Does anyone have just one job anymore? It seems these days that everyone has either a paying side gig that helps them stay afloat financially, or a passion project that they’re hoping will one day turn into something big… And in this week’s episode, we’re diving into what it looks like to realize a dream while still working full-time.

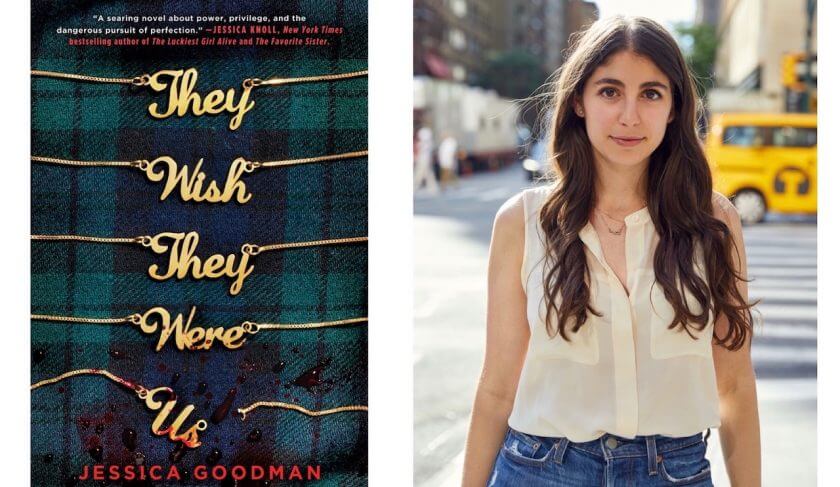

We’ll be learning it all from someone who has been there, who set aside those precious hours (early in the morning, before anyone else was awake!) and saw her dream through. Jessica Goodman is the Op-ed Editor at Cosmopolitan Magazine, and the author of the new book, ‘They Wish They Were Us,” which came out in August, and has been called “a modern-day Gossip Girl, but darker,” by Marie Claire, and “One of this summer’s buzziest reads” by Entertainment Weekly. The book has also been optioned for TV, and Jessica will serve in the role of executive producer.

Listen in as Jessica and Jean talk about how she did it — specifically, how she managed to work full-time while still finding the time to come home and write, and what it was like to juggle the deadlines for both her book and her day job.

Jessica weighs in on what ‘a day in the life’ looked like for her when she was writing her book, and the challenge of having to choose between work obligations and time with friends, or the gym, or vacation, or anything else “fun” when she was pursuing her passion project. Jean also weighs into the discussion with details of her experience writing several books, getting her company, HerMoney, off the ground.

Jessica talks about the emotional challenge of having a novel as her ‘side hustle,’ when there was no guarantee there would be a payoff at the end of the day, either in terms of money or recognition — there were no assurances when she began writing that anyone would ever want to buy her book. “I think that’s the hardest part. Because you’re just doing everything on spec [speculation] which basically means that you’re the only person who believes in you, in that moment. You have nobody else. You’re basically just saying you’re doing this because you want it, and you believe in it, and there’s no financial incentive yet,” she says.

Jessica also discusses her experience with mentors at the magazine, the advice they’ve given her, and how they’ve acted as helpful touchstones for her along the way. She also talks about how she has no plans to “quit her day job” and how she’s happy to have a job that keeps her busy and inspired, despite the fact that she’s found success with her novel. She says she hasn’t yet come to the “fork in the road” where she’ll need to choose either her career in journalism or her career as a fiction writer.

She also offers her best advice to other women who may be looking to do something similar, and finally get their novel-writing, business-starting, side gig dreams off the ground.

In Mailbag, Jean and Kathryn discuss where women can thrive with a career in finance, ways to save on personal income taxes, and putting all your eggs into the basket of a target date fund. In Thrive, what to do if you just gave a scammer your personal information.

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Transcript

Jessica Goodman: (00:01)

I think that’s the hardest part, because you’re just doing everything on spec, which basically means that you’re the only person who believes in you in that moment. You have nobody else. You’re basically just saying you’re doing this because you want it and you believe in it, and there no financial incentive yet.

Jean Chatzky: (00:22)

HerMoney is supported by Fidelity Investments. Whether you’re saving for something in the near future or way down the road, Fidelity has tips and tools to help you meet your savings goals. So, visit Fidelity.com/HerMoney to learn more.

Jean Chatzky: (00:35)

Hey everybody. I’m Jean Chatzky. Thanks so much for joining me today on HerMoney. So, maybe you are listening to this show today on your way to your real job. Or maybe your headed home or to another room, cause we’re all telecommuting these days to work on your side hustle or your second job, or maybe even your third or fourth gig, if you’re a freelancer. The point is, I don’t think anybody or at least very few people have just one job anymore. It seems like so many people have their day job, but then they also have a side gig or they have a passion project that they are hoping will one day turn into something really big. And today, we’re going to dive into what it looks like to realize a dream while you’re still working full time. We’re going to learn it all from somebody who has been there – who set aside those precious hours and slogged through it. Jessica Goodman is Op-Ed Editor at Cosmopolitan. She’s the author of the new book, “They Wish They Were Us,” which came out in August and has been called a modern day “Gossip Girl,” but darker by Marie Claire. And one of the summer’s buzziest reads by Entertainment Weekly. The book has also been optioned for TV and Jess will be serving in the role of Executive Producer. Jessica, welcome.

Jessica Goodman: (02:14)

Thank you so much for having me. I’m so happy to be here.

Jean Chatzky: (02:17)

Thank you for being here. You know, I read your book. I really loved it. I did not see the twist coming at the end. And I’m not going to blow it for anybody who is still in the midst of this book or picking it up. But I want to talk today about how you did it. About what it took to write a novel, which is a dream for so many people, while still working full time. It cannot have been easy.

Jessica Goodman: (02:50)

It certainly was not easy. No.

Jean Chatzky: (02:53)

I know that you have a very demanding full-time job. So, tell me a little bit about your life over the past couple of years. And even actually before you do that, take a step back. How long has this been a dream?

Jessica Goodman: (03:06)

Yeah, I think I had always wanted to be a writer even when I was a kid. But it wasn’t really until I got to college when I saw what that actually looked like in practice. I joined the magazine and I was the Editor-in-Chief of the magazine in college. And that’s where I really met people who were pursuing writing as a full-time career. I met people who’ve had internships in journalism and became writers and editors after college. And I was able to see a path forward to make a living that way. And I always really liked to write fiction. I took a bunch of fiction writing classes, but I didn’t know any authors. I didn’t know anyone who was making that their life’s work as a profession. And so, I think, to me, writing fiction was always something that was fun, but it was on the side. It was not really a career path. But I did take a YA writing fiction class, a young adult writing fiction class, when I was a junior in college. And that was so special to me because that’s where I actually started this book. I wrote 50 pages and the outline for that book in that class. And it was always something that I just thought was really fun and a wonderful creative experience, but I put it down and I didn’t really touch it or do anything with it until about 2016, and that’s when I was an Editor at Entertainment Weekly. And it was such an incredible position. I loved working there, but it was really grueling. You know, I was working really long hours and it was very intense and I didn’t really feel like I was exploring my creative side that much, cause it was so much editing and working with other people’s words. But I really just wanted something that was wholly mine. And so, I picked that book back up again and I started working on it then, in the early hours of the morning and on the weekends. And yeah, that’s kinda where I started to be like, maybe I could redo this. Maybe I could do this again.

Jean Chatzky: (05:04)

I think that gets to the heart of the question, which is, you know, I ask this having written a number of books myself, when you are working a job that is grueling, and today, people are working often several jobs that are grueling, how do you find the time and the energy and the discipline to work on your passion?

Jessica Goodman: (05:28)

Yeah, I think it’s so hard. And I think that there’s no one size fits all. And I have so many author friends who have like completely different experiences than I do. But for me, it was really just asking myself, do you really want to keep doing this kind of work forever? And if not, what is your exit strategy? And you know, again, I really loved my job there. But I realized that it was unsustainable, like the kind work that I was doing. And it was a wonderful stepping stone and a great position to have, but I couldn’t keep working the same kind of hours and covering the same kind of things I was covering for years and years on end. And I didn’t really know what could be next for me. And so, it was almost like, if I don’t do this, I’m not giving myself an exit strategy. I’m not giving myself another opportunity to do anything besides what I’m already doing. And I kind of just have to create a path out of thin air for myself. But, you know, I think after about a year of working on the book while I was still at Entertainment Weekly, I actually got a new job at Cosmopolitan, where I still work. And that job was way more flexible in terms of hours. And the content was really different. And I definitely felt more creatively lit up in terms of my day job when I was there. But because I had started on this path, writing the book before, I was still so invested in that. And I started to really think, well, in case this whole journalism thing doesn’t work out, this is an alternative path for you, and you’re really just going to kick yourself in the butt if you don’t do it. It was almost like I didn’t wanna let myself down in a way, because I had proven that I could finish the book. I could get to the end, the words The End, even though I still had to revise it a bunch.

Jean Chatzky: (07:27)

Yeah.

Jessica Goodman: (07:27)

I wanted to do that for myself.

Jean Chatzky: (07:29)

So much of what I hear you saying is, I think the experience that people have when they decide, okay, I have my job, but I’m going to go get a master’s. Or I have my job, but I’m going to take a coding course on the side. Or I have my job, but I’m going to see if this recipe for salsa or brownies or whatever could be the start of a business that I could have next. And as we go through this coronavirus pandemic, and so many people have lost their jobs as so many industries have changed, it’s something I think more and more people will grasp onto. I want to come back though for a second to the tactics. I remember when I was in middle school, my mother got her master’s and the way she got her master’s with three kids was to go to class while we were in class. But then she did all of her studying from five to seven in the morning. She would just wake up two hours before the rest of the family and get it done. And when I have written books, I did the same thing. I got up two hours before anybody else. And the benefit of that was that it was also two hours before the emails started rolling in. So, I really had a chunk of time. How did you do it?

Jessica Goodman: (08:53)

It was the same for me actually. I am definitely a morning person and I completely adjusted my schedule to wake up a little earlier. And my schedule right now is, I try to write from seven to nine in the morning. And you know, when I’m on deadline that extends to six to nine sometimes. But I used to be like a workout in the morning type of person and wake up at seven and then work out and then go to work basically. And I just completely changed that so I could write in the morning. Again, it’s because the emails don’t come yet. You know, no one’s really bugging you. The only person that’s bugging you is like the other person in your household who wants coffee. For me, because I’m not a parent, and I understand that it must be just so much more difficult for people who have to take care of others, but I don’t. And so, that’s how I do it. And I cannot write at night at all. My brain is just like totally fried. That is Real Housewives time for me. So, I really need to not do anything with my brain at the end of the day, most of the time. But you know, I do sacrifice quite a bit on the weekends. You know, when I am working, I write usually in four hour chunks on the weekend. And there’s so many times that I have to turn down social events. Now, most of them are over zoom, so it’s a little easier to make some of them. But, in the pre-coronavirus times, there were a lot of moments where I was like, I can’t go to this birthday party. I can’t go to this bachelorette party or baby shower or whatever it was because, you know, you have to make hard choices about what’s important and what moments you can skip in order to meet your goals.

Jean Chatzky: (10:24)

Another hard choice that you’ve made, or maybe I’m just putting words in your mouth cause I don’t actually know, you have a two book deal now. As we mentioned, this book is being made into a television series. Halsey is now attached and you’re still working your day job. Are you going to quit?

Jessica Goodman: (10:44)

You know, I don’t think so just yet. I haven’t come to the fork in the road where I need to make that decision. But you know, I think it’s really hard, because part of me wants to be able to focus on creating this fiction path for myself and just go gung ho in it completely. But I also love my job at Cosmo and I love the nonfiction world, especially as we’re gearing up for an election cycle. You know, part of my job is cultivating op-eds around the news and politics, and that’s really important to me as well. But it’s getting more challenging to balance everything. And I have to be really careful with my time. I’m really like a big planner and I plan out my day in like a word doc or a sticky note. And it’s basically down to the minute, you know, what I’m working on, when I’m doing events for my book. But I have to turn down events for my book, because I know that I’m working at Cosmo, and it’s hard. But right now, I’m able to do both. And I feel really, really grateful about that.

Jean Chatzky: (11:48)

Was it hard to keep working on something creative when you weren’t sure there was going be a payoff monetarily

Jessica Goodman: (11:54)

So hard. I think that’s the hardest part. Because you’re just doing everything on spec, which basically means that you’re the only person who believes in you in that moment. You have nobody else saying keep going, unless you have your great friends and what not. But you’re basically just saying you’re doing this because you want it and you believe in it, and there no financial incentive yet. And there might never be. And so, it all really had to come from within. And from the immediate people around me saying, you know, you’re going to be so mad at yourself if you don’t actually do this, if you don’t give yourself a shot. And I think that’s the hardest part. You just want it to end. You want there to be a pay off. You want to get paid and you’re just not going to, until you do. And it could take years. And that definitely was the hardest part for me. And I for sure had some low points where I was like, this is never going to happen. I was doing like terrible envelope calculations of what my hourly rate was going to be based on like the lowest advance I was going to get. And that’s not really helpful. But yeah. I think it just all had to come from within. And if you’re the kind of person who you know that your project is going to fulfill you in so many ways that your day job won’t, it’s just so important to keep telling yourself and reminding yourself it’s going to be worth it – even though you don’t know what the actual pay off might be.

Jean Chatzky: (13:27)

So, so important. I think that’s a great place to take a pause and remind everybody that HerMoney is proudly sponsored by Fidelity Investments. Wherever you are on your financial journey, it’s important to have a plan for your savings. And that’s where Fidelity comes in. They’ll work with you to help you create a savings and investment strategy and help you fine tune it whenever life changes. Plus, they have tips and online tools like their planning and guidance center that can help you meet your short and long-term goals. Visit Fidelity.com/HerMoney to learn more. We are back with Jessica Goodman, author of “They Wish They Were Us.” I was lucky enough to know you as you were coming out of school and to be part of this mentorship team. But I imagine that as you were writing this book, you turn to other women who had written books while they were on staff at Cosmo. How important was having that support network to you?

Jessica Goodman: (14:25)

Incredibly important? I think so many creative projects or writing especially is very lonely. Like you’re sitting at a desk in a room with a word document and your brain. You know, that’s it. And so, I really tried to find people, especially women, who had done something like this that could talk to me and remind me that the lows I was feeling were totally normal. The highs I was feeling were also normal. And I think that in all areas of my career, having other people to talk to about these kinds of things, has just made everything bearable. You know, I’m not sure what I would do if I was kind of navigating these waters alone. But I will say that it’s not incredibly easy to find people who you connect with in this way as well. And it’s not like I have, you know, dozens of people that I can call at a moment’s notice. It’s more like maybe two or three that I know that I can text or call if I’m having an issue. But those two or three people mean the world.

Jean Chatzky: (15:26)

Let’s talk about the money and how money changes life. You got your book deal. You actually got a two book deal, which is phenomenal. And then this book was optioned for television by Jean-Marc Fillet, right?

Jessica Goodman: (15:40)

Yeah. Yeah.

Jean Chatzky: (15:40)

I mean, Jean-Marc Fillet, who did Big Little Lies. That’s first of all, incredible. You are the Executive Producer on this soon to be television show. Clearly, financially life has changed a little bit. How’s that been?

Jessica Goodman: (15:56)

Well, it’s very interesting because, since the news about the TV show came out, which is just absolutely incredible. And I just want to shout out Sydney Sweeney also, who is the young actress who kind of made all this come together. She’s the first person who read it and she’s going to be an Executive Producer and and star as Jill as well. And she’s just a phenomenal partner. But as this news came out, I kept getting so many texts that were basically like, when are you going to quit your job? Like, oh my God, are you guys buying a house? Like your whole life has changed, right? And in so many ways, yes, my life is definitely on a different path than it was a year ago, two years ago. But no, my daily life hasn’t changed in terms of lifestyle, place of living, you know, all of that kind of like, we’re not buying a house. We’re not like buying a pool or anything like that. But it has definitely given me a cushion and a sense of security and I think a different mindset about money. Whereas I am way more conscious of saving and investing right now and looking towards my future in a way that I don’t think I have been before. You know, every little piece, every little check or big check that I get from these projects is something that I think will help me build a better future for myself. But it’s not like I’m running out and buying Gucci bags or anything like that, especially now during the pandemic. I still work in my day job as a journalist and as an editor at a magazine where I haven’t gotten a significant raise in more than three years. That’s just how the industry works. And so, it has been interesting to kind of talk to people about that. And obviously, I’m in a very fortunate position, especially during a pandemic, when so many people don’t have work right now. And I feel extremely about that. But it’s interesting to talk about.

Jean Chatzky: (17:53)

You didn’t quit your day job, which I think is really just sort of a statement on the life that we live today. And the fact that even though you have successes in some areas, the whole picture, the whole world feels kind of tenuous. But in that day job, you are the op-ed editor for Cosmo. And so, I’m just wondering, in terms of the last six months, in terms of all of the changes that we are seeing in this landscape of our world and the different ways in which people have woken up, what are you finding are the things that your readers really want to talk about? What do you find that’s really moving people right now.

Jessica Goodman: (18:41)

Yeah. I mean, my whole job has changed in the past six months, I think, as the pandemic has become our daily life. Most of the stories that I’m working on these days are either about the pandemic, about Black Lives Matter or about the 2020 election that’s coming up. So, you know, really fascinating stories about this incredibly dramatic and stressful and important period that we’re in. I think our readers obviously are mostly young women who are extremely passionate about the world, in which they live and want to be delighted and entertained, but also very well informed. So, the stories that I commission and edit are mostly first person stories about what it’s like to live in America right now. You know, we’ve talked to so many health-care workers, so many essential workers, about their daily lives. We’ve talked to women who, recently we did a very powerful story about a woman who was trying to get an abortion in Texas when all of the clinics shut down and how she had to do a medical abortion at home herself or a medication abortion, I should say. And, you know, these are the kinds of stories I think that people want to know about, because we’ve never lived through a period like this before. And obviously in terms of Black Lives Matter and all of the protests that have happened since the murder of George Floyd. You know, we’ve been trying to cover that from all angles and really share what it’s like to be a young Black woman in America. And so, we’ve been trying to amplify those voices as much as we can as well. But it’s certainly a very interesting and, at times, very difficult period to live through and work in journalism I think. You know, we all just want to put out the best content that we can, that feels important.

Jean Chatzky: (20:25)

I could not agree more. All right. Last question, Jess. Volume two, your second book, should we look forward to Jill Newman’s adventures in college?

Jessica Goodman: (20:38)

Well, I’ll never say never about a “They Wish They Were Us” sequel, but I actually just finished my second book. It should be, you know, swiftly moving along through copy edits very soon. But that is another stand-alone thriller that will come out next summer, summer 2021 also from Razorbill. And I can’t say a ton about the plot just yet, but it follows two sisters and it is very twisty and turny. And if you like the themes in “They Wish They Were Us,” I think you will also like the second book, cause it follows similar themes in power dynamics, I would say,

Jean Chatzky: (21:15)

Well, I can’t wait. I’m not going to give any spoilers. But let me just say that about a third of the way from the end, I said to Elliot, oh, I figured this out 50 pages ago and about 20 pages from the end, I said, I got it wrong.

Jessica Goodman: (21:32)

I love that. That’s the best kind of feedback you can give.

Jean Chatzky: (21:36)

So, you’re good at the twisty, turny thing. I’m thrilled for you. Congratulations. Thank you so much for being here.

Jessica Goodman: (21:44)

Thank you so much for having me. This was so much fun.

Jean Chatzky: (21:46)

And we will be right back with Kathryn and your mailbag.

Jean Chatzky: (21:57)

And HerMoney’s Kathryn Tuggle joins me now for our mailbag. Hey Kathryn.

Kathryn Tuggle: (22:02)

Hey Jean.

Jean Chatzky: (22:03)

So, when was the last time you read a young adult novel?

Kathryn Tuggle: (22:06)

When I was a young adult?

Jean Chatzky: (22:08)

Really?

Kathryn Tuggle: (22:08)

Yeah. I haven’t. Even when I was a young adult, I was reading adult novels. Reading has always been my passion. Like my SAT score is like, I aced the verbal and I got like three points in math. So, words are my thing. But I’ve been thinking that I should give young adult novels a chance because I know so many adults read them.

Jean Chatzky: (22:31)

Well, I have to say, I mean I think, like you, I was reading adult novels in elementary school, right? Or in middle school, but I don’t think I ever gave the young adult novels up. I haven’t read one like this for quite some time, but I devoured Harry Potter, which shows up on the young adult lists. I devoured The Hunger Games. And I don’t know, I sort of find, I like them. And this one was a fun beach read. Plus it was nice to read something where I knew the author, which is always fun.

Kathryn Tuggle: (23:00)

Absolutely. And you know, I was thinking about you in the context of getting your dream off the ground while still working your full time job, just with how you launched HerMoney a couple of years ago. How we launched HerMoney a couple of years ago. I mean, you pretty much did this yourself while working full time.

Jean Chatzky: (23:18)

Well, I don’t know about that. I had a lot of help, yourself included and the wonderful and often-missed Kelly Hultgren. We just miss her all the time. So, I do think, if you want something bad enough, you make room in your life to do it.

Kathryn Tuggle: (23:33)

A hundred percent. Couldn’t agree more.

Jean Chatzky: (23:36)

Yeah. So we’ve got some questions let’s dive in.

Kathryn Tuggle: (23:38)

We do. Our first question comes to us from Jennifer. She says, dear Jean. Let me start by saying that your podcast has been so refreshing and eye opening. I just found it and I’m quickly catching up on past episodes. In one recent episode, something came up that’s been on my mind. People don’t take female financial planners seriously. I’m 36 and pursuing a certified financial planner license. But I’m wondering if a traditional planner is really the way to go. I come from a media and translation background and I’m exploring whether or not to go into financial writing, maybe start a website or design an educational program instead. Where have you seen women in finance thrive? To give you some additional context? My primary goals are getting caught up on my finances and making sure I have enough time for my kids after school. My ex-husband did a number on our finances and it will take me a while to fix everything. And this journey is what inspired me to get into financial planning in the first place. I have two kids, so whatever I do next needs to be flexible and help me make good money. Thank you so much.

Jean Chatzky: (24:38)

I think, judging by your background, that you are going to be a fantastic financial advisor. And I think the traditional route is exactly where you should start. I have spoken to so many firms and so many companies who can’t find all of the female financial planners that they want to hire. And what that says to me is that the job market for you is going to be wide open. And I think that you will have absolutely no trouble landing in a position that offers the flexibility you need at a decent rate of pay. As far as the financial writing, I’ve got to say, and Kathryn, you can weigh in on this, that doesn’t pay quite as well. Starting a website is a wonderful thing to do, but it also doesn’t necessarily bring the monetary rewards consistently as you need them. And designing an educational program I think is kind of a different field. But I would say, you don’t have to choose. Get your license. Get a job. And then write financial articles to build your business. Start a website to build your business and to grow your brand. Once you are a planner and once you are working with people, you want to grow that business so that it is thriving as much as possible. And you need to get your name out there. You need people to be calling and asking for you specifically. And as far as the people not taking female planners seriously, I just don’t agree. I know some unbelievably fantastic female planners. I know some unbelievably fantastic male planners. I do agree that there has been some well-documented sexism and there are very large gaps in pay in fields like economics. It is very true that there are far fewer female planners than there are male planners right now. I am sure, although I don’t know the numbers, that there is a significant wage gap in what female planners earn versus what male planners earn, in particular because male planners who go by that old traditional broker model have had a lot longer to build their business. But not taken seriously is not something that I have heard. And it’s certainly something that we would never tolerate here.

Kathryn Tuggle: (27:18)

I would like to second that. I have not heard that about female financial planners not being taken seriously. In fact, the only thing I’ve heard is what high demand they’re in because there are so few of them. And I just wanted to say, anecdotally, since you know you’re a good writer it sounds like, the yoga teachers I know who are good writers, who have been able to start blogs to promote their yoga teaching services, are just far and away outpacing the yoga teachers who don’t have those writing skills. So, I am kind of thinking in the back of my mind, become a certified planner, then use those writing skills that you have to really say what you want to say to your audience every week on your blog and in a newsletter, and you will absolutely be taken seriously. And you will absolutely have the best of both worlds.

Jean Chatzky: (28:09)

Yeah. Exactly. I think that’s very true and you’re not limited to writing. You know, if you’re a good communicator, start a podcast, go on television. There are so many avenues for you to pursue.

Kathryn Tuggle: (28:23)

Absolutely. Great advice, Jean.

Jean Chatzky: (28:25)

Thanks.

Kathryn Tuggle: (28:26)

Our next question is from Mary. She writes, hi Jean and crew. I love your newsletter and look forward to it every week. So, thank you. Question. I’d like to educate myself on ways I can save on my personal income taxes. Can you suggest some books, online resources and more where I could start? Thank you.

Jean Chatzky: (28:44)

Mary, this is not a question that I think I’ve ever been asked before. And quite honestly, there aren’t that many places that I turn specifically for tax advice, income tax advice. Every year, the folks at Ernst and Young, they put out a very fat tax book that they update every year. The folks at TurboTax put out a lot of great content that I turn to when I am doing a tax story, and I sometimes talk to their experts. Far and away, my favorite source on taxes is somebody that I’ve been following, quite literally, for 30 years. She’s a woman named Laura Saunders and she writes about taxes for the Wall Street Journal on a weekly basis. You can just Google her column. I worked with her 30 years ago at Forbes, and she was writing about taxes then. And she’s very clear about the fact that she approaches this from the position of a journalist. So, she’s asking the questions that you want to ask. And she’s writing the answers that we all need to know. And so, I would just put her on your weekly rotation and take it from there.

Kathryn Tuggle: (30:05)

Love that. Our last question comes to us from an anonymous listener. She writes, dear Jean. I’m 32 years old and I currently have a simple IRA plan with Vanguard at $8,000 through my employer, and a rollover IRA at $3,000 from my immediate past employer. I contribute 3% of my $61,000 salary, the max my employer will match. When I set up my simple IRA, I allocated 20% of my contribution to an index fund and 80% to a target date fund year 2050. Now, after learning a bit more, I think the 20% allocated to the index fund is unnecessary and the target date fund would automatically give me the balance I’m looking for. I’ve realized over the last two years that I’m fairly risk tolerant – more than I expected. Should I be putting a hundred percent of my contributions into a target date fund? Or should I be doing something completely different from my current strategy? If I need to make adjustments with allocations, is now the time? I’m also putting about a thousand dollars a month into paying off student loans and credit card debt. I anticipate having all that paid off in about five years. Once that’s done, should I make any changes based on adding an additional $500 or so per month toward retirement? I also want to amp up my emergency fund, which is currently at $3,000. Thank you so much for your advice and guidance. I adore your show, your empathetic and pragmatic point of view makes it one of the few financial podcasts I can listen to right now.

Jean Chatzky: (31:29)

Well, thank you for those nice words. I appreciate that. I know now is a really tough time to stomach any sort of financial advice. So, that actually means a lot. I think the 20% that you have allocated to the index fund is unnecessary. The target date funds are set up to be one and done solutions. And so by putting money into whatever sort of index fund you’ve put it into, you’re basically throwing the balancing exercise that this target date fund is trying to do a little bit out of whack. With an 80/20 split, you’re probably throwing it not that much out of whack, but by the same token, you could simplify your life just by going all in with the target date fund, as long as you’re happy with it. And it sounds like you are happy with it. As far as making adjustments with allocations, the target date fund will actually take care of that for you. And when you free up the money, and I love that you have charted your path to clear your student loans and clear your credit card debt. Once you have gotten rid of both of those things, I would take the extra $500 a month. I’d use it first to beef up that emergency fund a bit. And then I’d put the rest into that retirement fund. I know that your employer is only matching 3%, but we want to get you to the point where you’re contributing closer to 15% of whatever it is you’re earning each year to your longterm retirement, including those matching dollars. And it doesn’t sound like you’re quite there yet. But you’re definitely, definitely on the way to getting there.

Kathryn Tuggle: (33:16)

Great guidance. And yeah, you’re, you’re really doing so well. That’s my main takeaway from this. Doing great.

Jean Chatzky: (33:22)

So, target date funds are interesting. They make it hard for people because they’re so simple, right? We’ve all been told, don’t put all of our eggs in one basket, right? You’ve heard that for years and years and years and years – since you started investing. And target date funds ask you to do exactly that, right? Put all your money into this one fund. But what you have to realize is that it’s a fund of funds. And so, you’re not really putting all your eggs in one basket. You’re just asking somebody else to manage the diversification for you.

Kathryn Tuggle: (33:53)

That is such a great distinction because we do get this question a lot. Like, oh, you know, should I be in a target date fund? I feel like I should be doing something else. So, it’s a great point.

Jean Chatzky: (34:03)

Yeah. It’s set up for you to not have to worry about doing something else. Thanks for the questions, Kathryn.

Kathryn Tuggle: (34:09)

Thanks Jean.

Jean Chatzky: (34:10)

In today’s Thrive, let’s talk about what to do if you just gave a scammer your personal information. Sadly, we live in an era rife with scams. And the pandemic has only made things worse. Losses due to coronavirus scams now total more than a hundred million dollars. And since March, many states have reported a doubling of complaints related to COVID-19 scams. The most common type of information scammers need from you are your social security number and date of birth. If you have given up one or both of these, here’s what you need to do to protect yourself. Number one, freeze your credit. These days, credit freezes at all three of the big bureaus – Equifax, Experian and TransUnion – are all free. And a freeze is the only way to completely restrict access to your credit reports for free. When you freeze, lenders and fraudsters alike are barred from viewing your information until you unfreeze it. And that means that no one, including you, can fraudulently open a new line of credit in your good name. Step two, monitor all your accounts and change your passwords. While a credit freeze will stop new account fraud, you’ll need to keep a close eye on your existing accounts. This means monitoring them while also changing your passwords, even if you don’t think been compromised. And step three, reduce your vulnerabilities. If you fell for a scammers call or email before, ask yourself why. Many scammers come to you with some sort of sudden problem that you need to address by giving information or access or data or cash. Ask yourself, have you ever talked to this person before? Are they coming in with a problem, because that’s always a cause for suspicion? If you fall for a scam, it is a good wake up call. It shows you were not paranoid enough. And it’s a reminder to be more careful in the future. Thanks so much for joining me today on HerMoney. Thanks so much to Jessica Goodman for telling us all about her new book and how she worked to get her passion project off the ground. If any of you have been thinking of doing something similar, I hope her words of wisdom have inspired you to get started. If you like what you hear, I hope you’ll subscribe to our show at Apple Podcasts. Leave us a review because we love hearing what you think. We want to thank our sponsor Fidelity. We record this podcast out of CDM Sound Studios. Our music is provided by Video Helper and our show comes to you through Megaphone. Thanks so much for joining us and we’ll talk soon.