Money can be a complicated subject, especially within the context of a serious relationship. While it’s not exactly pillow talk, it is a very important topic to tackle if you want to build a strong foundation for your future together.

One common area of tension is whether and when to merge your bank accounts and debt, along with whether to take on shared expenses. Merging finances takes compromise, planning and some potentially uncomfortable conversations, but if you approach it strategically it can be (nearly) painless.

Set the Scene

Before you decide whether to merge your finances, you’ll need to think about your level of commitment to each other. If you’re not sure yet whether you’re in it for the long haul, merging isn’t for you. But if you’re ready for a long-term commitment, you’re in good shape to consider combining finances.

To get started on the right foot, pick a few key topics you want to cover initially. Then pick a specific time and place to talk — you’ll want to do this at a time when you are both in the right state of mind (i.e. not getting ready for work or making dinner) so you can think about things with a clear head.

If the conversation starts to get too charged, agree to table the discussion until you’ve both had a chance to cool off. Know when you need to get a third party involved, like a counselor or financial planner.

Cover the Basics

Start your conversation by laying out the details of your individual financial situation for your partner and vice versa. This requires significant disclosure but ensures you are both well aware of the big picture. Make sure you’ve answered the following questions:

1. How much money do you make?

Talk about your salaries, bonuses, stock options and any other compensation. If you are a full-time freelancer or independent contractor with an unpredictable or lumpy income, make sure your partner understands that.

2. What do you own and owe?

Make a list of your assets and debts. Then talk through how you view debt in general. If one of you has significant student loans or a credit card balance, does the other feel some obligation to help pay that off? It’s okay to decide that you’d like to each tackle your own debt situations separately, but in that case you may want to hold off on fully merging your bank accounts.

3. What are your financial priorities?

Are you seeking financial security, or are you more concerned with finding meaningful work than a cushy salary? Is spending money on fun, exciting experiences what’s most important to you? Or are you committed to saving up to own a home?

4. What are your personal and joint goals?

See where you stand on career paths, family, and what you prioritize when it comes to saving.

5. What are your financial hang-ups?

Are you a big spender? Are you terrified of debt? Are there any really bad financial experiences in your past that continue to haunt you?

6. What is your “financial style”?

If you’re a saver and your partner is more of a spender, is it going to drive you nuts to see the way the other person chooses to spend money on a daily basis, even if all their other obligations are met?

Decide How to Merge

There’s no right or wrong way to merge your finances — you can combine your money either completely or partially. Combining completely means merging all bank accounts, sharing all credit cards, and agreeing about how you will pay down debt you each brought into the relationship. Some couples see this as a great way to simplify things, but it also requires a lot of compromise.

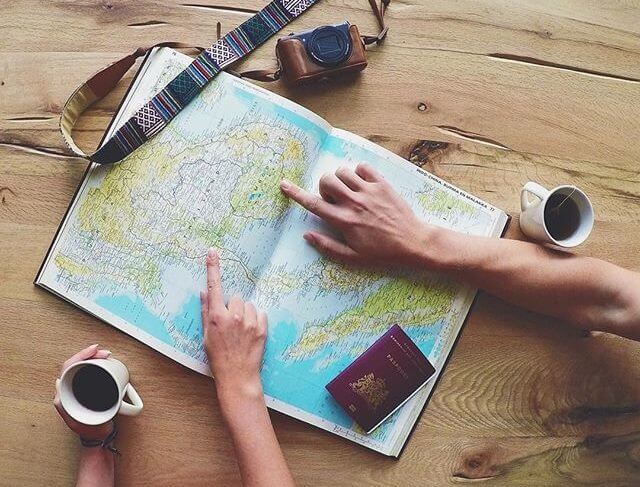

On the other hand, you can tailor your approach to your specific needs and partially combine. For example, some couples open a joint checking account where they deposit a portion of their paychecks to cover joint expenses like rent, utility bills, and basic groceries. Others also have a joint credit card that they use to pay for date nights out, travel, or anything else they do or want to purchase together. However, each person may also keep a separate credit card or bank account to cover their individual expenses. This means that you have no oversight over each other’s day-to-day spending decisions, giving both of you enough freedom to circumvent fights about what’s “frivolous” or not. You can also open a joint savings or investment account to put away money for joint goals like taking a big trip together, buying a home, or starting a family.

Pick the Right Time for You

Deciding to merge finances looks different depending on the place you are in your relationship. Consider the special circumstances around each stage of the relationship, and how that affects joint finances:

Seriously Dating

If you’re seriously dating but not quite ready to move in, you have an opportunity to create good habits. If you start having some big-picture conversations about money now, the brass-tacks talks will be much easier down the road. Start slow and encourage your S.O. to open up by sharing some of your own money story — maybe your student loan situation or your big financial goals for the future.

Moving In Together

Since you’ll likely be sharing expenses for the first time, you’ll need to be clear about how much both of you want to spend on shared expenses like rent, utilities and groceries. Discuss how you will divide these expenses: While 50/50 may seem like a no-brainer, if you have drastically different incomes, you may want to consider splitting things proportionally.

Getting Married

Get into the nitty-gritty of each other’s finances and offer full disclosure even if you plan to manage your accounts separately. Discuss your goals for each of you as individuals and together as a couple. Just because you’re getting married doesn’t mean you need joint bank accounts.

Having Kids

Kids introduce a whole new dynamic into money conversations. If you have a child on the way, you should prepare for how things will change financially: You’ll need to have conversations around college savings, paying for childcare and education, and the financial values you’ll want to teach your kids.

Work Out the Details

If you decide that you do want to merge finances, you’ll have to work out the logistics. Decide which systems you will use to manage your money — technological or otherwise — plus how you will divvy up responsibility (with clearly defined roles), how often you’ll check in on your finances, and how often you’ll communicate about money.

If you’re feeling overwhelmed, you can start the process of managing finances together by opening a savings account for a specific goal. It’s a great first step toward merging without doing everything all at once.

Finally, remember to go at your own pace and do what feels comfortable for you both. With a few best practices under your belt, you can keep your relationship happy and healthy.