Even though since COVID began it seems like most of us are busier than ever, some members of our HerMoney community have used the time that was once devoted to social engagements or vacations to be a little more artistic. For example, that needlepoint project that you’ve had tucked away in a corner basket for two years just might have gotten dusted off … or those sketches that you haven’t picked up since your last trip abroad may have recently seen some new ink. And let’s face it, there’s a reason why adult coloring books are now on every single bookstore shelf across America. Countless studies have shown that when we’re making art, our levels of cortisol — the stress hormone that can wreak havoc on our bodies — lowers dramatically. And these days, who doesn’t want less stress?

Furthermore, as countless successful artists will tell you, there are reasons to create art beyond just its beauty and the joy it brings to both artist and observer — many artists sell their creations as a lucrative side gig, and sometimes that can even turn into a lucrative full-time gig.

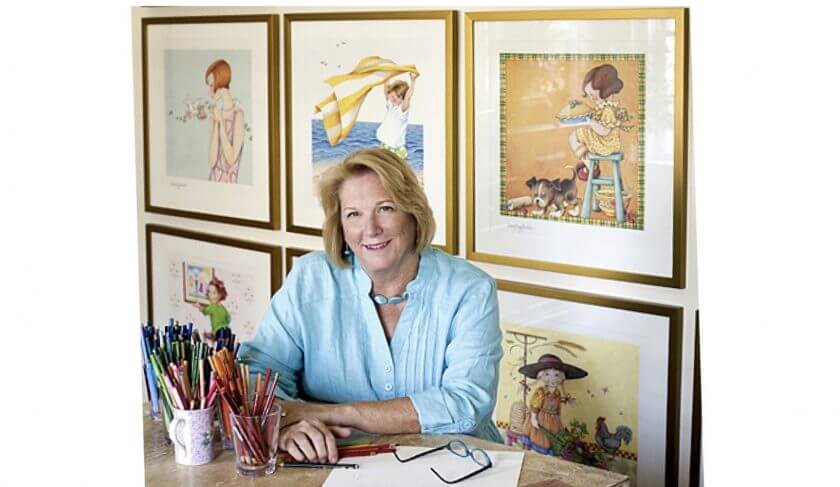

That’s exactly what happened for artist Mary Engelbreit whose lifetime sales now top more than $1 billion. On this week’s episode of the HerMoney Podcast — our 250th episode! — Mary joins us to discuss how she launched her company over 40 years ago with a simple line of greeting cards. Today her signature artwork appears on more than 6,500 products including books, calendars, stationery, fabric, dinnerware, kitchen accessories and so much more. She’s also the author of 15 books, and her inspirational and whimsical drawings have brought joy to countless fans the world over.

Listen in as Mary tells Jean how she got inspired by fairy tale illustrations as a child, and made the decision to become an artist at age 11. (She and Jean also talk about why age 11 can be a touchstone in our lives when it comes to deciding what we want to pursue.)

She started out as a teenager by selling greeting cards to a local gift shop, and then years later got her first big break at the New York Stationery Show, with a small collection of just 16 greeting cards. “We were noticed by New York Magazine as one of the best in show, and that was what really made it take off. And we learned, by the seat of our pants, what licensing was. So we started licensing and we’ve never stopped,” she says.

Mary also speaks candidly about balancing her business and her family, and how she managed to carve out space for both. “When I had kids, they just played around me while I was drawing, and it just moved forward. And then my husband joined the business, so we were all very involved. The kids would go to the store openings and it was just part of their lives, too,” she says.

We also dive into a discussion around what art really means to the creator, and how it can be an incredible method for de-stressing. “It’s such a personal thing, and it’s such a private thing. You know, you’re not doing it to please somebody else, like to please your family. It’s all for you,” Mary says. “Your peace of mind. Your satisfaction. You know, just to draw something that turned out the way you meant it to turn out, or to sew something that turned out really cute. It’s just very satisfying. And that’s a good thing. There’s nothing wrong with pleasing yourself like that. I think it’s very important to your happiness.”

Mary also discusses how she expanded her brand to have stores and a magazine, and she speaks candidly about what she might have done differently in her journey from artist to entrepreneur. For creators looking to follow in her footsteps, she talks about the importance of social media and growing your brand online.

Jean and Mary also talk about planning for your financial future as an artist, selling your products on Etsy vs. exhibiting in galleries, and how to know if there’s a market for your work.

To find out more about Mary’s work, you can visit her website here, sign up for her newsletter here, and follow her on Facebook and Instagram.

In Mailbag, Jean and Kathryn talk about putting our investment dividends back in the market vs. tucking them away into a cash account, and whether or not a listener who is headed towards retirement should take her pension or cash it out. We also discuss the best ways for a single mother to protect herself and her family financially in the event that she’s laid off. In Thrive, we discuss how your nerves can cost you up to 5% per year in investment returns — and how you can avoid sabotaging yourself.

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Transcript

Mary Engelbreit: (00:02)

That’s such a private thing. You’re not doing it to please somebody else, like to please your family. It’s all for you. Your peace of mind. Your satisfaction. You know, just to draw something that turned out the way you meant it to turn it or to sew something that turned out really cute. It’s just very satisfying and that’s a good thing. There’s nothing wrong with pleasing yourself like that. I think it’s very important to your happiness.

Jean Chatzky: (00:38)

HerMoney is supported by Fidelity Investments. Whether you’re saving for something in the near future or way down the road, Fidelity has tips and tools to help you meet your savings goals. Visit Fidelity.com/HerMoney to learn more.

Jean Chatzky: (00:55)

Hey everyone. I’m Jean Chatzky. Thank you so much for joining me today on HerMoney. So I don’t want to presume that any of you have had more time to work on creative pursuits over the last few months, because I think I speak for, well, maybe all of us when I say that we are busier than ever. But anecdotally, I do know that some of us have used the time that we may have spent on social engagements or a vacation to be a little more artistic. That needlework project that you’ve had in a corner basket for two years might just have gotten dusted off. Or those sketches that you haven’t picked up since your last trip abroad may have seen some new ink. And let’s face it. There is a reason why adult coloring books are now on every single bookstore shelf across America. Countless studies have shown that when we’re making art, although my projects, I don’t think would be called art, but we’ll discuss. When we’re making art, our levels of cortisol, the stress hormone that can wreak havoc on our bodies, goes down dramatically. And these days who doesn’t want less stress. Furthermore, as countless successful artists will tell you, there are reasons to create art beyond just its beauty and the joy that it brings to both the artist and observer. Many artists sell their creations as a side gig. And sometimes that can even turn into a full-time gig. To walk us through her incredible experience in the art world is none other than artist Mary Engelbreit, who launched her company over 40 years ago with a simple line of greeting cards, and today leads a business with more than a billion dollars in lifetime retail sales. Her signature artwork appears on more than 6,500 products, including books, calendars, stationary, fabrics. I could go on and on. She’s also the author of 15 books, several of them, New York Times bestsellers. And her inspirational, whimsical and down to earth drawings have brought joy to countless fans the world over, including our producer, Kathryn Tuggle. And I don’t think I have ever seen her fan girl quite as hard as she is today. Mary welcome. Thank you so much for being here with us.

Mary Engelbreit: (03:31)

Thanks for having me. I appreciate it.

Jean Chatzky: (03:33)

It is our pleasure. Believe me. Tell us a little bit, I mean, I grew up with you. I feel like I grew up with you. I don’t say that often, but you were a presence in my home growing up. I know you are a presence in Kathryn’s. Tell us how you got your start.

Mary Engelbreit: (03:50)

My mother read to us every night and I would illustrate the stories the next day, because I love the illustrations in those old books. She had her old books and her mother’s books. So I was very influenced by those old fairytale illustrations. And I’ve been drawing as long as I can remember. And I remember when I was about 11, I announced to my parents that that’s what I was going to do for a living.

Jean Chatzky: (04:17)

That’s so funny that you say 11. I once had a conversation about how to find your passion in life, with a guy named John Huey, who was for years the editor of Fortune magazine. And then he went on to run all of Time Inc. when Time Inc. existed. And I asked him, how do you find your passion? And he said, if you don’t know what it is, go back to what you enjoyed doing at age 11. That’s it.

Mary Engelbreit: (04:44)

I think that’s true.

Jean Chatzky: (04:45)

Yeah.

Mary Engelbreit: (04:45)

I think that’s true. I was determined. And my parents were very supportive too, which made a huge difference.

Jean Chatzky: (04:52)

Where do you come up with your ideas? And your art is in so many places and in so many mediums, but how do you create it originally?

Mary Engelbreit: (05:01)

That’s a good question. Desperation. Deadlines. You know, thankfully, I’m never short of ideas really. And I think it’s because I just illustrate what happens in my life, with my kids and my husband and my friends. And so, you know, it’s ordinary stuff that I believe is happening to everybody so that people recognize it when they see it in the drawing. I think that’s it.

Jean Chatzky: (05:28)

You know, it’s interesting that you say desperation and deadlines because I’m sometimes asked, you know, how do you keep writing? How do you write book after book, after book? And that’s really it for me. I mean, I may not always feel a hundred percent inspired, but when it’s your job, you keep doing it.

Mary Engelbreit: (05:48)

Yeah. You have no choice. I mean, if that’s what you want to do for a living. And I don’t mind deadlines. I don’t mind working on deadlines. I don’t mind working by myself. You know, I like working at home. And this pandemic, while it’s horrible for people, I don’t mind it. It’s a good excuse not to go out. And I’ve gotten a lot of work done during it. And like I say, I don’t mind being at home and just working. It’s kind of a joy. There are no excuses.

Jean Chatzky: (06:18)

What was your first break. I mean, you were creating as young as 11. But when did you and how did you turn it into a business?

Mary Engelbreit: (06:31)

Well, when I was in high school, there is a little store here in St. Louis. It was so cute. We all went there and spent our allowance. And they had greeting cards, but they also had a lot of other little cute things. And I brought some of my little drawings. What I was doing at the time in high school was taking lines from songs like from Crosby Stills and Nash, Joni Mitchell, was totally illegal, and I was illustrating them on little blank wedding invitations. And so I took them into the store and asked if they would buy them. And they said they would for 25 cents a piece. And they sold them for 50 cents. And that was really the start of my career. I mean, I’ve been doing it in one way or another since then.

Jean Chatzky: (07:16)

It’s a far cry from 25 cents to a billion dollars.

Mary Engelbreit: (07:21)

Yeah. I mean, I just think the drawings connected with people. I first started, I remember it was before I was married. So a little over 40 years ago, I started sending out my drawings just cold to greeting card companies and asking them if they’d like to publish them. There were so many little greeting card companies then, and several of them bought them. I eventually settled on, I think it was Portal Publications. And it just started growing from there. Then I decided I wanted them to make prints and I wanted them to make calendars and they weren’t really interested. So I decided that we would do it ourselves. And I got somebody to help me run the business side of it. And we went up to New York to the stationary show that they have every spring with our pitiful little, I think it was like 16 cards or something. But we were noticed by New York Magazine as one of the best in show things. And that was really what made it take off. And we learned by the seat of our pants, what licensing was. We were approached by agencies that wanted to license the artwork. We had no idea what that was. So we found out within an hour and started licensing and we’ve never stopped

Jean Chatzky: (08:40)

Today, I know that there are a lot of artists who maybe do it as a hobby, thinking that they might like to try to sell what they make. That maybe they could sell what they make. How do you, if what you’re making has a market? One of the things that we heard in doing research for this show, Mary, was that artists sometimes have to make a choice between putting their work on Etsy or going the small gallery route and exhibiting there. What are your thoughts on that?

Mary Engelbreit: (09:16)

Well, I do have my work in a gallery here in town, The Green Door Gallery. I do know some artists who, almost every one of them, has an Instagram site. But I notice, when they’re getting ready for a show, the Instagram pretty much shuts down. So I think the shows are very, very important to them. It’s kind of like just an extra thing for me, but really the other work is more important to my career. But if you’re strictly a painter, it might be more important to you and to your kind of customer to be in the gallery. But yes, there’s Etsy and I buy a lot of stuff on Etsy. That’s the way to sell your stuff. There are plenty of people who started on Etsy and got a big following. And that’s the thing. You have to get those followers to show the companies that you’ve got the sales and they’ve been taken on by bigger companies. But a lot of people just make a living on Etsy.

Jean Chatzky: (10:16)

It’s incredible these days. It’s so, I mean I love how so much of the world has been democratized, right? I mean, you want to be a personal finance personality, you put up a website and you’re in business in many cases, right?

Mary Engelbreit: (10:31)

That’s right. Scary, but yes.

Jean Chatzky: (10:31)

It’s true.

Mary Engelbreit: (10:35)

But it is true. And it’s kinda nice. I mean, it opens it up to everybody. If you have a good idea, you know, and if you can reach a lot of people. You have to have something that’s gonna resonate with people. You can’t put something out there that people have seen before or different, close enough versions of it. Yeah. I think it’s a great way to get going.

Jean Chatzky: (10:55)

I want to talk a little bit more about your life and how you created a business while raising kids, having a family, you know, balancing things. But before we do that, let me remind everyone that HerMoney and conversations like these is proudly sponsored by Fidelity Investments. Wherever you are on your financial journey, it’s important to have a plan for your savings. That’s where Fidelity comes in. They’ll work with you to help you create a savings and investment strategy and help you fine tune it whenever life changes. Plus they have tips and online tools, like their planning and guidance center, that can help you meet your short and long-term goals. Visit Fidelity.com/HerMoney to learn more. We are talking with artist, Mary Engelbreit. So Mary, you started your business at a time when there were not a lot of women starting businesses, let alone businesses that grew to be as large as yours. How did you do it? How did you carve out space for both your business and your life?

Mary Engelbreit: (12:01)

Well, my business was part of my life. There was never any question to me that I would not do it. So when I had kids, you know, I’ve worked around them and they played around me while I was drawing and it just moved forward fine. And then my husband joined the business to run the business end of it. So we were all very involved. The kids would go to the store openings when we used to have stores. And you know, it was just part of their lives too. I guess it just never occurred to me that it had to be one or the other. And, I wouldn’t have taken no for an answer anyway. And so I just plowed forward.

Jean Chatzky: (12:44)

What was that like when your husband joined the business? Was that at all stressful? I mean, we’ve heard from a lot of couples. Who’ve been in business together through this podcast and sometimes it works wonderfully and sometimes it’s a little dodgy.

Mary Engelbreit: (12:58)

Right. We worked wonderfully together. We had a great time and it was especially good I think with the kids, when they were little, because it was a real family thing. And when we got bigger, we had more employees, we had a business partner at one time, and then it wasn’t as fun. And he left to do his own thing and I kept doing it. And I’ve often wished that we hadn’t done that, frankly. I wish we had just stayed smaller. I think we could have had the same kind of success, but just not so many people. And a lot of it seemed unnecessary, I think. But at the time I started, Martha Stewart started. I think she started a little before me. And she was amazing all the different things she was doing. And I think there was some idea that, not that we had to do that, but we could do that. So why don’t we hire some more people and you know, we’ll open some stores and we’ll do this and we’ll do that. And looking back on it, even though it was fun and the stores were great, people love the stores. We even started a magazine.

Jean Chatzky: (14:16)

I remember.

Mary Engelbreit: (14:17)

Which was so fun. I just think, looking back, I probably would have done things a little differently. Not have felt like I have to do it this way. I can keep this much simpler.

Jean Chatzky: (14:31)

Yeah. Sometimes I think when, even it’s pressure that we put on ourselves to try to keep up, it makes things difficult.

Mary Engelbreit: (14:39)

Yeah. While it was all fun, it got a little too big there for me to be comfortable. I like to walk into my studio and know everybody there and, you know, say hi, have potluck lunches and that kind of thing.

Jean Chatzky: (14:54)

Talk to me about the money. Did you, I mean, we think artists and the word that we think before it is starving, right?

Mary Engelbreit: (15:01)

Yeah.

Jean Chatzky: (15:01)

How did you plan being an artist for your future financially? Was that something that you, that you thought about? Was it something, you’re laughing.

Mary Engelbreit: (15:12)

Yeah, no. Um, no, I know my parents thought, oh great. But they never said that. Like I said, they were always supportive. But no, I just thought I was going to illustrate books and have a nice life. And when we went to that stationary show with our little cards and looked around, I realized, oh, there’s a lot you can do here. You know? And when people started approaching us to do prints and calendars and books and putting our designs on picture frames, I got the picture right away. And that’s what we turned into, that day, was a licensing company. So we don’t produce any products. Well we do now, but back then we didn’t produce any products. We just licensed products and produced art. And we still do that. That was our main business. That’s where the money is.

Jean Chatzky: (16:06)

For sure. But as it was coming, I mean, how did you make sure. Were you conscious of changing tastes and the fact that that does happen, that you need to save while the getting is good.

Mary Engelbreit: (16:19)

You do have to stay on top of that. Not only other people’s tastes, but my tastes, too, changed. When we first started, what I was doing was pretty different. You never saw greeting cards that had black backgrounds or said funny things on the front. It was mainly animals and flowers and things like that. So it got a lot of attention and that stayed in style for a long, long time. The really, really detailed drawings that I did at the beginning, I did get tired of myself. And so I changed my style a little bit. You’ve got to drag people along with you when you do that. Most of them followed, luckily. But yeah, you certainly have to keep that in mind. You don’t want to be an idiot about it. You’re in it to make money. So know, you do have to do what’s going to sell.

Jean Chatzky: (17:09)

So for those women who are listening to us, who are thinking they want to grow their business, and maybe their businesses in the field of art, but maybe it’s not. I mean, what’s your best advice for anybody who’s looking to grow a following.

Mary Engelbreit: (17:24)

Well, now social media is everything. It’s the only thing. You know, that’s the way to do it. Unless you’re doing something that could turn into a TV show, which is the other thing, but usually the way you get a TV shows to get it on social media first. So I would say you almost have to have a website or some kind of social media presence. And by that, I mean, you know, not just posting a few things on Instagram. You have to have a newsletter. You have to remind people that you’re there constantly. And in a friendly way so that you’re not annoying them. And you know, they want to see what you’re doing next. And if they don’t, then you know you’re going down the wrong path and you have to kind of change what you’re doing. And sometimes it’s even good to ask that. What would you like to see? What’s your favorite part of this? It’s a great way to stay in really close, personal touch with your customers. I think.

Jean Chatzky: (18:27)

I know that today your art is something that you do every day. Is it something that you turn to during stressful times and why do you think it is so stress reducing for people?

Mary Engelbreit: (18:39)

I definitely look at it as stress reducing and yeah, if I couldn’t do it would not be pleasant for anyone near me. You know, it causes endorphins to happen and it’s such a personal thing. And it’s such a private thing. You know, you’re not doing it to please somebody else, like to please your family. It’s all for you. Your peace of mind. Your satisfaction. You know, just to draw something that turned out the way you meant it to turn it or to sew something that turned out really cute. It’s just very satisfying. And that’s a good thing. There’s nothing wrong with pleasing yourself like that. I think it’s very important to your happiness.

Jean Chatzky: (19:24)

Yeah. No question, especially right now, a little bit of this kind of selfcare I think goes a very, very long way.

Mary Engelbreit: (19:31)

Definitely. I do too. And since we are in this position and we have to stay home, why not take advantage of it and try something like that, that you’ve always thought about. It doesn’t matter if it looks good or if it’s salable. Now is a good time to try stuff like that, I think. And see if you’ve have fun doing it and you’ll have fun for an afternoon anyway.

Jean Chatzky: (19:55)

Absolutely. Mary, where can we find more about you, about your work?

Mary Engelbreit: (20:00)

Well, my website is Mary Engelbreit.com, and then I’m on Instagram. I also have a Facebook page. And so all of those things have all the information you’d probably want. You can get a newsletter that keeps you apprized of what we’re doing. So I’m all over social media, just like everybody else. The books are available, wherever books are sold. And calendars and that kind of thing.

Jean Chatzky: (20:24)

Fantastic. We will put it all in our show notes so that people can find you as well. Thanks for spending a little bit of time with us today.

Mary Engelbreit: (20:31)

Well, thank you so much.

Jean Chatzky: (20:33)

And we’ll be right back with Kathryn and your mailbag.

Jean Chatzky: (20:42)

And HerMoney’s Kathryn Tuggle joins me now. Hey Kathryn.

Kathryn Tuggle: (20:47)

Hey Jean. That was a great episode.

Jean Chatzky: (20:49)

Oh, well thank you for teeing it up. Now I know that you are, as you put it yourself, a fan girl. Tell me about Mary’s role in your life.

Kathryn Tuggle: (21:00)

Yeah, we had Mary Engelbreit, everything. It was common ground for my mom and I to agree on the Mary Engelbreit aesthetic. So we had my ankle bright mugs, calendars, journals, all of it. In particular, I had a coffee mug for many years that was one of her illustrations of this little girl who had just clearly heard something shocking. And the little caption of the illustration was, oh no. And I drank out of this mug. I still drink out of this mug when I go home. And I don’t know, I feel like that’s just one example of how she kind of captures real life with her drawings and with her art. And I think that that’s why she’s so relatable. And I felt that I got that from this conversation, just how genuine she is, how relatable she is. And you know, she’s doing what is put on her heart. She’s drawing what has been put in her heart to draw. And I love that about her.

Jean Chatzky: (21:56)

Yeah. I definitely got that from her. It’s funny listening to her. You think about the people who were sort of omnipresent in your life, even though you didn’t ever know them, right? Like Charles Schultz and I’m thinking of artists now. Sandra Boynton was fairly big in my house when I was growing up and especially big with my children, the children’s books that she wrote. And I’m in awe of people who are artistic. I actually, at the farmer’s market over the weekend, I bought some yarn from the alpaca farmer because it was beautiful and I thought, all right, maybe I will knit something. But God knows if I’ll ever do that. Seriously, like, I can knit. I haven’t knit for a really, really long time. But I do think there’s something meditative about it, about coloring or knitting or paint by numbers or whatever it is that you can do just to blow off steam. I mean, I love going to those pottery places where you buy a mug and you paint those. I have a bunch of them. That’s about it for my artistic ability. Actually I will drink out of the ones that I’ve painted and not be too embarrassed.

Kathryn Tuggle: (23:11)

We should do that as a HerMoney outing when everything normalizes, I would love that.

Jean Chatzky: (23:15)

I would love that too. We have one here in my little town. We can go right there.

Kathryn Tuggle: (23:19)

Yeah.

Jean Chatzky: (23:20)

Yeah. So anyway, thank you. That was a fun conversation. I enjoyed it. And I only remembered after the fact that my good friend Paige grew up in St. Louis and grew up with Mary. So very small world.

Kathryn Tuggle: (23:33)

Such a small world.

Jean Chatzky: (23:35)

So what do we have today from our mailbag?

Kathryn Tuggle: (23:37)

Our first note comes to us from Jan. She writes, my knowledge is limited so I must ask. I have investments of around $750,000 diversified. Some moderate risks, mostly low risk. I’m 67 and recently retired. I never touch the money other than using dividends for my car lease. My question is, when the markets are up and confidence is high, I feel like the extra cash should go into a cash account so that when it crashes again, as I assume it will do soon, then I have not lost the gains. Can you tell me if my thinking on this is correct or incorrect? I truly appreciate all you teach us. Wonderful information.

Jean Chatzky: (24:13)

Well, thank you so much, Jan. I’m not sure what you mean when you say the extra cash. Are you talking about new contributions? Here’s the thing. And this is the thing that you have to focus on. When you retire, you need to make sure that you have a chunk of money that will last you a good three years so that you don’t have to ride ups and downs in the market. And that money should not be at moderate risk or low risk. That money should be at no risk. And it doesn’t have to cover all of your living expenses. You should be looking at what sort of money are you getting in from social security, what are you getting in from pension income, what are you getting in from dividends. I mean, that’s the money that you can really count on. And then how much more do you need to cover your basic expenses of daily living. That amount, for three years, should essentially be in cash. And the rest of your money can be allocated in a way that takes more risk because you don’t need it. And you don’t need to worry about what happens if the market goes up or the market goes down in the short term. So I’d start thinking about this as kind of two separate pots of money, the cash account and the investment account. And then I wouldn’t necessarily worry short term so much about the ups and downs of the market in the investment account. It’s a shift. In the years before retirement, it’s all about accumulate, accumulate, accumulate. Once we retire and we’re not accumulating and we’re not earning, then we have to think about, how do we make it last while also living in the present. And that’s the shift I’m trying to get her to make here. And if you haven’t sat down with a financial advisor, really good time to do that and just make sure that you have your money set up so that it can accomplish both of those things for you.

Kathryn Tuggle: (26:30)

Yeah, absolutely. A meeting with a financial advisor would be an amazing idea for her right now.

Jean Chatzky: (26:37)

And she may have already done it. So if she has then good on you, Jan, and you’re good to go. But if not, those are the mindset shifts that I’d like to see you make.

Kathryn Tuggle: (26:46)

Absolutely. Our next note comes to us from an anonymous listener. She writes, hi HerMoney team. Thank you for understanding all of our financial matters and giving such sage advice. I’m a single mother, 36 years old, with 90% custody of my children who are four and six. I’m in sales, and with COVID, my numbers are horrible. I’m worried about my job. With interest rates being so low, I was thinking about refinancing my house and taking out money. This way, if I do lose my job, I have additional cashflow while I job search. Here are my numbers. My house is worth $575,000 and I owe $250,000. I have $45,000 in savings in an emergency fund, $38,000 in Robinhood and $171,000 in my 401k. My monthly spending is approximately $5,000 with house, bills, childcare and food. I don’t know if taking money out of my house is the best idea, but I like that I have options. For example, if I don’t lose my job, I could possibly buy a rental property. Another option is to sell my house and buy a smaller one with the equity from the house, therefore not having a mortgage. I like my neighbors. I like the school. But I hate this uncertainty. Everyone has opinions, but I would love to hear from an expert. Thank you for your assistance.

Jean Chatzky: (27:59)

Well, you are very, very welcome. And it sounds like, I mean look. You’re doing great. You have accumulated quite a nest egg at a very young age. So let’s run through the different options that you talked about. I’m actually going to take them in reverse order because I think these are things that you should be thinking about independently rather than as one big decision. All right, let’s look at selling the house first. You like your neighbors, you like the school. You hate uncertainty. This is no time to move your children out of their school district and deal with getting set up with a whole new remote system. I mean, that would just make me go bonkers. And it’s also no time to leave neighbors that you really like and trust, I think. But if you could sell your house and buy a smaller one, very close by, I might consider that. I might consider that as a way to pocket some cash and deal with the uncertainty that you’re feeling. If you are looking at moving, and moving means moving away, that would not be for me. At least not right now. Second option. I could buy a rental property. Do you want a rental property, right? Are you putting that out there because you are looking for another income earning opportunity or is this something that really appeals to you? Because buying a rental property is work. You’re a landlord, all of a sudden. Or you have to pay somebody to manage it for you. You’ve got small kids. Do you want somebody calling you in the middle of the night if something happens to the heater or the toilet? Just think about that before you actually do it. If this is something that’s been on your wishlist. There are a lot of people out there who really want to own rental real estate, who envisioned this as a big part of their retirement nest egg. And if that’s you then go for it. But if that’s not you, and you’re just looking for a way to make money with this money, I’d think really carefully about that. Third decision. You could refinance the house. There are about 19 million people out there, according to the last analysis that I saw, for whom refinancing right now would be a very good money saving move. I’m not sure if you’re one of them. I mean, if you’ve got a mortgage that is three and a half percent or higher, I would say, yeah, you should look at refinancing. But pulling money out of the house, you may want to pull a little bit out, but I wouldn’t necessarily do that. What I think I would do instead is look into a home equity line of credit. This is something that you will need to secure when you have a job. I would look into a home equity line of credit whether or not you refinance the house, because it will become your back pocket emergency cushion. And in that case, if you do lose your job, you’ll have access to the money from your house without having to go through the refi, without having to move, and giving you, based on the amount of equity that you have, significant time to get back on your feet. So those are my three answers to your three questions. Again, I think it’s really important to not let A trigger B trigger C, in this instance. Look at them separately and then decide where you want to go.

Kathryn Tuggle: (31:43)

I agree completely. And I also think just to reiterate, she is doing so incredibly well with her savings and the path that she’s on. So that should, you know, hopefully take out a lot of that element of uncertainty, just knowing that you are so well-prepared for the future at such a young age.

Jean Chatzky: (31:59)

Absolutely and good luck.

Kathryn Tuggle: (32:01)

Our last note comes to us from Sue Ellen. She says, my company was recently bought out. I work at Speedway and it was bought by 7-Eleven. I’m 95% sure my job will be gone when the deal is finalized in the first quarter of 2021, I’m 63 and I was planning on retiring when I hit 65. I have a work pension through Speedway. It has a current cash payout value of $266,000 with an option for lifetime monthly payments of $1400. I also have a small 401k at $76,000. I’m concerned about the future safety of the pension. Is it better to take the cash out and try to create my own income stream? I’ll also have social security, which would be $1,568 if I were to start collecting immediately, I’m expecting a significant inheritance of $500,000 from my father when he passes. He’s 88 and in good health. My current monthly expenses are around $4,300. My last mortgage payment will be January 2026, and that payment is small at $315 a month. I’ll also need to find health insurance for myself and my two daughters who are 22 and 18. One just graduated college and one is just starting. Any thoughts or ideas are appreciated. I love your podcast and thank you.

Jean Chatzky: (33:16)

Thanks so much for writing Sue Ellen. This is such a hard time to go through a shift like this. I’m not worried about the future safety of the pension. This is a big company. Those pension obligations are going to have to be satisfied. What I am a little more concerned about is bridging you, essentially, for the next few years, until you are able to perhaps take social security when it is worth a little bit more for you. I also think that that inheritance from your dad, although really substantial, it could be a decade. I mean, he’s in good health. People are living a really, really long time these days. So I don’t think you want to factor that into your planning right now. I would be in the process of looking for another job right now that, even if it doesn’t check all the boxes that the job you have currently checks, maybe you can find something that will continue to bring in an income, continue to provide health insurance that you can then access for you and your daughters, and allow you to put off social security for a couple of additional years. At that point, the pension with it’s monthly payments and social security combined should be enough to provide you with enough to live on. That’s sort of the math that I’m playing with right now. Because you will, if you can wait, get a significant 8% bump on those social security payments every single year, which will get you into an over $2,000 really quickly. That combined with the pension should get you to the point where you’re almost making ends meet — especially if you combine it with an income stream that can carry you into the next couple of years, preferably beyond 65 and closer to age 70. I want to address your question about creating your own income stream with that pension with the current cash out value of $266,000. I just ran some numbers on two things. One is what sort of immediate lifetime annuity you would be able to get. It’s only about $1,100 a month, which is less than the monthly payments of $1,400 you’re expecting. Investing the money and then pulling out 4% of it a year would provide you with even less. So on the surface of things, this pension payout looks pretty good to me. I also just want to spend a second talking about that health insurance. No, we do not want to go without health insurance for ourselves or for our children. Your 22 year old daughter, who just graduated from college, should make an effort to look for a job that gives her health benefits, so that you don’t have to worry about that. And the one who’s in college should look at what sort of plan is offered through that college or university, which may be much less expensive than the one that you’d be able to add her to or buy for her if you are in a situation where you’re shopping for your own coverage on the exchange. Either way, job number one is to look for a job while you have a job and to understand that even if you don’t find a job that is exactly what you were doing now or at exactly the same level of salary that you have now, you’re buying yourself time that these pension assets and 401k assets and social security can continue to grow. So I hope that that’s helpful. I know this is coming at a bad time for you Sue Ellen, but I think that you’re going to be just fine.

Kathryn Tuggle: (37:36)

I agree.

Jean Chatzky: (37:37)

Yeah.

Kathryn Tuggle: (37:37)

She’s asking all the right questions, which is great.

Jean Chatzky: (37:39)

Yeah, and it’s really hard. I mean, I know of a number of people whose employment situation has changed during COVID. It is rough. But people are getting hired. And we recently had Kathy Murphy on the podcast. She pointed out Fidelity, our sponsor, is hiring 4,000 people. So if customer service work is work that you think that you might want to do, that’s just one place to look. But if you are in a position where you can take the skills that you’ve gathered in your current job and just apply them in a company that is actually hiring, you should be okay.

Kathryn Tuggle: (38:15)

Absolutely. Thank you, Jean, for the great guidance.

Jean Chatzky: (38:17)

Thanks Kathryn. In today’s Thrive, on HerMoney, we talk a lot about staying the course and not getting spooked during times of market turmoil. But have you heard that your nerves can cost you up to 5% a year in investment returns if you’re not careful? Behavioral finance experts at Oxford Risk, which is a London-based risk management software firm and consultancy, figured out just how costly it would be to heed the advice of your inner-panic voice. They calculated that increasing your allocation to cash can cause investors to underperform their less panicky peers by an average of 4-5% a year. That range is what’s known as the behavior gap. It’s the difference between the returns we earn when we make rational investment decisions versus moves driven by emotion during times of stock market turmoil. Despite our complex brains, what too many people do when facing a financial shock is fairly predictable. Basically we act like scaredy cats, except instead of freezing with fright, we’re driven to take some action. The most common move is to overindulge in the investing equivalent of comfort food. Cash. We move our money out of the market and into a safe haven where we hang out for a while without worrying about the storm cloud over our heads. Now sure, we’ve de-risked our holdings. But we’ve exposed ourselves to other types of risks by rearranging our portfolios. That’s how we end up under-invested in certain sectors, and lacking the proper diversification to provide a good balance of growth and stability. Another risk is getting too comfortable with money sitting in cash. Just ask any investor who was still sitting on the sidelines when the March stock market crash did an about face. There is nothing wrong than realizing that you did the exact opposite of buying low and selling high. Fortunately, there are several universal actions that can help investors avoid sabotaging their own returns during times of turmoil. We’ve got a whole list of them up at hermoney.com. But here are just a couple. First, don’t turn paper losses into real losses. Until you seal the deal by selling out of investments, your losses are only virtual. Give them time to recover, especially if you don’t need the money in the next five to 10 years. Similarly, keep putting money into your 401k or other workplace retirement plan. And second, remember that the investments on the news aren’t your investments. Long-term plans should be looked at through long-term lenses. Staying glued to the ticker tape and every market update serves no purpose other than to increase your anxiety. Even if the companies you own are making news, remind yourself, they’re just part of your overall portfolio built with a long-term strategy in mind. Thanks so much for joining me today on HerMoney. Thank you to artist Mary Engelbreit for brightening our day with her insight and her art. I’m so glad she could come along. If you like what you hear, I hope that you’ll subscribe to our show at Apple Podcasts. Leave us a review. We love hearing what you think. We’d also like to thank our sponsor, Fidelity. We record this podcast out of CDM Sound Studios. Our music is provided by Video Helper and our show comes to you through Megaphone. Thank you so much for joining us and we’ll talk soon.