It’s been about a year since the HerMoney team last spent a real day working together at our HerMoney offices in Times Square. Like thousands of other companies around the world, when COVID hit, we had to pivot. We had to evolve quickly, reinventing what we once knew about our careers, take what we’d been handed and try to make the most of it… And everyday, I think about just how lucky we are, that we were able to make the transition, that we’re all healthy and working together successfully via Zoom, email and Slack, making HerMoney happen from the comfort of our homes.

There are countless other companies that had to pivot during this strange season, and, perhaps more importantly, millions of individuals who had to not only pivot, but also reinvent their individual careers. Over the last year, so many people found themselves in need of a change — perhaps a drastic one — in their own working lives.

If your industry shut down, or if your company experienced layoffs, you may have been forced into rethinking what you wanted the next 20, 30, even 40 years of your working life to look like… Or perhaps COVID just helped you reprioritize what was most important to you — and you realized that your job was Just. Not. It.

Of course job transitions are nothing new — 49% of people report that they’ve made a major career change at some point. But COVID has directly impacted how people are entering — or re-entering — the workplace, and has accelerated many career and hiring trends that have been building for the last few years. Yes, it’s a strange time to get hired, but companies are hiring… So, what should you do if you’ve recalculated and you’re looking for a new gig?

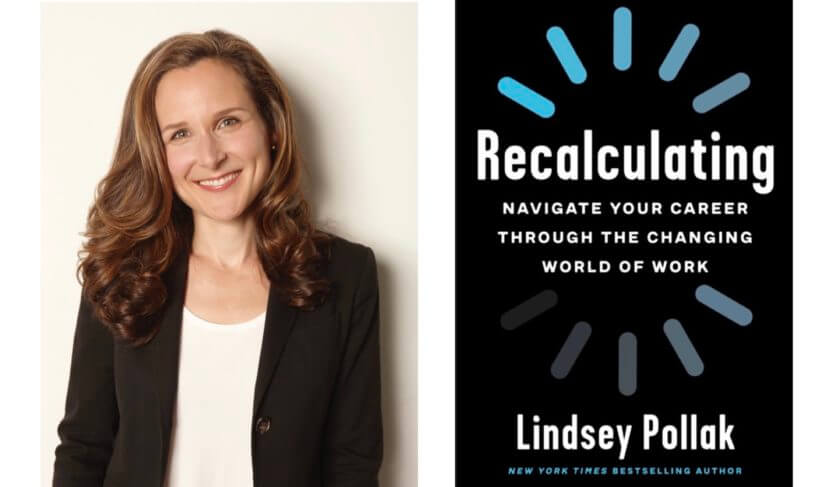

Lindsey Pollak, New York Times bestselling author and one of the world’s leading career and workplace experts, has answers for us in this week’s episode of the HerMoney Podcast. Her new book, “Recalculating: Navigate Your Career Through the Changing World of Work” just hit bookstore shelves this month, and offers so many important takeaways for career changers and transitioning professionals looking to thrive in today’s rapidly evolving workplace.

Listen in as Jean and Lindsey discuss how job seekers of all generations and skill sets can learn how to adapt to this “new normal,” and all the ones that will (inevitably) come after it. Because in an era when so much seems uncertain, it’s not always easy — or comfortable — to adapt + change + pivot.

Lindsey reviews some of the biggest changes in workplaces nationwide since COVID. In addition to millions of us working from home, we also have an increased reliance on virtual communication and automation, there’s renewed employer emphasis on diversity, equity and inclusion, and there’s been a distinct expansion of the “gig” economy and alternative employment options. In other words, even if you didn’t make a career shift, it’s likely that, in a way, you reinvented your career.

The pair discuss what the first steps should be for anyone who’s reinventing their career, whether they’re interviewing for a new job, re-entering the workplace, or pivoting in their career. Lindsey also addresses how we can all network effectively while we’re all living in this virtual world, and how networking may change in the years to come. And networking is a big piece of the puzzle for job seekers — an estimated 70% of jobs are found through networking, according to Lindsey’s book. But what does that look like in a world where there are no conferences and happy hours?

“You’ve really got to take that step — even if you’re networking — to put yourself out there and apply. Control what you can. You can’t control the job market. You can’t control whether a company hires you or not. But you can control how many people you network with. You can control how many applications you submit, how many events you attend, so try to focus on the areas where you can actually move the needle. You’ve got to put the applications out there,” she explains.

Jean and Lindsey finish their conversation with the top tips for success for all career “recalculators” and discuss some dos and don’ts for LinkedIn and social media in general.

In Mailbag, Jean and Kathryn hear from a listener who is a year away from retirement and has questions about a strategy for drawing down her savings. We also hear from a listener who is curious how she should look at her and her partner’s retirement savings… Is it all “ours”? And in Thrive, how women over 50 can secure their financial future as retirement comes into view.

READ MORE:

- 6 Things You’re Unintentionally Doing (Or Saying) In The Workplace That Could Be Holding You Back In Your Career

- What My Dream Retirement Looks Like: A Career I Love

- Everything You Need To Know To Build A Freelancing Career Now

- How Women Over 50 Can Reclaim Workplace Confidence And Power

JOIN US! Our best money and life advice delivered to your email box for free each week. Subscribe to HerMoney today.

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Transcript

Lindsey Pollak: (00:01)

You’ve really got to take that step even if you’re networking to put yourself out there and apply. Control what you can. You can’t control the job market. You can’t control whether a company hires you or not. But you can control how many people you network with. You can control how many applications you submit, how many events you attend. So try to focus on the areas where you can actually move the needle. You’ve got to put the applications out there.

Jean Chatzky: (00:29)

HerMoney is brought to you by Fidelity Investments. Celebrate Women’s History Month with Fidelity. Join us for marquee virtual events and get resources for a healthier financial future. Learn more at Fidelity.com/HerMoney.

Jean Chatzky: (00:44)

Hey everyone. I’m Jean Chatzky. Thank you so much for joining me today on HerMoney. It has been about a year -a year since my team and I last spent a real day working together at our HerMoney offices in Times Square – which is so hard for me to wrap my brain around. But like thousands of companies around the world, when COVID hit, we just had to pivot. We had to evolve quickly, take what we’d been handed and try to make the most of it. And believe me, every day I think about just how lucky we are that we were able to make that transition, that we’re all healthy, that we’re working together successfully via zoom and email and Slack, and that we’re able to make HerMoney happen from the comfort of our homes. There are so many other companies that had to pivot during this strange season, and perhaps, more importantly, millions and millions of individuals. Over the last year, so many people found themselves in need of a change, perhaps a drastic one, in their own working lives. If your industry shut down, or if your company experienced layoffs, you may have been forced into rethinking what you wanted the next 10 or 20 or even 30 years of your working life to look like. Or maybe COVID just helped you reprioritize what was important to you and you realized that your job was just not it. Of course, job transitions are nothing new. 49% of people report they have made a major career change at some point. But COVID has directly impacted how people are entering or reentering the workplace, has accelerated many career and hiring trends that have been building for the last few years. Yeah, it is a strange time to get hired, but companies are hiring. So what should you do if you’ve been among those who have recalculated, recalibrated, and you’re looking for a new gig? Here to walk us through is Lindsey Pollak. She is a New York Times bestselling author, and one of the world’s leading career workplace experts. Her new book, “Recalculating: Navigate Your Career Through the Changing World of Work,” just hit bookshelves yesterday. We are so glad she’s here with us with some advice for career changers and transitioning professionals. Lindsey, welcome.

Lindsey Pollak: (03:17)

Thank you so much for having me.

Jean Chatzky: (03:20)

So I have to ask, because this book seems so perfectly timed, when did you decide to write it?

Lindsey Pollak: (03:28)

You know, I didn’t mean to. My last book came out just two years ago, and I usually wait a long time. I say it’s like my accidental fourth child. I was sitting in my apartment in New York. It was May, 2020. My speaking business, I’m a professional speaker, had gone from fully booked calendar to exactly zero bookings. And I remember looking out the window thinking, what am I going to do? And I’ve always written books that I wish I had had. My first book was called “Getting From College To Career.” I was like, what am I supposed to do? I’ll write a book about it. And honestly, it was born out of, what am I going to do? And I literally looked out the window and saw cars. And I had this image of when your GPS says recalculating. You can’t keep going the way that you’re going. You have to find another way. And that’s how the book was born.

Jean Chatzky: (04:15)

I think that we are all a little sick of hearing the words, the new normal. I am certainly sick of saying them. But in the book you write that job seekers of all generations and skillsets have to learn how to adapt. So what is this new normal exactly?

Lindsey Pollak: (04:34)

You know, it’s not a brand new normal. To your point that you said earlier, it’s an acceleration of trends that had already started, that are now happening so much faster than we anticipated. So the very rapid decline of certain industries, increased automation, more people going into the gig economy and not having full time jobs with benefits, people working longer and later into their lives, people being forced to switch careers multiple times, people deciding not to go to college because of the cost. So we saw these trends going up, but they accelerated at light speed when the pandemic started. So none of it is a surprise, but the speed of it is what’s throwing people off.

Jean Chatzky: (05:23)

You’ve also mentioned a number of things in the book that have been just changes in workplace in general, across the country, sometimes across the world, since COVID. And not just working from home. But you talk about this increased reliance on virtual communication. We should tell people that before we started taping this podcast, Lindsey and I were just talking about how we do so many webinars, like so many webinars. But this is part of it. There’s also constant disruption. There is renewed employer emphasis on diversity and inclusion and equity. There are a whole array of employment options that we didn’t have before. Can we just unpack those a little bit and talk about what they’ve meant to how we live our lives today?

Lindsey Pollak: (06:15)

You know, it’s an acceleration, but it’s such a personal one. So if you just take remote work. Yeah. I worked from home once in a while before. But now that I’ve been doing it nonstop for a year, I have much stronger feelings about it because, you know, I know what it’s like. And sometimes, in a way, you don’t really know how you feel until you’re absolutely thrust into something. So I think it’s a myth to say everybody now wants to work from home because it works. I know plenty of people who really want to go back to the office. I know people who never want to go back to the office. I know people who said, you know what, the George Floyd and Brianna Taylor murders forced me to decide that I only want to work for social justice, and that’s going to be the most important thing that I do for the rest of my career. I want to start a business or I want to get out of having my own business and have a secure paycheck. So I think just as the bigger trends in the marketplace have accelerated, our own personal feelings about work have accelerated because we’ve been in the most extreme version of whatever our particular work situation has been. So everybody has very strong opinions about what they want moving forward.

Jean Chatzky: (07:22)

Yeah. I mean, I can remember,, going into COVID, how relieved I was not to have to get on the 53 minute train into Manhattan. And this morning I drove to the post office, which is located at the train station, to just drop off a package. And I was thinking like, I would really like to get on that train. Like I would just, I would like to get on the train. I would like to read my newspaper on my phone. I would like to talk to my train friends who I haven’t seen because I have a whole set of train friends. I mean, it’s been, you’re right. It’s thrust us into this position where it’s just not a choice anymore. And that’s hard to deal with. Recalculators. Who are they? Who falls into the bucket of somebody who’s recalculating?

Lindsey Pollak: (08:05)

Everybody. I think the message of COVID is, nobody can coast. And I was really intentional on not using a word like career changer, right. Or career pivoter. Because that sort of implies that you’re at a fork in the road and you make a turn and you start going in that direction. Recalculating to me is more this constant reenergizing. reskilling, keeping up with the times, making sure that you’re never not paying attention. And I don’t mean it to sound exhausting because I know that can sound very exhausting. But you have to keep up with what’s happening in the world. And you can never say, well, that’s it, I’ve learned enough. And when I looked at the people I really admired over the course of time, it doesn’t even have to be in 2021, but it’s the people who never said, well, you know, I’m kind of here and I’m just going to hang out. It’s the people who are always looking for the next opportunity, looking to meet new people, looking to learn new things. And so I think the people who have been successful over time have always been recalculators. We probably didn’t use that word. But it’s about never coasting, never sitting still.

Jean Chatzky: (09:10)

So if you are somebody who’s listening and you’re thinking, okay, I wasn’t thinking of myself as being in this phase of my life. But I guess Lindsey says I am. So I’ll accept that. What’s the first step?

Lindsey Pollak: (09:25)

So the first step is embracing creativity. I have what I call five rules for recalculators and that’s number one. Which is, you have to look at the bigger picture. You have to cast a wider net. You have to think about what else is out there and just think of it from like a networking perspective. And I’m glad you brought up diversity and equity inclusion. I think it plays into that. If everybody I know looks like me and lives in my city and is about my same age and it might industry, I’m not going to see the next trends coming. And I’m also going to have a pretty kind of boring career. You know, I remember talking to a woman about these issues years ago. She said, well, I don’t really need to build my network. I don’t need to learn more. I’m so happy in my company. It’s a great place to be. I don’t need to make any changes. And the company was Lehman Brothers, right? You never know what’s coming down the path. So again, I don’t mean to say that you have to be constantly moving all the time, but the more diverse your network and your thinking and just sort of your innovation, I think the more successful you’re going to be over time. And frankly, the happier, because you won’t get stuck, which is where nobody wants to be.

Jean Chatzky: (10:29)

I know there’s some incredibly creative people who feel like we’re constantly throwing spaghetti against the wall. I mean, I sometimes think I have too many ideas. And I need to not, you know, you can’t embrace them all. So as you are trying to recalculate, how do you figure out which of your ideas are really good ones and which of them should be discarded and discarded quickly?

Lindsey Pollak: (10:56)

I probably need the same advice because I’m the same way. I’m always trying lots of different things. I would probably say that habits are a really big piece of that. So if you have an idea, is there a certain group of people that you always talk to about it. A sort of personal board of advisors. Maybe that’s always your first step and that weeds out some of the ideas. Maybe your second step is that you do the first action that would be related to that idea and you see if it builds momentum. So I think it’s really starting with baby steps. I’ve never, ever been a fan of jumping off of cliffs, mostly because I’m just a risk averse person. But I would say, I worked at workingwoman.com in the late nineties, early two thousands. And that went out of business. I joined Working Mother. And I worked five days a week and then four days a week and then three days a week and then two days a week, to start my own business. I just tiptoed. And so I think sometimes if you take the smallest step possible towards an idea, you say do I want to take the next step or not. So baby steps for all of your ideas and then see what grows.

Jean Chatzky: (11:58)

I love that. What are the other rules for recalculators? I don’t want to make you give away the whole book, but what are the other ones on your hit list?

Lindsey Pollak: (12:06)

Probably my favorite, happens to be number five, is ask for help. This is a lot. And this is incredibly tough year. You know, that kind of goes without saying, but we can’t say it enough. You’re not alone. And there are so many people and podcasts and webinars and books and organizations. My favorite that I always shout out is, no matter how long ago you graduated, you can go back to your college or university career center and get help with prepping for zoom interviews, or figuring out how to develop a LinkedIn profile. There are so many resources, more than ever before, to help you through this process. And one of the facts I came across was that, in the early days of the pandemic, one of the top searches on Google was how can I help. People want to help each other. People want to help each other. And if you’re uncomfortable networking, maybe you’re introverted. You don’t like reaching out and asking for help, then offer help, right? That’s a form of networking too. So I just think this, you know, because we’ve been so separated, I just think there’s a craving for people to support each other. And I’m hoping there’ll be kind of a renaissance of networking and relationship building. Use that to your advantage and ask people to help you. There’s so much support out there.

Jean Chatzky: (13:14)

Yeah. And while we’re talking about people who are helping and who in particular want to help women, let me just talk for a second about our sponsor. HerMoney is brought to you by Fidelity Investments. Harness your economic power. Join Fidelity’s Women Talk Money pop-ups for tips on a healthier financial future. Earlier this month, I spoke with Dr. Romie Mushtaq about improving your financial wellness in good times and in bad. And today on March 24th, former HerMoney guests, Eve Rodsky and Tiffany Dufu will share how to use healthy money habits to create the life you want. Learn more or watch event replays on demand at Fidelity.com/HerMoney. I’m back with Lindsey Pollak, author of “Recalculating: Navigating Your Career Through the Changing World of Work.” We’re talking career transitions and pivots, and the importance of reinvention, especially in times like these. What are your best networking strategies while we’re all living in this virtual world?

Lindsey Pollak: (14:23)

So I’ve always been a fan of informational interviewing, which is basically reaching out to people and saying, hi, do you have 15 minutes to give me some advice about my career? I think alumni networks are super powerful. Everybody is connected. I came across this stat that the average person knows 150 other people at minimum. So this is your friends, your family, people you went to school with, coaches, neighbors. Just reach out and say, hey. It’s been a tough year. Hope things are going well. I’m looking for a job. Do you know anybody or do you know anyone in this industry? So just have those casual conversations every day, all the time. And then sort of a random tip, which I love is, my colleague, Chelsea Williams said she’s doing a ton of networking on free webinars. She said, she goes on Eventbrite. She types in whatever is interesting to her. It could be jobs in financial services, daycare jobs, whatever it is that you’re into. And then type the word free. And there’s probably somebody giving a webinar on that topic. And in the chat, people usually introduce themselves and say, hi, I’m here because I’m looking for a job. Hi, I’m here for this. Share your LinkedIn profile. Tell people what you’re looking for. There are all these kinds of new ways to just form connections. And the only thing it takes is that you have something in common. So whatever your connection point is, even if it’s happening to be in the same webinar, is a really powerful way to meet other people. Just ask for a quick conversation and that’s networking.

Jean Chatzky: (15:46)

Do you find Clubhouse a good place for networking?

Lindsey Pollak: (15:50)

So I’ve joined Clubhouse. I’m @LindseyPollak. I’d love to know Jean, if you’re on there. I have mixed feelings about clubhouse so far. I like it because it’s a great way to find people with similar interests, just like Twitter was in the early days. So if you join a club or a discussion room about personal finance, you’re going to find other people. And I’ve found a lot of people will bring that conversation off to LinkedIn or wherever. I was just in a clubhouse room about career development. And I went to graduate school in Australia at a super obscure school called Monash University that nobody has ever heard of in the US, and there was a woman there from Monash University. And we connected and connected on LinkedIn. So what I’d say about clubhouse is the same thing I would say about Twitter or Facebook or anywhere. Make the connection there, but then bring it to another level separately, maybe on LinkedIn or through a phone call. Establish the relationship, meet someone, but then have the conversation about career development elsewhere. What do you think about Clubhouse so far?

Jean Chatzky: (16:46)

I’m lurking so far. I haven’t participated that much. I’m listening. But I think it’s going to be interesting. I’m going to start talking shortly. I’ll get there.

Lindsey Pollak: (16:58)

I love it. I look forward to listening to you.

Jean Chatzky: (17:00)

You’re talking a lot about LinkedIn. We did a whole show about building your LinkedIn profile and how to do it right. We know that the volume of searches using the remote filter on LinkedIn has gone up by about 60% since March of last year. Do you think that’s something that’s likely to continue? Do you think you hurt yourself if you apply it?

Lindsey Pollak: (17:21)

I think you have to decide if that is your top priority. So if you are absolutely positive and it is non-negotiable that you want a remote job, then I think you should go all in. And I actually interviewed someone from LinkedIn who said, if you put it out there and that’s what you want, and that’s what an employer wants, you’re going to have a better fit. I think if you’re considering remote among other opportunities, I would not put it there, because it might rule you out of other situations. So it really depends on your commitment to remote possibilities. I would also say, just as something to keep in mind, a lot of companies I think are still very undecided about what they’re going to do with their workforce. And they might say remote today and change their mind tomorrow. So just keep in mind that some of those opportunities might be a little bit more short term than you might realize. And there might be some changes happening as more people get vaccinated and companies start to see what really happens when they bring people back to the office.

Jean Chatzky: (18:12)

So for the people people who are listening right now who are job searching, and we know there are a lot of women who have been displaced in this pandemic, it’s easy to get discouraged. What are your top three tips to keep it going?

Lindsey Pollak: (18:29)

Number one is it’s okay to feel discouraged and to be sad and to be angry. I was annoyed and upset when Working Women went out of business. I liked that job and I had to mourn it for awhile. So it’s okay to be frustrated and feel it and take care of yourself. So, number one, I think is always self care. Number two is action, action, action, action, action. I can’t tell you how many career experts said that when they start coaching a job seeker who’s really frustrated, they say, well, how many jobs did you apply for today? And they say, none. Well, how many have you applied for overall. Two. It might take hundreds of applications. So I think getting in the mindset that this is a marathon, not a sprint. And I’m not saying it’s fun. And I’m not saying it should require dozens and dozens of applications. But you’ve really got to take that step, even if you’re networking, to put yourself out there and apply. And the third piece I would say is, control what you can. You can’t control the job market. You can’t control whether a company hires you or not. But you can control how many people you network with. You can control how many applications you submit, how many events you attend. So try to focus on the areas where you can actually move the needle. I think the biggest mistake people make is they sit home and they wish, and they wonder, and they worry, and that’s not going to get you a job. So my rule of thumb is you will not get 100% of the jobs you don’t apply for. I guarantee it, you’ve got to put the applications out there.

Jean Chatzky: (19:49)

And I think you can network through LinkedIn rather than, my husband is a career coach. And he always says he would rather see people put their energy into making connections with people at three companies where they really want to work, rather than just dumping resumes into those easy apps that they offer you the opportunity to just click on, on some of these job sites. Because if you make it connection, at least there’s somebody to help surface your resume.

Lindsey Pollak: (20:22)

And you have to do both. You know, I think this is also important that, while you’re networking with those three companies or however many you decide to apply for, you also have to go through the steps of applying on their website and through their process. Because it’s a whole lot more powerful to say, hey, Jean. I’m applying for a job at this company. Could you make an introduction? I’ve already submitted my application. Then saying, well, I’m just kind of looking into it. Now you’re showing your commitment. And that’s really powerful.

Jean Chatzky: (20:48)

If you were a woman working in travel or hospitality or restaurants or so many other fields that have just seen a complete collapse, you may be looking at not just recalculating, but Uber-recalculating, a complete and total reset. What do you say to those women?

Lindsey Pollak: (21:10)

So there’s a lot of research on what’s called changing lanes, which is, of course I love the recalculating car metaphor, which is that you’re never actually starting from scratch. There are so many transferable skills from one industry to another. Do not think that you have to start over. I really recommend taking a career assessment test to see what are those transferable skills that can port from one career to another. And just to give you one example, I spoke to a guy who worked in restaurants. And of course that was a no-go during COVID. He was a chef and he was a little bit tired of it anyway. He went back to his college career center to say, what else can I do? And what turned up from a career assessment is that he had tremendous skills in logistics, because he had ordered all the ingredients and done all of the logistical work of running a restaurant. He took a one credit class and switched to a great job in logistics, which was a growing field. So sometimes you’re further along a change than you think, but you have to be able to identify what those crossover skills are.

Jean Chatzky: (22:09)

Are there any particular career assessment tests that you like and a good place to access them,

Lindsey Pollak: (22:16)

You can always go to your college career center and most of them will offer a free assessment. I also work with a company called Cappfinity that offers what’s called the strengths profile. If you go to my website at lindseypollock.com/SP for strengths profile, I have a free assessment offered by Cappfinity.

Jean Chatzky: (22:33)

Awesome. Lindsay, great information. Really, really helpful and necessary information, as we are all dealing with this right now. Tell me just a little more about where we can find you.

Lindsey Pollak: (22:48)

My website is my name, LindseyPollak. I am on Clubhouse along with LinkedIn and the other networks that we’ve talked about. And Recalculating is available wherever you like to buy your books.

Jean Chatzky: (22:59)

Thank you so much. I hope to talk to you again soon.

Lindsey Pollak: (23:01)

Thank you.

Jean Chatzky: (23:03)

And we’ll be right back with Kathryn and your mailbag.

Jean Chatzky: (23:09)

I’m back with HerMoney’s, Kathryn Tuggle. Hey Kathryn.

Kathryn Tuggle: (23:13)

Hey Jean. I loved that show.

Jean Chatzky: (23:15)

I thought it was really fun. Although I have to admit that as soon as she made the car reference, every time she said recalculating, or I said, recalculating, I didn’t hear it in my voice or her voice, I heard it in the voice, you know, Miss Magellan, or whoever’s the person who speaks to me in my car.

Kathryn Tuggle: (23:32)

I loved the origin story of that because, how many times have we all taken a wrong turn and heard that voice. But it makes so much sense. Because that’s exactly what we are doing when you do take a wrong turn, whether it’s your fault or whether it’s absolutely no fault of your own, you have to recalculate.

Jean Chatzky: (23:53)

Yeah. And I think she’s right that it’s universal. I mean, I really did not think of myself as recalculating before this conversation, but she’s right. I’m having these discussions in my head all the time. Are we going to get another office? Do we want another office? Who would actually go to the other office? You know, all of these things. And about the business that we’re in as well. I mean, it’s a constant, you’re on this ride with me so you know. But it is a constant feeling of maneuvering.

Kathryn Tuggle: (24:27)

It is. It is. There’s changing tastes. There’s changing workplace environments. There’s changing needs. As you were saying with the webinars, you know, it used to be you’re always giving keynote speeches in person. Now there’s so much digital. And when will it go back to normal? Will it ever go back to normal? And what is normal? We are all recalculating every single day in countless ways.

Jean Chatzky: (24:54)

Absolutely. And so are our listeners, which is why I want to make sure that we answer their letters. So why don’t we turn to those.

Kathryn Tuggle: (25:01)

For sure. Our first note comes to us from Laverne. She writes, hi Jean. I look forward to Wednesdays to hear the weekly HerMoney topic and listen on my Wednesday walks. I’m 62 and plan to retire this year, just before my 63rd birthday. My goal has been to save $1 million on my own, and I now have approximately $970,000 in retirement, brokerage and savings accounts. I’m married and my husband has about 2 million in retirement and savings accounts and he’s already retired. My husband also has a few pensions that pay approximately $3,500 a month. We do have estate planning documents. We plan to proceed paying our expenses, as we have for many years, proportionately. We each pay toward insurance, car and household expenses. We recently sold two rental properties and paid off our primary residence, which is valued at just over 2 million. We are blessed. Living on the east coast in New Jersey, our property taxes are astronomical – over $40,000 a year. Therefore we plan to sell our home and either move elsewhere or into more affordable housing in New Jersey. I think that, when we do, our monthly expenses will be around 10 or $12,000 a month. Last year, we had our assets and expected expenses evaluated twice to determine retirement readiness. Both times we were told that we are prepared. But here are my concerns. How should I draw down funds from my monthly expenses? I don’t plan to take social security until 66. And I plan to limit spending to 4% or around $40,000 a year, until I collect social security. Then I plan to draw down 30 to $35,000 each year. Also until I qualify for Medicare, I will need to pay for my own health insurance. This will be for about two years. What should I do about long-term care? Any resources to recommend? Also, how should I invest retirement funds that are now in target date funds, once I’m retired. Thank you so much.

Jean Chatzky: (27:03)

So Laverne, I think the next chapter of your life sounds incredibly exciting. And I am so glad that you and your husband have gone through the retirement readiness calculations and that you have been told that you qualify. And it sounds to me like you absolutely do as well, particularly once you make those tweaks in your living, like moving to eliminate those property taxes, or at least dramatically reduce them. I was rolling my eyes as Kathryn, read your letter because I live in a place with extremely high property taxes too. And I know that moving is going to reduce the amount that we are paying as well. It’s one of the things that we’re looking forward to in the near future. You put your finger on a really interesting question. And that is, we are all told to spend so much time accumulating, accumulating, accumulating for retirement, and far less making our money last through retirement. And when you talk about drawing funds down for your monthly expenses, you’re talking about the science of decumulation. And it is as crucial a process as the accumulation phase. And so my answer to you is not going to be a one word answer. I think you put a lot of thought into how do I invest my money for retirement? How much do I need to save a year to get you to the point where you are at that million dollar level? Your husband did too. You clearly did it with your rental properties. And so, although you are very obviously familiar with the 4% rule, which says that if you withdraw no more than 4% of your money a year, that money should last you for 30 years, I think you need to have a sit down with a financial advisor to talk about this Uber discussion of how are we going to withdraw. How much money do we need to keep in safe havens so that the rest of our money can grow, but we don’t have to worry about the assets that are sitting in bonds or other safer places, being able to carry us through some volatility in the markets? How should we invest those funds that are now in those target date funds? What’s the asset mix that makes sense for us. I don’t want to just spit ball an answer for you here. I’d like to see you and your husband sit down and plan out how you are going to actually manage those withdrawals. There are a lot of tax considerations that come in here as well. And you’re going to want to make sure that you deal with those as you deal with your distributions from your retirement accounts. So I know me sending you back to the financial advisor is not exactly what you were looking to hear. If you don’t have a financial advisor, go to HerMoney.com, fill out our questionnaire. You’ll see it at the very top of the page. And we will happily, and for free, tee up the names of a few financial advisors that you can talk to, that you can interview, and that you may want to consider working with. As far as the long-term care question, at age 62, you’re a little bit past the age at which we suggest buying long-term care insurance is optimal. If you’re healthy, you may still be able to get it, but it may be very expensive. I want you to get a couple of quotes for long-term care policies. You can get one for a traditional policy, get one for a hybrid policy, that’s perhaps a life insurance policy with a bucket of long-term care benefits. And then weigh that against the cost of investing and then funding your own care down the road. Lastly, you mentioned pensions. And pensions, in addition to social security, will provide you with a guaranteed paycheck that will carry you through your retirement, will carry your husband through retirement. But I want you to look at, in particular, whether you have enough in guaranteed sources of income to cover what you believe will be your fixed expenses in retirement, that 10 to 12,000 per month. I like the idea of knowing that that amount of money is going to come in no matter how long I live, and no matter what happens to the other investments in my portfolio. And in my case, I plan on, down the road, converting some assets from my retirement accounts into streams of income that will ensure for that. It does ask that you perhaps give up some returns on the side of being aggressive in the markets, but it is something that would make me feel more comfortable. And it’s something that I think that you should consider as well. But good luck. I hope that it goes well. And if you have any additional questions about finding an advisor or reaching out to somebody in the network that we can hook you up with, please let me know.

Kathryn Tuggle: (32:57)

Thank you, Jean. Laverne is asking all the right questions. And the amount of saving that she and her husband have done is so wonderful. But you’re totally right that decumulation is just as important.

Jean Chatzky: (33:09)

Yeah. It’s so wonderful. And she didn’t even mention if those two rental properties were included in her calculations. And if they’re not, they are sitting very, very pretty.

Kathryn Tuggle: (33:20)

Absolutely. Our next note comes to us from Katie. She writes, hi Jean. You and Kathryn timed the collegiate episode perfectly for February as all the parents of seniors are dreading the final arrival of numbers. We went out and got Ron Lieber’s book this past weekend and are working through it now. As my husband and I began to look at our different buckets of college savings, I began to wonder. How should you look at your own and your partner’s retirement savings. In theory, after 20 good years of marriage, it’s all ours. But is it wiser to look at it separately as his and mine. To complicate matters, when I returned to the workplace after staying home with my children, which was my choice, the savings from my transitional part-time role, went into a Roth that I mentally earmarked as the principal being for college and any gains being for retirement. We’re also going to have this Roth and spending discussion with our financial advisor, but I’d love to hear your thoughts. For context, here’s some of our numbers, we’re 50 and 49 years of age. The children are 18, 14, and college bound. 529s, we have about $46,000 and $40,000. His retirement total is nearly $500,000 with earnings around $160,000. My retirement totals are about $162,000, but I also have a small government pension and plan to be vested in my current one. As a portion of the numbers above, my Roth has grown to about $66,000. My husband also has one at $25,000. I’m not sure where the principal versus growth breakouts are. To the oldest child’s credit, he’s been listening to us discuss money and debt, and he said, he’d like to not touch his 529 if possible, because he plans to attend law school. But not touching the 529 now, makes the small private school a harder reach, which of course the FAFSA calculations say we should be able to completely afford out of pocket. And that might be right, but only if we completely stop saving for retirement, which brings me back to my original question that you guys answered for me in episode 226. If we’re looking at retirement target multipliers, like having six times your income at 50, is that as a household or as an individual? Is it gross income or net? In researching on some sites, It looks like that benchmark is based on starting wage, not current. With growth and no additional principal, together we should get to 1 million before our 60th birthdays. So touching some of the Roth may not be an issue. I’ve also wondered if we, or just he, or just I, should stop saving for retirement in hopes of just cash flowing college these next eight years. In a year of so many unpredicted events, I realize it’s tough to have a crystal ball. We’re so fortunate to have the money to even consider juggling and rearranging, but there still doesn’t seem to be a great right answer. Thanks for all you both do to educate us all.

Jean Chatzky: (36:21)

So let me just be completely honest, Katie. I don’t have a crystal ball. I know, you know, I don’t have a crystal ball, and there isn’t one right answer. I wish there was one right answer. There are different choices that you can make and they all have different outcomes at the end. But thank you for writing again and I’m happy to give you my thoughts on all of this. You asked some specific questions and you referred to the retirement benchmarks. The ones that I quote on this show are ones that were developed by our sponsor, by Fidelity. And for those of you who haven’t heard them, they go like this. By the time you’re age 30, you should be aiming to have one times your annual income put away for retirement. That is your gross income. By the time you’re 40, 3 times. By the time you’re 50, 6 times. By the time you’re 60, 8 times. And by the time you retire, 10 times. The numbers are based on your income at the time. So if you think about it, these are numbers that aim to help people be able to replace about 45% of their preretirement income. They were developed for a population of earners who make between $50,000 a year and $300,000 a year. But if you earn more, you’re going to have to replace more. And that’s why they are tied to your current income, not tied to your starting income. Because nobody wants to go back to living how they lived when you were right out of college, or when you were in your twenties. At least not somebody who’s gotten used to living on a lot more when they were in their fifties or in their sixties. As far as the question about whether it’s a household or an individual, it works for both, because you’re trying to replace your combined incomes and your combined household spending. And so I’d look at it. You guys are very close in age. You didn’t say where you are in salary. But you can add your incomes together and that’s the money that you live on and you’re trying to replace 45% of that. So that’s what you are benchmarking toward. In terms of these questions about pulling money out of the Roth to pay for college. I’ve always thought that the Roth is an excellent college savings vehicle because it allows you to get at that at that sort of money. And so, if you have run these calculations and you think you are going to be on track, and I don’t know your income, so I can’t really tell you if you are on track. But if you think based on these calculations, that you are largely on track, then pulling money out of the Roth to pay for college or to help pay for college seems to me to be something that makes sense. You can also run additional calculations where one or both of you doesn’t contribute or one or both of you doesn’t contribute as much, while your children are in college, in order to help cash flow through those periods of tuition payment. If you decide to do that, what I would encourage is for both of you to try to kick in enough to grab any company matching dollars, but then scale back on any money that you were contributing above and beyond that. That’ll allow you to get as much as you possibly can in terms of compensation in the form of these retirement dollars while perhaps taking a little bit off the table to put toward tuition. I hope that that’s helpful. Of course, the other piece of advice that I would have as you’re making these final college decisions, as so many people are now, is to call the schools. Call the financial aid offices at the schools that you are choosing between and ask if more is available. I talked to a set of parents just yesterday who had two schools on their bucket list. They picked up the phone, they called both schools. They said School B offered us more money than you did School A. Is there any wiggle room? And surprise, surprise. Another few thousand dollars materialized. So I would encourage you to do that as well. Lots of luck. Please write again. Please keep listening and thanks so much for being part of our community.

Kathryn Tuggle: (41:07)

That’s such a great point, Jean, about picking up the phone and just asking, because you never know.

Jean Chatzky: (41:12)

Yeah. I know Ron made that point very strongly when we talked to him, which was a wonderful conversation and a terrific episode. And I just think it can’t be repeated often enough. You gotta ask. You gotta ask. You gotta ask. It may not be comfortable, but you have to ask anyway.

Kathryn Tuggle: (41:29)

The squeaky wheel.

Jean Chatzky: (41:30)

Yes. A hundred percent. Thank you, Kathryn.

Kathryn Tuggle: (41:34)

Thank you, Jean.

Jean Chatzky: (41:35)

And in today’s thrive, finance for women over 50. How to reap the rewards and avoid the pitfalls. By 2028, women will control 75% of the world’s discretionary spending. And by 2030, they’ll hold 66% of America’s wealth. Today, 62 million American women are age 50 or older like me. And if you’re part of this demographic securing a solid financial future for yourself has never been more important. This week at hermoney.com, we’ve got a run-down on some of the most important things you can do to secure your financial future as retirement comes into view. First, make sure you’ve got that cash reserve going. All women, regardless of age, need an emergency fund that is accessible at a moment’s notice. The guidelines vary, but on average, you’re going to want to have at least six months of living expenses. According to some 2020 research by the Urban Institute, jobless women, age 50 to 61, are 18% less likely to find new work than those aged 25 to 34. While those 62 and older are 50% less likely to find new work. The value of an emergency fund became more clear in the last year when many Americans lost their jobs. It provides a cushion for all events that create financial stress. Second, understand how to capitalize on your longevity. Women continue to outlive our male counterparts. We hold the longevity advantage with a life expectancy of more than 80 years, 80.5 to be exact, compared with the life expectancy for men of 75.1 years. To prepare yourself for what will be a long and we hope very happy life, make sure you have the following as part of your financial plan. A current will, healthcare directives, durable powers of attorney and a plan to fund possible long-term care expenses. These are all things that you can discuss with a financial advisor if you’re looking to sit down with the one. Third, and maybe most important, don’t be afraid to invest. Time is an investor’s best friend. Statistics tell us it’s likely that a woman who’s 50 today will live another 30 years. If she supplements her retirement income with distributions from an investment portfolio, she’ll need a long lasting investment portfolio. Stocks are a great choice for longevity-oriented investment portfolios because they offer the potential to outpace inflation, provide current and future income and appreciate over time. They are a no-brainer when working on securing your financial future. The financial outlook is bright for women 50 and older, but the woman who is most prepared for her future is the woman who will reap the most substantial rewards in the years to come. Thanks so much for joining me today on HerMoney. Thanks to Lindsey for walking us through the many ways that we can recalculate during these strange times. I hope you are able to take some action steps away from this conversation. If you like what you hear, please subscribe to our show at Apple podcasts. Leave us a review. We love hearing what you think. We also want to thank our sponsor Fidelity. We record this podcast out of CDM Sound Studios. Our music is provided by Video Helper and our show comes to you through Megaphone. Thanks so much for joining us and we’ll talk soon.