When’s the last time you got a bargain? And, no, those Old Navy flip-flops you just scored for 30% off don’t count. This week, we’re talking about getting bargains on BIG purchases, and diving into how to buy a car, how to buy a house, and so much more. When was the last time you walked away from a big purchase feeling like you got a deal you could be proud of?

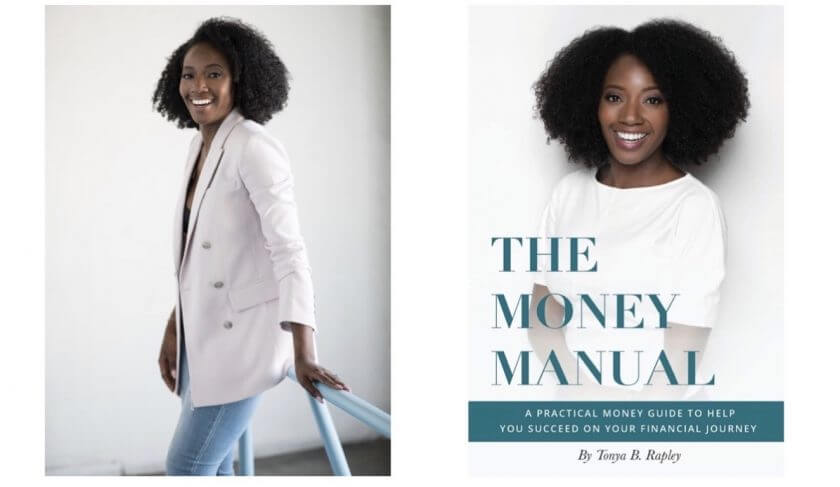

The ability to negotiate is an integral part of our overall financial health and wellbeing, as is the discipline to turn our backs on something we want — when we aren’t offered the deal we need. Today, we’re sitting down to talk about what it looks like to make smart financial choices, particularly when it comes to big purchases, with money expert Tonya Rapley, founder and CEO of MyFabFinance.com and author of the Amazon bestseller, “The Money Manual: A Practical Guide To Help You Succeed On Your Financial Journey.” In college, Tonya worked as a car saleswoman, and she just purchased her first home and her first company, so there’s pretty much no one better to dive into the topic of “big life purchases” than her.

Jean and Tonya talk about what inspired her to become an entrepreneur, and how major milestones like Black Women’s Equal Pay Day (which just passed on August 13th) keep her going, and keep her moving the ball on her own important work.

The pair also discuss negotiation skills for all of life’s biggest purchases, as well as salary negotiations. Tonya shares the moves she made when she realized she was being paid less than a white colleague.

Tonya dives into some of the best deal-getting tactics she learned during her days selling cars, and tells us all how to buy a car, and, more importantly, how to get a bargain when we walk onto a lot. We talk dealer discounts, no-haggle lots, and the best times of the month (and day!) to pull the trigger. She also talks about the importance of knowing when to walk away, and how this may actually yield a better deal for you in the long run.

“When I was selling cars, we were willing to cut the most deals towards the end of the month. Because your car sales cycle as a car salesperson is monthly,” Tonya explains. “And so you’re trying to reach your quota at the end of the month, so the sales team is going to do what they can do, the management and everything, to make sure they move cars off the lot towards the end of the month. And then, buying in the evening, because everybody’s ready to go home. So a lot of times you can wear the sales manager down at the end of the night, or you can walk away at the end of the night because everyone’s tired, and they’ll call you back in two or three days with a better offer.”

Tonya also discusses her recent purchase of a house, and how she was able to negotiate for herself and her family through every step of the process. She and Jean also talk about how we can be our own best advocates when we’re investing, saving, browsing real estate, or anything else. She talks about how we can get over the nerves and anxiousness we feel when we’re about to pull the trigger on a big purchase, and Tonya shares her best piece of advice for women who may be car shopping right now.

In Mailbag, Jean and Kathryn talk about sticking with target date funds in retirement vs. branching out into other investments; whether to buy a home or condo when you’ve been living small and saving money for years; and if one of our listeners will really hit her $1M savings goal if she keeps on her investment journey. Lastly, in Thrive, Jean talks about options for what you can do if your company is reopening after a COVID-19 shutdown but you’re just not comfortable going back into the office.

SUBSCRIBE: Own your money, own your life. Subscribe to HerMoney to get the latest money news and tips!

MORE ON HERMONEY:

- Car Buying Experts On How To Save Big On Your Next Big Vehicle Purchase

- These Car Insurance Companies Are Paying Quarantine Refunds

- Car Deals Abound Amid The Pandemic. Here’s Where To Get Yours

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Transcript

Tonya Rapley: (00:02)

When I was selling cars, we were willing to cut the most deals towards the end of the month because your car sales cycle, as a car salesperson, is monthly. And so, you’re trying to reach your quota at the end of the month. And so, the sales team is going to do what they can do, the management and everything, to make sure that you move cars off the lot towards the end of the month. And then buying in the evening, because everybody’s ready to go home. And so, a lot of times you can where the sales manager down at the end of the night, or you can walk away at the end of the night because everyone’s tired, and they’ll call you back in two, three days with a better offer.

Jean Chatzky: (00:38)

HerMoney is supported by Fidelity Investments. During this uncertain market, planning for retirement is more important than ever. Not only can it make you feel better about where you stand today, you’ll be more prepared for tomorrow. Visit Fidelity.com/HerMoney to learn more.

Jean Chatzky: (01:00)

Hey everyone, I’m Jean Chatzky. Thank you so much for joining us today on HerMoney. So, when is the last time you got a bargain? Actually, don’t answer that, cause I am not talking about that Madewell 70% off sale that you just killed on your lunch break. Or the fact that everything at your favorite store seems to be perpetually 40% off. When is the last time you walked away from a big purchase, feeling like you got a good deal. A deal you could be proud of. The ability to negotiate and turn our backs on something we want, when we aren’t offered the deal we need, is so important. And the ability to do it is such an integral part of our overall financial health and wellbeing. Well, today we are sitting down to talk about what it looks like to make smart financial choices, particularly when it comes to big purchases with money expert, Tonya Rapley, founder of MyFabFinance.com and author of the Amazon bestseller, “The Money Manual: A Practical Guide To Help You Succeed On Your Financial Journey.” And Tonya is a recent big purchaser. She is joining us from her closet in her new home in Atlanta. But also we’re going to dig into the fact that when she was in college, she actually worked as a car saleswoman. So, so interesting. Tonya, I love your background. Thank you so much for being here. I mean, let’s just tell everybody you moved yesterday and you are still taking the time to call into this show. You are my hero.

Tonya Rapley: (02:46)

Thank you so much. Yeah, I’m not a stranger to moving at this point, but this is a friend of Jean. And so I was like, we gotta make this happen. So thank you.

Jean Chatzky: (02:56)

Oh, my pleasure. Tell me a little bit about My Fab Finance. What is the ethos of your company?

Tonya Rapley: (03:06)

You know, essentially it is to make individuals who previously felt overlooked by the financial services industry feel comfortable talking about money, and to give them a space, to discuss and learn about money. We serve an audience. Our audience is primarily women who are 25 to 44, college-educated Black women. And these are women who are generating incomes and they’re making money. Sometimes they’re in the position of being the most successful person in their family. Sometimes they are faced with caring for their families and their parents. And so, we meet them with those unique needs in mind.

Jean Chatzky: (03:47)

One of the things that I thought was so inspiring to me was when we were chatting before we did this interview. Black Women’s Equal Pay Day had just passed in August. And you said, this is why my work is important. Talk about that.

Tonya Rapley: (04:05)

It is, it is. I think it’s important for one reason, because it’s important for women, particularly Black women to see women who are making money and doing it well, to see other women who are doing it well, to have a sounding board to talk about their salaries with and so forth, and some issues they’re encountering in their workplace. So, the last job that I had before I resigned to become a full-time entrepreneur, I did not know that I was being underpaid until a Black woman who worked at the company pulled me aside and told me. And I had previously fought for the raise that I received and found out that a non-Black colleague of mine who had just graduated from college, here I am with a master’s degree, just graduated from college, her starting salary was a salary that I had negotiated after being there for three years. And I had more responsibility. And that was really the catalyst for me to just say, you know what, I’m going to go do my own thing because I value myself more. But it’s because of situations like that, where we don’t have someone to tell us, hey, you’re making too little in this role. Or, hey, here’s some tools to negotiate. Maybe the people at your college only talk to you about interviewing and applying for the job and they didn’t talk about salary negotiation. So, here’s some tools relevant to the world that we exist in today that will help you with that. But then also we know that there’s a gap, because of the pay gap, there’s a gap in wealth creation and wealth maintenance in Black communities and for ,African American women. And so My Fab Finance also seeks to bridge that as well and help provide them with investment tools and understanding. This is how you grow your money. This is an understanding of opportunity costs. A lot of people don’t even understand that basic concept of opportunity costs. So, we are there to close gap. To close it in different ways, because I think there are several ways that the wealth inequality gap can be closed.

Jean Chatzky: (06:03)

Before we move on and talk about the big purchases, I’d love to actually get your thoughts on that. I mean, what is the problem with opportunity cost and what are your favorite strategies for closing the wealth gap? I mean, I’m guessing just based on your history, that ownership of things like businesses and homes plays a big role.

Tonya Rapley: (06:26)

Yeah. So, to answer the first question, opportunity cost, yes. I don’t think enough people understand what their time is worth to them. And I think that is important, especially when we think about negotiating. What is your time worth? What does it cost you to leave your house? You know, as far as daycare and everything else that’s required for you to leave your house and work this job. What do you need to make so that you can be happy after all of your expenses are covered, because you’re losing time or you’re losing money. And you need to understand that. So, for me, it became easier when I became an entrepreneur because once I calculated my hourly rate, I could say, okay, this is what my hourly rate is. If it doesn’t meet this, it’s not worth my time. And that even goes down to when I’m ordering food out. So, I was actually just writing an article about this, about how I do order in occasionally. I use meal delivery services. I order my groceries because of opportunity costs. I can spend two hours in a grocery store or cooking a meal, or I can spend two hours writing an article. That’s worth my time. You know, so, people don’t understand or have a good grasp on that. And then moving into tools to help people close that gap, in particularly Black women, it is explaining things such as the opportunity cost or how much their time is worth to them. But then it is also looking at the different variety of vehicles available. Real estate has traditionally been touted as the way to create wealth in African American communities. It’s one way to create wealth, but it’s not the only way to create wealth. And so what does it look like to start your own business? And what does it look like to be a profitable business owner? What does it look like to begin investing in the market or maxing out your 401k. So many people don’t feel comfortable doing things like that. So, we remove the jargon and just really give you bare and basic facts. This is what you need to know. This is how you do it. And this is how you get started. And then a lot of times my goal is for someone to grow beyond what My Fab Finance offers and say, okay, I have a good handle on this. Now, I actually want to go become more advanced than this. So, what does it look like for me to move beyond that? But that’s how we get them started.

Jean Chatzky: (08:36)

I love all of that, but I, in particular, love the part about knowing what your time is worth. I’ve written about that in the past too. And my favorite hack, I mean, if you work by the hour, then you know what your time is worth, right? But if you have an annual salary, chances are pretty good you don’t. But all you have to do is lop off the last three zeros of that salary, last three digits and divide by two, that’s pretty much your hourly rate. And so, if you can figure out that you’re earning 30 bucks an hour, then if it costs less than that, you don’t do it. You know, unless it’s something that you love. I mean, gardening has always sort of been my litmus test cause I hate to garden. And so, therefore I am willing to pay more for it. But, you know, I think there are a lot of people who love it. And so, they’re willing to do it even though it doesn’t meet their hourly rate. But I think it’s such an important and accessible piece of data to have in your back pocket.

Tonya Rapley: (09:36)

It really is the baseline for so many things. And people don’t realize that. Like it is the baseline. Okay, is this going to cost me this or is it going to cost me that? And I love that tip. I’m going to make sure that we share that on My Fab Finance. You know, just divide your salary with those three zeros dropped by two. And also I think it’s funny that you mentioned that you hate gardening because now as a new homeowner, I was up last night for an hour on Pinterest looking at gardening for new beginners. I’m like, oh man, do I really want to get out there and pull these shrubs out that the previous owner had here.

Jean Chatzky: (10:10)

No, you do not.

Speaker 2: (10:17)

Or do I just want to call someone which is more cost effective.

Jean Chatzky: (10:17)

Yes. I will cook all day long, but I really do not want a garden. Absolutely. All right. Let’s dig into cars and big purchases. My husband has a theory about big purchases and his theory is that you don’t regret them. Like he’s never had buyers remorse about big purchases. He’s had a lot of buyers remorse about the small things. You know, he’ll come home and he’ll talk for half an hour about how he should have bought the other yogurt. And really, I don’t care. But you know, when it’s a car, when it’s a house, he doesn’t have regrets. I don’t know that that’s always been true for me. I sometimes think about things differently. But you actually sold cars, which I think is so fascinating. How did you get into that?

Tonya Rapley: (11:01)

Yeah, I did. I sold cars. Wow. Everything is a part of our journey for a reason, you know. I was in college and there weren’t a lot of good jobs available to college student., But I had rent to pay and I was applying for administrative positions and so forth and wasn’t hearing any callbacks. And they’re always hiring car sales people. Selling cars is really, it’s demanding. You’re working on weekends because that’s when people buy cars. You’re working on holidays and everybody else, of course, in July, is out celebrating and everything and having barbecues. You’re working because those are big sale days. It’s really demanding. If you’re looking for a job they’re always hiring. So, I landed in that job. I sold Nissans. I was actually pretty good at it.

Jean Chatzky: (11:48)

I’m sure you were.

Tonya Rapley: (11:48)

Well, you know, one of the things that was really good for me, I was genuine. I was a genuine salesperson. There are some people who I worked with that use underhanded tactics and everything. I didn’t believe in pushing people beyond what they could afford. And then also I enjoyed it. I actually enjoyed it because a car for so many people is your means of transportation, helping people buy their first cars. My first car ever sold, it was to a woman who was pregnant with her first child and she was an army nurse. And I will never forget that was my first car that I ever saw. But I learned a lot, too. And I didn’t realize it was setting me up for My Fab Finance and negotiating down the line and understanding different things. But it was a meaningful experience.

Jean Chatzky: (12:37)

So, when you’re buying a car today and there are a lot of people, I mean, car sales were down in the second quarter, but they are also a lot of people who are buying COVID cars. They’re trapped in cities or they’re in cities and they’re just looking for ways to escape. And so, they are setting foot into the market and buying a car sometimes for the first time. What do they need to know about getting a discount or a good deal?

Tonya Rapley: (13:04)

One of the things that people should know is that there are better times to buy cars. COVID cars are a thing now. So, it could be more challenging to buy a car in say, a city like New York City, where people are trying to get out. So, there’s an increased demand for cars. But maybe if you travel a little further out to Westchester County or somewhere where there’s a more suburban feel and so forth, where people aren’t looking to purchase cars because they already own them. So, you want to be mindful of when and where you’re purchasing at. So, even if you’re purchasing one now, you can change the location of where you’re purchasing from. And then also, the time of day and time of month matters. And so, when I was selling cars, we were willing to cut the most deals towards the end of the month because your car sales cycle, as a car salesperson, is monthly. And so, you’re trying to reach your quota at the end of the month. And so, the sales team is going to do what they can do, the management and everything, to make sure that you move cars off the lot towards the end of the month. And then buying in the evening, because everybody’s ready to go home. And so, a lot of times you can where the sales manager down at the end of the night, or you can walk away at the end of the night because everyone’s tired, and they’ll call you back in two, three days with a better offer. So, the timing really does matter when you’re buying a car. It’s not just like, oh, I feel like buying a car. Let me go to the lot. No, you most likely aren’t going to get the best deal if you’re not buying in the evening or at the end of the month.

Jean Chatzky: (14:31)

A lot of car lots these days are no-haggle, right. Or sold on the internet. How can you figure out if you are getting the best deal then? And also, you know, part of buying a car is shopping for financing. Should you be coming into the car dealership with financing already in your back pocket?

Tonya Rapley: (14:53)

So, my most recent car I purchased actually was at a no-haggle lot. But it was at a no-haggle lot because I wanted to buy a certified pre-owned vehicle. I think both of us to talk about our love for the types of cars that we have. And I wanted to buy a certified pre-owned and they just happened to be a no-haggle lot. But before I purchased, I went online to compare the pricing based on the miles and everything offered. So, if you are going to go to a no-haggle lot, don’t buy immediately. Go home and do your research to find out if that price is actually a competitive price, or if you can find a better price somewhere else. And you want to do that based on the mileage of the car, the condition of the car, et cetera. So, make sure you do your research. Don’t buy initially, if you’re going to do it at a no-haggle lot. Buying a line, a lot of times you’re going to look at the car online. You’re still going to have to go onto the lot. You’re still gonna have to interact with someone. Unless you’re going through some of these new, so we have FinTech. And I guess, I don’t know, you call it AutoTech. These companies, where they’re allowing people to buy like Fair or Carvana and so forth. I’m not as familiar with those because those are newer, but with anything you want to do your research. And I always found when I was selling cars, that people who got the best deals were the people who showed up with their financing in hand. Because when you show up with your financing in hand, especially if it is a haggle lot, then they understand, okay, we have to make this car fit these parameters. We can’t get creative with the financing in the back end, which is a lot of times what they do is they get creative in the backend or, you know, tell you that they can’t approve you for this, or they can do this, or can’t do that. When you show up with your own financing, first of all, they know you’re ready to buy a car. They know that you have the money needed to buy a car and they’re going to do what they can to fit within your parameters. So, they’re essentially playing your game instead of you playing theirs when you show up with your own financing. And I just like having my financing with the institution that I’m comfortable with and so forth. I did shop around with my financing, but went with one of the banking institutions that I have my relationship with and got a really good rate.

Jean Chatzky: (16:53)

I think that there is a lot in what you just said that applies to so many big purchases. And I want to get into that in just a sec. But before we do, let’s remind everybody that HerMoney is proudly sponsored by Fidelity Investments. Whether you’re just starting to save for retirement, inching closer to it, or looking for smart ways to help protect your savings in today’s uncertain market, Fidelity can help. And when life throws you changes, Fidelity’s guidance can help you keep your financial plans in check. So, you’ll feel better today and more prepared for tomorrow. Visit Fidelity.com/HerMoney to learn more.

Jean Chatzky: (17:33)

We are back with Tonya Rapley, founder of MyFabFinance.com, author of “The Money Manual: A Practical Guide To Help You Succeed On Your Financial Journey.” So, you just bought a house. You also just bought a company. I mean, what is it in all of these big purchases that tie the things together? I mean, were you ready to walk away if you didn’t get the deals that you were looking for?

Tonya Rapley: (18:01)

I’m buying all the things right, Jean. So, we bought the company in November of 2019.

Jean Chatzky: (18:10)

And what kind of company is it?

Tonya Rapley: (18:10)

It is a bath sponge subscription business. So, is an eCommerce business. Most people do not replace their loofahs regularly as you should, or as advised by dermatologist – every three to four months. So, we do it for you. We offer four different premium sponge options. And once you start your subscription, we send it to you monthly, so you don’t forget to toss it. When I came across a company and realized,, oh my gosh, I’ve had my loofah for too long. This is genius. And was able to work on an amazing deal with the person who was selling. And actually negotiated with that and got the company for half of what he was asking, along with the inventory and everything else. And so I knew with that, I wanted to add something else to my portfolio that was more scalable than My Fab Finance, because My Fab Finance is a service-based business based on me, primarily, other than our courses that we offer. And I wanted something that was more scalable and there is no limit, except for right now, a lot of us eCommerce businesses are dealing with inventory shortages because of the pandemic. But other than that, it was a great opportunity and we did negotiate that. We had a really good seller that we were working with. I think that that relationship with our seller was important, too. We really hit it off. His core values were in alignment with mine. And I think that was important when you’re thinking about buying a business. In particular, if you’re buying it from a previous owner, are my core values in line with this business and the business owner – how they’ve been doing business. What are the opportunities for improvement that I see? I saw that they weren’t really maximizing social media. And so, we really wanted to start utilizing social media and so forth in that business strategy. So, that has been a great purchase so far. It’s been good so far. But still learning. It’s been a learning lesson and I’m still just learning different things. All industries are different. But then, moving to buying this house. So, we bought our house during the pandemic. First time I stepped foot in my house was the day of closing. I had to rely on a lot of virtual tours and so forth. But for us it was timing. We knew that we wanted to purchase a home. We also knew that things were changing because of the pandemic. And my husband, who has been a freelancer, we had been preparing our finances for the past three years to buy a home, but his jobs were slowing up when the pandemic started. So, we also knew it was important for us to go ahead and secure our financing while we had strong financials. We know that we’re going to do what’s needed to pay our mortgage, but financial companies, aren’t always so comfortable with that. So, for us, the timing was, while our finances are right, let’s go ahead and do this and get it done. We had a 60 day close period. As entrepreneurs, and I remember, I was saying, why can’t we do a 30 day close? I’m ready to move. And we needed all of those 60 days and then stuff just because of things, the IRS and everything else. But a home is a major purchase and it’s not just the number that you see on Zillow or that estimated mortgage amount. Since we bought this home, we’ve already had a repair person come out to repair a dishwasher. We found that we had to replace it tub because our painter messed something up when they were painting. I’m talking about hardscaping and landscaping cause we had drainage issues outside so it’s muddy. And so there are just so many other things that you have to pay for. I just bought a mattress this morning. So, it’s not just the home purchase. It’s a big purchase because of all of the additional purchases, also involved as homeowners.

Jean Chatzky: (21:38)

This is a time right now because interest rates are so low, because people are saying, I want to live someplace different. I can commute and be remote now. I don’t have to go into the office as much as I did. People are thinking about moving in I think a way that they hadn’t before. As we wrap up this conversation, what’s your top-line advice for all of those people who are thinking of dipping a toe into real estate right now.

Tonya Rapley: (22:05)

Make sure that you do it because it’s what you want to do and not because of what the experts tell you to do and so forth. Because it is not something that you want to get into haphazardly. It is life changing. It literally is life changing for good or for bad. And so, I just really think that people need to make sure that it’s based on their own desires and their own motives. I bought my first house. I’m 36 now. My little sister bought her first house at 29. But for me, it was really making sure that it was the right time for me and making sure that no matter what happened, I would be okay. And I think that’s the other thing that people need to understand, is that you want to be in a position where it’s not all or nothing. Or all my eggs are in this basket, and if it fails, I fail. With much risk comes much reward, but there are still ways to do things that are less risky and do them wisely. You can still take risks wisely. And when it comes to real estate and homeownership, you want to make sure you’re doing that – taking a wise risk.

Jean Chatzky: (23:04)

And when it comes to all of these purchases across the board, your homes, your cars, your businesses, I know that you are a crack negotiator. What’s your bottom-line advice for getting that right?

Tonya Rapley: (23:18)

Oh my gosh, Jean. I’m a terrible negotiator when it comes to things like that. And I think what’s made me a terrible negotiator is being an entrepreneur. Because I’m just like, well, I know what my time is worth. And everybody else time is worth this, et cetera. But what has helped me is really talking to people who are good at negotiating, and putting together a game plan before I go in. That has been crucial. It’s like, okay, let’s have this conversation with someone else. Let me have a conversation with someone who is better than me, so I know what I should go in expecting and what’s fair for everybody involved. Because I always want to make sure it’s good for everybody involved. So, if you’re not a strong negotiator, talk to someone else and get a game plan together. And once you have that game plan, stick to your game plan. But don’t wing it. Don’t go in because then you’ll get taken.

Jean Chatzky: (24:04)

Absolutely. Tonya Rapley. You can find out more about Tonya at MyFabFinance.com and follow her. You’re great on Instagram. I love you there.

Tonya Rapley: (24:14)

Oh, thank you Jean. That means so much. We work hard at it.

Jean Chatzky: (24:19)

Absolutely. I hope to talk to you soon and good luck with the house.

Tonya Rapley: (24:22)

Always a pleasure to talk to you. I’m going to be asking for tips on finding people gardening service.

Jean Chatzky: (24:27)

Yeah. Don’t garden. Absolutely not.

Tonya Rapley: (24:32)

Thank you.

Jean Chatzky: (24:33)

And we’ll be right back with Kathryn and your mailbag.

Jean Chatzky: (24:44)

And HerMoney’s Kathryn Tuggle joins me now. Hey Kathryn.

Kathryn Tuggle: (24:48)

Hey Jean.

Jean Chatzky: (24:50)

Nice to see you.

Kathryn Tuggle: (24:51)

You as well. I’m gonna see more of you later.

Jean Chatzky: (24:54)

I know. I know I’m excited. We are having a social distancing dinner, which will be a lot of fun. I can’t wait to see Ben’s hair.

Kathryn Tuggle: (25:01)

Oh gosh. That’s going to be good. We’ve talked about it a few times now. I think that our readers are going to demand a picture pretty soon.

Jean Chatzky: (25:08)

Yes.

Kathryn Tuggle: (25:08)

Maybe we’ll share one on the social media of us all tonight having fun.

Jean Chatzky: (25:12)

That sounds like a plan to me.

Jean Chatzky: (25:14)

You know what was so interesting about what Tonya said about negotiating, and by the way, she really was in her closet, which I know a lot of people don’t really get. But a lot of podcasters podcast from their closets because the acoustics are just great when you’re surrounded by clothes. But somebody told me recently that you know a negotiation is successful when neither side walks away happy.

Kathryn Tuggle: (25:37)

Interesting.

Jean Chatzky: (25:38)

I think that makes sense. It means that nobody got exactly what they wanted, which also seems to indicate that people probably got a little bit of what they wanted.

Kathryn Tuggle: (25:49)

Right.

Jean Chatzky: (25:50)

Right? So maybe you know, if you’re not completely satisfied, it was a good negotiation.

Kathryn Tuggle: (25:54)

I think that’s a good rule of thumb.

Jean Chatzky: (25:56)

Yeah, absolutely. All right. Let’s kick off some questions. I know our mailbox is full.

Kathryn Tuggle: (26:01)

It is. It is. Our first question comes to us from Sam from California. She writes, hi Jean. I first started tuning in to your Today Show segments back when I was in college. About a year ago, I was so excited to discover your podcast and because I, in a sense, grew up watching you, I knew that I could trust your sage advice. Listening to you regularly has empowered me to make my money work harder for me and my life goals. My question is about target date funds. In my twenties, I learned that this was a less intimidating way to ease into investing – similar to a set it and forget it approach. So, I opened up my first Roth IRA with Vanguard, target date fund 2050, in July, 2015, through a rollover from a previous job. I recently completed another rollover and decided to invest 38,000 in a more aggressive fund, target date fund 2060. Between those two funds and an additional IRA, I have about $110,000. I just turned 33 and now I’m wondering, are target date funds still the best way for me to invest in retirement, or should I be more active in diversifying my own portfolio now that I’m older, wiser, and more willing to do the research. To be honest, I’m still a little overwhelmed by the thought of that. I should also add that my husband and I recently decided to open up a brokerage account with Fidelity and will contribute up to $20,000 to be more active and conscious investors, like purchasing ESGs and other individual stocks. I’m leaning towards keeping my target date funds the way they are with Vanguard and focusing my energies on the new brokerage account with Fidelity. What do you think? Thank you for all that you do.

Jean Chatzky: (27:28)

Thank you for such a good question and thank you so much for the compliments. I appreciate them as well. The fact that you say that you are a little overwhelmed with taking that money out of target date funds and doing the work that is required to research investments that would substitute for them, leads me to think that you’re better off keeping the money where it is. When you take on a more active role in managing your asset allocation, which is, as you know, the percentage of your assets that you have in various categories – stocks and bonds and cash – you are basically making a commitment that as you age, as you get closer to your goals, and as your tolerance for risk starts to decline, which it will on a sort of a sliding scale as you close in on retirement being the ultimate goal, you are going to have to change your mix. And you’re going to have to change your mix pretty much every year, a little bit, as well as if the markets move and get out of whack. That can be a decent amount of work. And what I know is that people who say they’re in to rebalance, which is what it’s called, sometimes don’t do that. You’re already taking on a commitment with the money that you’re putting into the new account to invest with your values in ESG funds and so I would say one step at a time. Take it slowly. Go ahead and start managing, more actively, the money that you are going to invest in that new portfolio at Fidelity. If you like it, if you feel like, yes, you have time to take on more, then the benefit of moving out of a target date fund and into of an indexed ETF portfolio is that you may be able to reduce your fees in part, probably by about a half a percentage point. That’s not insubstantial. And so, if you find that you’ve got a knack for it and you’ve got the time for it and you’re ready to go, then I would say, take on more responsibility at that point. But road test it with the first 20,000 first.

Kathryn Tuggle: (30:08)

I love that. And you’re right. Half a percentage point is a lot.

Jean Chatzky: (30:12)

Yeah.

Kathryn Tuggle: (30:12)

All right. Our next question comes to us from Hannah, hustling hard and wanting a home. Hi Jean. I’m a 36 year old single, and child-free woman living in the San Francisco Bay area. I’m officially, debt-free after paying off my student loans last month.

Jean Chatzky: (30:26)

Woohoo.

Kathryn Tuggle: (30:27)

Woohoo. Right?

Jean Chatzky: (30:28)

Yeah. Right? We need a cheer. Can we get a cheer Charles? Anyway, Hannah, we are cheering for you.

Kathryn Tuggle: (30:35)

Yes, absolutely. She goes on to say I earned $200,000 annually with an additional 4,500 coming in every month from consulting work. My recession-proof company pays for my health insurance plan, life insurance, FSA, and gym membership, and I’m maxing out on my 401k with an employer match. I have about $20,000 sitting in an IRA and $350,000 cash in a high-interest savings account, which I add just over 10,000 to every month. My practical Prius is paid off and I spend relatively little every month using my two credit cards like they are debit cards, paying them off at least twice a month. Here’s my question. For the past few years, I’ve been living really small, saving up and working on repairing my credit score. I miss having a home where I feel comfortable inviting people over. I love entertaining, and I think it’s also a benefit to my career when I can host events at my house, which I used to do frequently. I’m currently in a tiny, tiny studio, and I feel like this is the prime of my life and I’m not enjoying it as much as I could. I also feel disorganized since I don’t have the space for a kitchen table, let alone a desk or office. I’ve been pre-approved for a high balance conforming loan up to $765,000. I’m looking at a beautiful one bedroom, one bath condo that I really love in a fun and up and coming neighborhood for $875,000. With my significant down payment, my monthly payments will be $4,000 a month or less, which is the minimum I would pay for a decent rental anywhere in the Bay. But decent rentals are hard to find, which is why I started thinking about buying to begin with and having my money work for me instead of throwing it away on a basic rental. Based on the numbers, my monthly housing costs, including bills, will be less than 30% of my net income. My six to eight month emergency fund will stay in place and I feel like I’ll still be living within my means. But I want to be really smart about this decision. I’d be so grateful for your thoughts and guidance.

Jean Chatzky: (32:26)

Oh my gosh, Hannah. Yes. Get out of that studio and buy something. You are just killing it. You’re killing it with all of this money that you’re saving. And I am worried that you are oversaving and under living. And that sometimes happens. It sometimes happens to people who are very sort of debt-averse, which happens after we have a load in student loans. It certainly happened to me when I, after my divorce, was very debt averse. And I don’t want you living above your means, but I think there is, reading your letter, absolutely no chance that you are going to do that. And I also think you’ve got perfect timing. I’ve been reading a lot about exodus from the cities and San Francisco seems to be one of those cities that is seeing some prices falling for the first time in recent memory, as far as housing is concerned. So, shop around. Find something you love. Find something that will give you room to entertain. Find something that will give you room to park that Prius and absolutely go for it. Absolutely go for it. And just understand that in the next few years, you may see the value of whatever you buy, because of everything that’s going on with COVID right now, you may not see appreciation in the value of whatever you buy. But I say to you, speaking as a woman who, when I sell this home, which I purchased while I was getting divorced over almost 15 years ago, I will not make a dime on this house. I am so happy I bought it. Because it allowed me to build a life that I really, really love. And that is exactly what I’m hoping for you.

Kathryn Tuggle: (34:24)

Perfect advice. I agree with everything.

Jean Chatzky: (34:27)

Oh thanks. Yeah, I get it. Look, I love, I mean, I love saving money. I love it. I love saving money more than I like spending it. And I like spending it a lot. So, that’s saying something. But I think sometimes when we feel this need to just accumulate, accumulate, accumulate, it can get in the way of one of the things that we want to do in our lives. And life, as we’ve learned in COVID, can sometimes be way too short.

Kathryn Tuggle: (34:55)

Absolutely. Our last question is from Aussie Gal. She writes, hi Jean and Kathryn. I’m in my early thirties, working my dream job in the music industry at a very decent salary. HerMoney has opened my eyes to investing in mutual funds instead of real estate. Thanks for that. Previously, I had always dreaded the idea of locking myself into a decades long mortgage with little liquidity or flexibility. The podcast has taught me that investing isn’t just for rich old white men, but also possible for young working women of color like myself. I have around $20,000 in the VDGR ETF, and I plan on adding $10,000 annually until retirement, and increasing that if my salary increases significantly, as well as changing to a more conservative ETF, as I grow older. The VDGR growth rates vary a bit, but our roughly four to 14%, depending on the timeframe. If I use a compound interest calculator and use 7% as the growth rate for the next 30 years, this gives me a projection of $1,092,000. The idea of being a millionaire is very exciting, but it seems too good to be true. Obviously, I understand that the growth rate can change from year to year and will decrease significantly when I changed to a balanced then conservative ETF. But is my projection here just bonkers? What else do I need to consider to make sure I hit that million dollar mark? If this is correct, then listening to HerMoney has put me on track to being a millionaire.

Jean Chatzky: (36:18)

Well, I just love that. Just for people who are wondering, this is a diversified growth stock index fund. And no. Your projection is not bonkers. I mean, 7% as the growth rates. Some people would say that you should use 6% instead. If you do that, you’re going to come in maybe a little bit under a million. But I think that you’ll be very, very close. And if you bump up your contributions, as you think that you’re going to do when your salary increases, and you absolutely should do, then you will more than exceed those numbers. The most important thing that we can control, in all of these calculations, is our savings rate. Our savings rate is responsible for the base on which our money has to grow. And so, if you can keep up your savings rate or even increase your savings rate, you’re going to do just fine. The other criteria is asset allocation and by putting your money into this diversified growth index fund, which basically provides you diversification across multiple asset classes, but also gives you some of the benefits of fixed income to lower volatility – you get both stocks and bonds in this ETF – you are taking that into consideration. And so, my advice to you would be just keep going. Keep saving. Keep putting your money in there and keep running that calculator. I find that using calculators like this are so inspiring and a terrific way to keep yourself on track.

Kathryn Tuggle: (38:17)

Love that. Yeah. Always refresh the calculator to make sure you’re on track.

Jean Chatzky: (38:21)

Exactly. The VDGR ETF is the Vanguard diversified growth index ETF. It gives you broad diversification basically. It puts you in multiple asset classes at the same time in the form of an ETF, which is basically an index fund that trades like a stock.

Kathryn Tuggle: (38:44)

Thank you, Jean.

Jean Chatzky: (38:46)

And in today’s Thrive, what to do if your company is opening up but you’re just not comfortable going back to the office. While some of us are ready for that nine to five hustle, others are still wary of the risks associated with being around others in a confined space. So, how can you successfully talk to your boss about your concerns while still making it known that you are a team player who values your job. At HerMoney this week, we’ve got a few tips. Here are a look at some of our favorites. First, be a problem solver. It’s one thing to express your worries about coming back to your cubicle, but it’s another to come to the table with real solutions. What your boss, and I say this as a boss, what your boss cares the most about is your work getting done in a productive, profitable, and efficient manner. So, be proactive. Show that you’re willing to go the extra mile no matter where you are. Offer to take on projects that may be more heads-down than collaborative and show a willingness to work, a flexible schedule – perhaps working earlier or later in the day, depending on the company’s needs. Next, document your work from home productivity. With any ask you make of leadership, data is a powerful tool that makes you appear prepared and your argument stronger. Let your supervisor know how successful you’ve been during the pandemic and how you’ll continue this pattern going forward at home. Lastly, remember to stay positive. There are no wrong answers or bad questions in a time of crisis, but you will regret not expressing your needs. The right kind of employer will not just respect you, but support you as well. Thank you so much for joining me today on HerMoney. Thanks to the fabulous Tonya Rapley for chatting with us about her career journey and how we can all be advocates when investing, saving, and shopping for a car or anything else. If you like what you hear, I hope you’ll subscribe to our show at Apple Podcasts. Leave us a review. We love hearing what you think. We also want to thank our sponsor Fidelity. We record this podcast out of CDM Sound Studios. Our music is provided by Video Helper and our show comes to you through Megaphone. Thanks so much for joining us and we’ll talk soon.