you against discrimination,“ explains Tu. “If you’re anybody in the queer community and looking for work, are you sure that your state has protections for you if you’re terminated at a certain point?” Tu and Low advise that before you even apply, call the human resources department of the company and ask how certain forms of discrimination would be handled. If they can’t answer your questions, then don’t bother applying.

Unexpected Legal Fees Within Family Planning

Growing a family, whether it’s trying to have a baby or adopting a child, can get expensive for anyone — and queer folks generally have to start from a place of options that tend to be more expensive, says Low, including IVF, adoption and surrogacy. However, “I think the thing that I didn’t anticipate in researching this – and doing these stories – is how much the hidden legal fees would play into it,” he says.

In the episode, they share the story of two women who were having a baby together: One woman decided to carry the child, and since the other partner wasn’t a biological parent, they had to hire a lawyer throughout the adoption process to guarantee the child would be legally hers, too. “You could have both moms on the birth certificate, but that might not be legally-binding,” adds Tu. As Jean aptly points out on the show: These are the things we don’t see on TV.

Hear the full conversation below: