Our bodies, the food we eat, our body image, and self-love… We live with all these things — we dwell with them, we dwell within them — every single day of our lives, so when one of these things is a source of stress or negativity for us, it impacts everything.

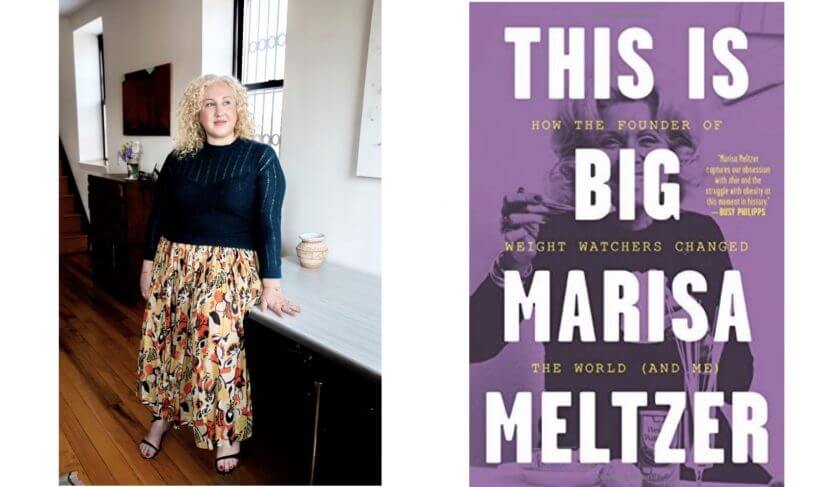

This week’s guest, Marisa Meltzer, is a New York-Based journalist who has written three books, and her most recent is “This Is Big: How The Founder Of Weight Watchers Changed The World — And Me.” (Find the book on Amazon, or at your local independent bookseller!) The book is part biography for Jean Nidetch, founder of Weight Watchers, who has been referred to as one of “history’s forgotten female founders,” and part personal memoir.

JOIN US: We’re changing our relationships with money, one woman at a time. Subscribe to HerMoney today.

Listen in as Marisa opens up to Jean about her own struggles with body positivity, and her comfort with the word “fat.” She weighs in on why she prefers to use the word fat over euphemisms like “pleasantly plump,” and why she doesn’t want to hide who she really is.

“Fat is an easy no-frills descriptor. Now, do I want thin people to call me fat? Probably not. Do I want strangers, or children on the beach to? No, not as an insult. But I also bristle at the way we try to talk around the idea,” she says.

Marisa also weighs in on how our relationships with food can be just as fraught as our relationships with money. “I often think that people have very similar relationships to food as they do money. I know that I do. I have a certain way of seeking out comfort, and being impulsive about, say, ordering a big delicious but highly caloric meal the same way that I might want to buy a designer dress,” she says. “Both things give me an immense amount of happiness, but they also give me sort of a shock of guilt, and I feel guilty about my weight the same way I feel guilty, sometimes, about my meager savings account.”

Marisa talks about the importance of finding community, and how she was able to find the people and the vibe she was looking for both within Weight Watchers, and at her favorite yoga studio in NYC. (Sky Ting, for anyone who wants to stop by— and they have online classes!) She also talks about her journey into weight loss, and some of her favorite tips for women who might be struggling.

She says that even though we’re all “chasing comfort” to a certain extent, we don’t have to give in to that. It’s okay to sit with our dissatisfaction or sadness, and not immediately try to find a way to mollify it. She says that she found a better path to emotional and physical wellness when she was able to have moderation with impulses. “You can’t control your body with your mind, but you can just sit through some of your impulses and not act on them,” she says.

Marisa also talks about dieting, and what happens when you do decide to sign up for a diet— what are you hoping will happen on the other side? Anyone considering starting a journey into self-improvement, whether it’s weight loss or getting on a budget, should think critically about their goals, and what they want their future to look like. It’s important that we don’t over-expect — “Having it all is a fantasy. It’s about finding the compromises that don’t make you feel like life is just drudgery,” she says.

Marisa also discusses some of her favorite foods, and how the biggest help in her weight loss journey was finding food that was “good for you, but that also you like.” She also references her favorite homemade salad dressing recipe, and we just couldn’t help but ask for details!

- A few stems of tarragon (chives, basil, or other herbs work too!)

- 2 garlic cloves or one shallot

- 1/3 cup olive oil

- 2 tablespoons vinegar (Marisa usually uses sherry or white wine vinegar)

- Juice of 1/2 lemon

- 1 big teaspoon mustard (dijon usually)

- Big pinches of salt and pepper

- Dump all of it into a blender and blend until the garlic is chopped and the dressing has emulsified, and adjust seasoning if necessary

In Mailbag, Jean and Kathryn check in with a very special guest — Piper Kerman, author of Orange Is The New Black — to help answer a question about how a listener can best help her relative who may be heading to prison. Piper weighs in on all the ins and outs of what it’s really like to be incarcerated, from a financial perspective. We also tackle questions on paying down debt during coronavirus, and we hear from a woman trying to help her mom (who is now a widow) downsize her home.

JOIN US: We’re changing our relationships with money, one woman at a time. Subscribe to HerMoney today.

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Transcript

Marisa Meltzer: (00:02)

I often think that people have very similar relationships to food as they do money. I know that I do. I have a certain way of seeking out comfort and am impulsive about say ordering a big delicious, but like highly caloric meal, the same way that I might want to buy a designer dress. Both things gives me an immense amount of happiness, but they also give me a sort of a shock of guilt. And I feel guilty about my weight, the same way I feel guilty sometimes about my meager savings account.

Jean Chatzky: (00:39)

HerMoney is brought to you by Fidelity Investments. Fidelity is committed to helping clients through any market conditions with financial planning and advice when you need it most. Learn more at Fidelity.com. HerMoney comes to you through Megaphone.

Jean Chatzky: (00:53)

Hey everybody. I’m Jean Chatzky. Thanks so much for being with me here on HerMoney. Today, we are going to dive into some topics that we don’t talk about all that much here, but that we should more often. Our bodies, the food we eat our body images and self-love. Because we live with these things all the time. Every single day. We dwell with them. We dwell in them. They seem to be during this crisis more present than most. And so when one of these things is a source of negativity or stress, it just impacts everything. I am so excited to have today’s guest Marisa Meltzer. She’s a New York based journalist. She’s written three books, and the most recent is the number one release on Amazon right now. It’s called, “This Is Big: How The Founder Of Weight Watchers Changed The World — And Me.” Marisa, nice to see you via zoom.

Marisa Meltzer: (02:00)

Oh, thank you so much for having me.

Jean Chatzky: (02:02)

Thank you for being here. Can you start by telling us a little bit about you and why this book?

Marisa Meltzer: (02:11)

Well, I first saw an obituary for Jean Nidetch in the New York Times. I had no idea who she was, but it said that she was a founder of Weight Watchers and I was instantly intrigued because I had dieted my entire life, really since I was probably four or five years old. And I had this moment of thinking, oh great, I’m going to put a face too this thing that matters to me. But then I read her obituary and it had this really fascinating Cinderella story as a female founder who had grown up working-class in Brooklyn, lost weight, and had this genius idea to create her own experience, based on community, which became Weight Watchers and became a millionaire, dated Fred Astaire and had great success. But I also had this feeling that that was only the beginning, that there was probably a lot more to the story. She, after all lived into her nineties and I also at the same time was turning 40 and really just had this overwhelming sense of wanting to make sense of certain things that had been challenging my whole life and weight with one of them. And so I decided sort of right away that this book had to be about her, but that it also had to be about me reckoning with this lifetime of weight.

Jean Chatzky: (03:47)

I want to talk about both of you, but let’s start talking a little bit about her. Jean Nidetch is not a name that many of us know. And we talk of her as one of history’s forgotten female founders. Why is she forgotten? Why isn’t she as famous as Oprah?

Marisa Meltzer: (04:08)

She was really lost to time. I think part of it was that her unique, charismatic personality, where she was a real extrovert and had a way with people. People didn’t quite know what to do with that sort of celebrity in the sixties and seventies. She was on the cover of Weight Watchers say frozen fish dinners. But once she wanted to branch out and be something beyond just the founder of Weight Watchers, there wasn’t that path that there is now, or even in the 1980s of an Oprah or a Martha Stewart or Gwyneth, where you could make an empire out of personality and a lifestyle. And she was also just plainly victim to sexism of the time, where she wasn’t considered an asset to the company beyond just kind of a mascot at a certain point. And when they decided to grow, they didn’t really take her along with them. And she became more and more of a literal footnote to the company. Right now there’s a quote from her in Weight Watchers headquarters, but it’s on the floor of the lobby.

Jean Chatzky: (05:23)

Oh no. So people are walking in and they’re stepping on it.

Marisa Meltzer: (05:27)

They are, yeah.

Jean Chatzky: (05:28)

Oh, terrible.

Marisa Meltzer: (05:29)

I do hope that they’ll tell her story one day, because it’s fascinating to hear about someone who was a female founder and a millionaire and who is kind of lots to time.

Jean Chatzky: (05:43)

I’m sure they’ll tell the story of her someday. Are you intimating the movie rights to your book have not been optioned.

Marisa Meltzer: (05:51)

There is an option, so hopefully, it’ll get an even larger audience.

Jean Chatzky: (05:57)

There you go. And you’ll keep us posted on all of that.

Marisa Meltzer: (06:03)

Absolutely.

Jean Chatzky: (06:03)

Just looking at the title of your book. I had heard you say in previous interviews that you are comfortable with the word fat. Is that how you describe yourself? And was that an evolution?

Marisa Meltzer: (06:17)

Yeah. I wouldn’t say that I’m wholly comfortable with it, but I’m more comfortable calling myself fat than any kind of euphemism. So euphemisms really tend to offend me in a way. Like this whole idea of curvy or plus size, or even pleasantly plump or whatever people say, that seems to want to kind of hide what it really is. And I don’t want to hide who I am in the ways that I am proud of myself and in the ways that I am more ashamed of myself. So, fat is a sort of easy, no frills descriptor. So do I want thin people to call me fat? Probably not. Do I want strangers or children on the street? No, not as an insult, but I also bristle at the way that we try to talk around the idea.

Jean Chatzky: (07:16)

Well, I think because we try to talk around the issue of weight. It’s become more of a difficult subject than maybe it needs to be. And the same as absolutely true of money. We’ve got so much shame and so much in the feelings of self-doubt when it comes to our ability to manage and deal with our money that we just shirk away from talking about it and dealing with it head on.

Marisa Meltzer: (07:42)

I don’t think that you could be more right. I often think that people have very similar relationships to food as they do money. I know that I do. I have a certain, you know, way of seeking out comfort and impulsive about, say ordering a big delicious, but like highly caloric meal, the same way that I might want to buy a designer dress. Both things gives me an immense amount of happiness, but they also gives me sort of a shock of guilt. And I feel guilty about my weight, the same way I feel guilty sometimes about my meager savings account.

Jean Chatzky: (08:22)

Well, I think you’re human, right? I mean, I’ve done enough research into this topic of how and why we’re so impulsive with our money and have had my own share of troubles with food, that it’s all about wanting to be in control of our environment, but also our mood in the moment. And we’ve learned, I think, as humans that buying something or having some chocolate or whatever it is that happens to light you up actually does light you up. You know, that’s just true.

Marisa Meltzer: (08:58)

Yeah. I think that in the same way that you get people who love to say that they have a secret for losing weight and they want to share it with you and that they, you know, I don’t know, quit eating carbs and never looked back. You see a lot of similar kind of debt gurus or money people who have really strict regimes that you too can follow and get closer to your goals. But they often don’t factor in how hard that is and how much our emotions play into it.

Jean Chatzky: (09:34)

So, right. So tell us about your journey with food and with money. I mean, how did you find your way through your relationship with Jean Nidetch?

Marisa Meltzer: (09:46)

Well, I think that Jean was both an inspiration and a cautionary tale for me. She was able to achieve so much, but it also came with a certain cost. Because when she denied herself some of the foods that she loved and then was in this kind of gilded cage of having to be slim for her livelihood for the rest of her life, she ended up being the kind of person who probably had a gambling problem. She gambled pretty much every day I’ve seen. She impulse bought fur coats. She gave vast amounts to charity that she probably couldn’t afford. She had multiple homes. And I see that desire to have a big life and a big appetite is just filtering over into other vices or just other parts of her life, other desires that she had. I very much related to that myself. I’m someone who loves a lavish vacation. I love designer clothes. I love an expensive restaurant. I would give back to charity if I could. And I too have that kind of appetite for life. And it’s still something that I’m working out. I think for food, I’ve accepted that struggle and that it’s always going to be something that I am working on. And sometimes it will feel more successful than others. And I think with money I’m on a similar path, although frankly, I think I’m less further down. I just spent several years working on my weight and my food issues. And I could probably write a whole other book about my fraught relationship with spending money.

Jean Chatzky: (11:37)

Maybe that’ll be next.

Marisa Meltzer: (11:38)

Perhaps.

Jean Chatzky: (11:38)

I want to dig into some specifics, but before we do that, let me just remind everybody HerMoney is supported by Fidelity Investments. For more than 70 years, investors have relied on Fidelity Investments to help plan for their financial futures. And as always, when the unexpected happens, Fidelity’s there to help you work through it with financial planning and advice for what you need today and tomorrow, helping to make it all clear. To see how Fidelity can help you and your family on the path forward, visit Fidelity.com.

Jean Chatzky: (12:11)

We’re talking with Marisa Meltzer, author of the new book, “This Is Big: How The Founder Of Weight Watchers Changed The World — And Me.” So how are you changed? I mean, as you look at coming through, let’s talk about your relationship with food. How are you changed from what you’ve learned about her and what have you learned that you think can help other women?

Marisa Meltzer: (12:39)

I’ve learned that we’re all chasing comfort and oblivion and that I don’t always have to give in to that. You know, sometimes you need that emotional comfort and sometimes that might be a certain food. But it’s also okay to sit with dissatisfaction or sadness or whatever emotion you have and not find a way to mollify it. That would probably be my main advice, to find some kind of moderation, not necessarily to eat like a French person and only have, you know, a few bites of dessert and push your plate away or whatever advice they give. But to have moderation in your impulses. And that you can’t necessarily control your body with your mind. That’s asking a lot. But that you can sit through some of your impulses. And also, even when you are deciding to diet, to think about what’s behind that. We don’t really talk about transformation very much as a society. It’s really easy to sign up for a diet or some kind of budget and to be excited and motivated about it. But what really are we hoping happens on the other side?

Jean Chatzky: (14:05)

One of the things you mentioned in the beginning was that Jean Nidetch founded Weight Watchers to be a community. And that that was, in many ways, the secret sauce to her success, that she allowed women to gather to talk about these things. And in many ways, that’s what we’re trying to do here. We built this HerMoney community and have a private Facebook group where we’ve got thousands and thousands of women who just talk about their money in a safe place. Why is community so necessary?

Marisa Meltzer: (14:41)

I think particularly for women, there’s this idea that you have to privately blog through a lot of things. One of them is certainly food, and another is money. And so Jean’s idea was that, if you put people together who have this common struggle with weight, that they might have tips, that they also might relate to each other, that they can learn and grow together. And I think there’s something incredibly liberating about that. I would not say that Weight Watchers is feminist, but it had a lot in common with consciousness raising groups, and this idea that women coming together to talk about the realities of their lives would be powerful and even political. And, I think that when it focuses on more taboo subjects like weight and the body and money, it’s even more powerful.

Jean Chatzky: (15:42)

Have you found various communities that have supported you as you’ve sort of gone on this journey?

Marisa Meltzer: (15:50)

Definitely. I, as many people do rely on friends. But I also found a bit of an unlikely community in yoga. I’ve taken yoga for a long time, kind of casually. I even went to a high school that offered yoga is PE, obviously it was in California. And, part of a work assignment for Vogue magazine went to a new yoga studio called Sky Ting in New York City. And just instantly felt like this is what I want. And it was a community that just felt like something I wanted to be a part of, which is interesting because I’m not a born athlete and I’ve spent so much time resisting being part of its community. And so I started going to classes there really regularly and retreats, and eventually became friendly with a lot of the regulars and the teachers and the owners, and even took a restorative yoga training program last year. And I started to teach a few classes. So that’s a really fun evolution. And especially for someone who grew up a fat kid, thinking that exercise was this real punishment and almost off limits to me.

Jean Chatzky: (17:16)

It’s so interesting. I see Kathryn. We’re, we’re on Zoom. I should tell everybody, because we’re all social distancing and Kathryn is producing from her home in New York. Kathryn, our producer teaches yoga as well. And, do you get the same sense out of it, that this a community that you’ve found as well?

Kathryn Tuggle: (17:36)

Absolutely. But it all depends on the studio. I mean, Marisa, you can probably attest to that because some studios, I actually call some studios the angry yogis. Do you know the angry yogis Marissa?

Marisa Meltzer: (17:50)

I believe I do. Yeah. I mean, luckily yoga is common enough that there’s a little kind of different, there’s a different flavor for everyone. And I think that it’s easy with enough shopping around to find your people. But, oh yeah. I mean, I had spent years going to yoga and kind of halfheartedly going to studios because, you know, it was like a Goldilocks thing. Like this one was a little too hippy. This one was like women with microphones making me do ab exercises, which was not what I was looking for. This one was in a really, you know, far flung and ugly location. I found fault with so many of them. And when I found Sky Ting, my yoga studio, it was really like just right. And it’s really interesting to bond with people in a way that’s not just about work or my opinions or my intellect, to have this bond with people that’s kind of physical, is really powerful. And I think that probably people in the HerMoney Facebook group can attest to that idea of finding community with people that might be different from your day to day life.

Jean Chatzky: (19:07)

Yeah, no question. How are you coping with the lack of community during quarantine?

Marisa Meltzer: (19:14)

It’s hard. I live alone. Thank God I have a dog, so that there is some other creature in the house with me. But, it is very challenging. I have a lot of friends that I am on text message group chats with constantly. I do Zoom hanging out with groups of friends. I tune in to do live yoga or meditations, just to feel that sense of community, but it’s not a replacement. I miss it.

Jean Chatzky: (19:46)

Yeah. Yeah. I did it too. And the longer it goes on more I just want to just reach out and touch someone, just like the commercial says. I mean, I walked into my, we’ve been on an every two week rotation for the grocery store here, but I walked into the local, small little meat market in my town where I hadn’t been in two weeks. And I just wanted to give the guy a hug, which of course you can’t do, but it’s just, it’s human contact. Let me just ask you as we wrap this up two things. One of which I will say for a moment, but as you’ve gone on this journey with Weight Watchers and your own weight, as well as your financial journey, have you found any sort of secret sauce? Have you found anything that you would say, if you’re struggling with this, this is something that really helps.

Marisa Meltzer: (20:38)

So food, I would say that the thing that really helps is finding food that is good for you, but that also you like. Everyone, I want to hope has some kind of food that isn’t total junk that gives them pleasure. I love for example, big salad with lots of stuff in them. And once I learned to make a vinegarette that I really liked, having a big salad at home with romaine lettuce and chickpeas and carrots and cucumber, and maybe some blue cheese was healthy, but also something that I look forward to. And so, you know, almost indulgent, maybe if I ate it with some baguette or something. It’s not traditional diet food, but it’s good for you and I could deal with it. And I think it’s about finding those small compromises that don’t make you feel like you’re constantly being deprived.

Jean Chatzky: (21:44)

I think that you’re so right. And I think it’s exactly the same with money, right? I mean, when we have these rules that are so hard and fast about what we’re allowed to do and what we’re not allowed to do. If they don’t work cause we’re not cookie cutter people, but if you can prioritize the things that really mean something to you, when it comes to your financial resources, then you can allocate money toward them. And you also know what you can skip because you don’t really care about it.

Marisa Meltzer: (22:13)

Absolutely. I know that I can skip something like concerts, for example, but that I always want to go on a nice vacation every year. I can skip buying a coat because I already have plenty of nice ones, one winter and, you know, use that money to save up for going somewhere fabulous over New Years. And so, yeah, we all have to make compromises. Unfortunately we all have to face the idea that having it all is a fantasy. And it’s about finding those compromises that don’t make you feel like life is just drudgery.

Jean Chatzky: (22:58)

Yeah, absolutely. Okay. Last question. And we’re going to just get superficial here. We love your dresses. You always look, no you do. You always look amazing. And where do you get them? Where do you shop?

Marisa Meltzer: (23:13)

I love to shop. I mean, somewhat indulgently I go to Paris. I try to go once a year. I spent eight years there in college and still speak enough French to get by pretty well. And they have a sale season that’s regulated by the government and when all the stores go on sale. So I usually try to go, often in the winter when hotels and plane tickets are really cheap. And I go during sale season and stock up. That is my hack. So, you know, you can take like a $400 flight and stay in an Airbnb and eat cheese and bread and wine that’s next to nothing and buy fabulous clothes that are 50% off and also get the VAT back. So it’s a real win.

Jean Chatzky: (24:09)

It’s a win all around. Marisa Meltzer. Thank you so much for spending some time with us. I appreciate it.

Marisa Meltzer: (24:17)

It was my absolute pleasure. Thank you.

Jean Chatzky: (24:20)

And we’ll be right back with Kathryn and your mailbag.

Jean Chatzky: (24:23)

And HerMoney’s Kathryn Tuggle has joined me to answer your questions. Hey, Kathryn.

Kathryn Tuggle: (24:36)

Hello. Hello.

Jean Chatzky: (24:37)

So I thought that was a great conversation. I read a couple of different pieces about Marisa’s book and I just thought, yeah, we have to talk to her. I mean, she made, so clearly this tie between food and money and how we treat them both as human beings. And I was just, I was mesmerized.

Kathryn Tuggle: (24:59)

Yeah. It’s such an important topic. The way that we deal with these things is so much about control and so much about our own insecurities and the way we were raised and the things in our childhood that shaped us without us even realizing it. And that all just carries through into our adulthood. And until we have some introspection about things, it’s really hard to move past some of these things.

Jean Chatzky: (25:23)

Yeah, no question. And we want to get control of them without taking them too far. Right? I mean, I was a very avid calorie counter for a period of my life in high school and then into college. And it got a little bit into eating disorder territory. I don’t need to go into a lot of detail, but you know, it was hard to find that balance between control and obsession.

Kathryn Tuggle: (26:00)

Absolutely. And I don’t know any woman in my life who has not had body issues at some point. Nor do I know any woman who’s not had money issues at some point. We all just have to come to a point where we hit a level of acceptance, hopefully love, that comes for most of us. But I think just being able to accept this is my situation, this is my body, this is who I am, is such a beautiful thing when we can get there.

Jean Chatzky: (26:29)

Yeah, absolutely. Well, I’m grateful for the book. I’m grateful we got her and I hope that our listeners got as much out as I did. Let’s answer some questions.

Kathryn Tuggle: (26:39)

Yep. Our first note is from Lisa in Georgia. She writes, hi Jean. I hope all is well with you and Kathryn, I was hoping you could provide guidance on paying down debt during the current uncertain times. I have $14,000 in credit card debt that I’m planning to pay off within the next 12 months. There’s a balance transfer with 0% interest if paid within the timeframe mentioned above. I am paying large sums, 1000 or above each month, to get this debt off my plate. I’m wondering if I should just pay the minimum monthly payment until we have a better sense of what’s in store for us with both the economy and the world and hold on to the larger dollar amounts and continue building up my emergency fund. I have approximately $18,000 in my fund, but I’d love to have more. Your direction and insight is much appreciated as I love your podcast and the HerMoney private Facebook page. It’s great to have so many resources and so much support as we better manage and control our financial futures.

Jean Chatzky: (27:36)

Oh, thank you. Thanks for such nice words, Lisa. I appreciate it. Here’s where I sort of come down on this. I’d like to know how long the $18,000 that you have in your emergency fund would sustain you. If it’s enough to carry you for six months, if you needed it, three months at a minimum, but preferably closer to six months, then I would absolutely go ahead and just pay down that credit card debt. Pay off that credit card debt. If you’re feeling like in these uncertain times, if you were to lose your job, you really would be at a loss without a more fully funded emergency fund, then I’d heavy up on the amount that you’re putting into the emergency fund. But one thing I want to point out here is that this is not an either or proposition. It’s not like you have to take a hundred percent of the money that you were planning to put against that credit card debt and put it in the emergency fund or vice versa. You could just sort of find the place that you feel best about. Maybe instead of paying off the balance within 12 months, you pay off the balance within 18 months. And if that means that you have to transfer your balance one more time to another card, I’m pretty sure that you could get another balance transfer card if you had to. I don’t want to see anybody feeling like if they lost their job right now, they would be up a creek. I don’t suspect that’s you. I think you can probably proceed with your plan to pay off this debt in the time that you’ve allotted yourself, but run the numbers and see where you shake out. What do you think Kathryn?

Kathryn Tuggle: (29:32)

Absolutely run the numbers. Like you said, everything hinges on how long her emergency fund will last her in terms of the number of months. But just looking at that figure to me, $18,000 seems like a lot. So I feel like you’re already doing so well.

Jean Chatzky: (29:48)

Yeah, absolutely.

Kathryn Tuggle: (29:50)

Our next note is from an anonymous listener. She writes, hello. Some recent family circumstances have inspired a question that I think may be applicable to a lot of people who often aren’t talked about on personal finance podcasts. So here it is. A close family member might be going to jail. I say might be because at this time we don’t have a sentence yet, but it could be anything from no jail time to a year or more. How can someone who is facing this type of situation prepare financially. I’ve looked online and it looks like some people recommend getting a financial power of attorney, but can you get this once you’re sentenced or already incarcerated and know how long the sentence will be? On the other side, how can family members take care of themselves if a family member who brings in money for the family is incarcerated? With the majority of people going to jail being men, it seems like the second question has a greater chance of implicating women who stay home. Are there things they can do or resources available to them that might help in this situation? Thanks so much for what you do.

Jean Chatzky: (30:49)

Well, you are welcome. Thanks for the nice words and sorry that this is happening to you and your family, but you sound like you are really taking control. And I think that’s exactly what is needed in this time. A little bit of planning. At least as much planning as you can do. I don’t know that I’ve ever talked about this on this show, but I have a cousin named Larry Smith and he is married to a woman named Piper Kerman who wrote “Orange Is the New Black” and who is a real advocate for prison reform these days. She is doing incredible work. And so, although I had some thoughts on your question, I figured she could answer it much, much better. So I put it to her. I hope you don’t mind here is what she had to say.

Piper Kerman: (31:34)

I’m delighted that you chose to take this listener question. It’s a really relevant and important one. And while it might seem a little out there to some of your listeners, it’s actually something that a huge number of American families confront. I’m sure your listeners know that we incarcerate more of our own people in this country than any other nation in the world by far. And what that translates into is not just more of our own people locked up, but an incredible impact on families. And 25% of American women have a loved one who’s incarcerated, whether that’s a spouse or a child or a sibling. So,

Jean Chatzky: (32:16)

Wait, just stop for a second. 25%? That is so much higher than I thought.

Piper Kerman: (32:23)

Yeah, it’s a staggering number. And it does really point up the particular impact on women when anybody is incarcerated. So it might be one of their children, it might be a sibling again, or very often a spouse. But yeah, that really shows you the scope of what I think is a problem. And the fact that so many families actually have to confront all of these financial questions, all kinds of questions. Confront families that are coping with incarceration, but financial issues are one of the most pressing. So, I was very fortunate when I experienced the criminal legal system and eventually incarceration. And when I say fortunate, it might seem like a funny thing to say. I spent six years on pretrial and then I spent 13 months incarcerated and two years on probation. So a lot, a big chunk of my adult life actually sort of entangled with the criminal legal system, but I was pretty young and I didn’t have children who I was financially responsible for, of course. And I didn’t have a mortgage and some of the other really significant fiscal responsibilities that many adults have. So some of the pressing financial questions that many people face were not things that I experienced myself. Nonetheless, I think what’s important for people to understand first is that when a person is incarcerated, it is sort of like a civil death. It’s almost like that person sort of ceases to exist in regular civil society. And what I mean is that a person who is incarcerated has really no ability to interact with their fiscal and legal responsibilities in the outside world. So a person who’s incarcerated is not permitted to do things like make a mortgage payment. A person who’s incarcerated is not able to really interact with the family courts if, for example, there was a question of custody or the welfare of one of their children. So having proxies is actually really important and that’s true, whether it’s a financial proxy or whether it’s a proxy for other adult responsibilities. You know, you’re the expert when it comes to all of these questions of personal financial planning and responsibility. But if a person is married, then some of those things might be covered, I believe. But if a person’s not married, then it poses a really pressing question. And when you look at women who are incarcerated, you know, the women that I did time with the majority of them are mothers, and most of them are single mothers and the mothers of minor children, kids under the age of 18. So these financial questions are desperate in some cases.

Jean Chatzky: (35:22)

Yeah.

Piper Kerman: (35:22)

So often if a situation is such that a person is married, who is going to go through the system, then all of their responsibilities will inevitably fall upon their spouse in terms of, you know, meeting credit card bills. So when I think about my own situation, I was, again, lucky that I didn’t have serious debt in the form of educational debt or in the form of a mortgage, but I did have credit card debt because often when an individual and therefore a family is facing the criminal legal system, people incur a lot of debt because they do things like pay for expensive lawyers,, which is very necessary.

Jean Chatzky: (36:04)

Sure.

Piper Kerman: (36:04)

It’s impossible to navigate the system without good legal counsel. So the difficult thing is that often people end up with a lot of incurred debt in the form of credit card debt. And then of course they have the regular responsibilities that, that a person might have in terms of rent or mortgage, you know, supporting children. So what steps they can take vary based on their financial situation, but in my own experience, for example, I didn’t have a lot of credit card debt, but I had some and my mother stepped up and paid. She basically paid those minimum payments during the course of time that I was incarcerated. Now, again, I was only incarcerated for 13 months. Some people might be facing a lot more time.

Jean Chatzky: (36:52)

Well, our reader asks about the timing on making all these moves, the timing on putting people into place, into position to be able to handle these things for you. Clearly you have to do it before you’re incarcerated, but do you want to wait until the last possible minute so that you can retain control yourself and then have somebody else take over or is it better to just sort of get it all taken care of?

Piper Kerman: (37:21)

I mean, what I would do if I was in that situation now is I would get all of those legal considerations taken care of in advance. You can always execute, I believe that you can simply execute papers kind of at the last minute, but I would definitely want to get things lined up if I was signing over power of attorney, for example. Or if I was signing over property. Now again, in a criminal legal situation, a person might not be able to sign over property. The government has the ability to seize assets and to freeze assets during the time that a criminal proceeding is coming and people should know that the government actually has the ability to take people’s assets away. It’s called civil forfeiture and that’s a whole ‘nother…

Jean Chatzky: (38:11)

A whole ‘nother ball of wax. I know in your own situation, just from talking to Larry, that there are expenses that families incur just even visiting when a family member is incarcerated. Were there any things in terms of just managing the finances through a period incarceration that became clear?

Piper Kerman: (38:38)

That’s a great point. So most people who are incarcerated are not incarcerated near their homes. I was incarcerated in the federal system. The federal government has prisons all over the country. The Bureau of Prisons policy says that people are supposed to be incarcerated within 500 miles of their home, but that policy is actually not followed. And that’s actually particularly true in the case of women because there are far fewer women’s federal prisons. So people may end up incarcerated many thousands of miles away from their home. And if family members want to see them, which is highly recommended, it’s highly recommended on all fronts. That is good for the welfare of the family who’s on the outside. It’s especially important for children of incarcerated parents to be able to see their parents so that they’re reassured that their parent is in fact, okay. Also, prisoners who are able to maintain contact with their families do better while they’re incarcerated. But even more importantly, they have lower recidivism rates and are much less likely to end up returning to prison. People who have those sort of lifelines to their families and their outside communities just fare better across the board. So those contexts are important and yet correctional systems often make it very difficult. So for example, if a family is from the Bronx in New York, it’s very possible that a loved one might be incarcerated way upstate near the border of Canada. And so for families, the cost of travel and also lost workdays, sometimes if you have to take off time in order to travel and see your loved one is very significant and that can involve planes, trains, buses, hotel rooms. One of the other costs of incarceration for families is the cost of putting money into people’s commissary accounts. So prisoners typically earn less than a dollar an hour for their labor. So, you know, I earned about 23 cents an hour when I was incarcerated. And prisoners also need to be able to buy almost everything they need. So prison systems don’t usually give you things like shampoo or toothpaste. People have to be able to purchase those things. They also have to be able to purchase stamps or prisoners have to pay for emails and they pay for phone calls. And the phone calls are much more expensive than the phone rates that we are accustomed to paying here on the outside world. So the pennies that a prisoner earns go into their commissary account and could go towards some of those expenses, but most of those expenses are born by the families. And those commissary expenses in comparison with legal costs or in comparison with travel costs may not have the same dollar level, but they are steady. So if a person is incarcerated, they’re going to need that financial support every month in addition to all of the costs that are imposed on a family to survive on the outside themselves.

Jean Chatzky: (41:55)

How much are they typically the commissary costs per month?

Piper Kerman: (42:00)

So let’s see, when I was incarcerated again, which mercifully was a while ago, more than 15 years ago, for a month of phone calls, you were limited to, 350 minutes a month. So you would have 350 minutes a month to talk to a family member on the outside. Not all at once. Phone calls were 15 minutes at a time. But the cost per minute was really significant. So phone time can end up being very, very expensive. That can end up being a much greater expense than shampoo or toothpaste. So that’s a good example of how punitive the system really is not just towards incarcerated people, but also towards a much broader community on the outside. And we have to double back on that statistic that 25% of American women have somebody that they love who’s in prison or jail.

Jean Chatzky: (42:53)

Amazing. Unbelievable. Well, I’m so glad that I reached out because I didn’t know any of this.

Piper Kerman: (43:04)

I mean the world prisons and jails is pretty intentionally hidden away from the public eye in a lot of ways. And yet it’s affecting so many of us.

Jean Chatzky: (43:12)

Thank you.

Kathryn Tuggle: (43:13)

That was amazing insight, Jean. Thank you so much for asking her to do that.

Jean Chatzky: (43:18)

Well, I’m glad she was willing to hop on the phone on a moment’s notice. It was fortuitous. But thanks so much for writing. And as far as being able to pick up the pieces yourself and make ends meet for your family, I think this is when you just reach out to your big network and you ask for help. We know that the vast majority of jobs are gotten because you know somebody. And I’m sure, you know, a lot of people who are ready, willing, and able to help you. So don’t stand on ceremony when asking for help these days.

Kathryn Tuggle: (43:52)

Absolutely. I think, especially now. Everybody’s just in that helping spirit. Our last note comes to us from Becky. She writes, hello, Jean and Kathryn. Thank you for the HerMoney podcast. I enjoy listening to you while I get myself ready for work in the mornings. I have a question that pertains to my mom and I’m hoping you can offer some suggestions. My mom is 64 and was widowed just over two years ago. She has a large home that my dad built with his own hands. It sits on four acres of property. With the current state of the world, I know she’s been giving some thought to moving. It will be quite an emotional journey as they lived there together for over 40 years. When mom does eventually sell, should she buy again? Rent? She’s independent, healthy, and active and likes to work in the yard. I think she would net about $250,000 from the sale of her home. I don’t know her exact numbers, but her retirement savings are not significant. Mom is currently still working full time. And I also foresee her making a change there too. I’m certain she would at least find some part-time work. She’s not one to sit still. So how do I guide her to making the right move when she’s ready? Thanks in advance.

Jean Chatzky: (45:00)

Absolutely. Your mom is about the age that my mom was when my father passed away. And so I think what’s so striking about it is she’s so young, you know. She’s so young. She’s so vital. She has so much time left and she has so much life left in her. And so my advice would be to let her guide you a little bit as far as what is the right situation for her. When she does eventually decide to sell, I would volunteer to start touring places with her. She probably wants something significantly smaller, but does she want something with a yard? Does she want something with the garden? Does she want something with somebody to take care of mowing the lawn for her? Does she want something where there’s a built in community or is she more of an independent person? I mean, there’s so many choices these days at so many different price points. I do think if there is the ability to preserve some money from the sale in order to supplement her retirement savings and social security, that would be great. And you can certainly look at those numbers. But listen to what she’s telling you. She wants listen to how she believes she might want to live. And if she’s not sure and I say this because it really took my mom a good five years to figure out what end was up after my father died. If she’s not sure where she wants to be then renting for a little while is absolutely the right move. Does that make sense, Kathryn?

Kathryn Tuggle: (46:57)

Yeah, a hundred percent. And I also think getting a complete picture of how much she does have saved will help answer that question as well.

Jean Chatzky: (47:04)

Yeah, no question. And how long she plans to really work. I mean, there are a lot of people in their early sixties who think they’re going to work till 70, who want to continue to work even longer than that. So that plays into the picture as well, but ask a lot of questions.

Kathryn Tuggle: (47:22)

Definitely.

Jean Chatzky: (47:23)

Thank you so much, Kathryn.

Kathryn Tuggle: (47:25)

Thanks Jean.

Jean Chatzky: (47:27)

Thanks so much for joining me today on HerMoney. Thank you to Marisa Meltzer for joining us and sharing her wonderful insight about how we think about food, how we think about money and how they’re so intertwined. If you like what you hear, I hope you’ll subscribe to our show at Apple podcasts. Leave us a review. We love hearing what you think. We also want to thank our sponsor Fidelity. Ordinarily, we record our podcast out of CDM Sound Studios, and we can’t wait to get back there. But today we’re using Zoom and a Yeti mic from the comfort of our own homes. Our music is provided by Video Helper and our show comes to you through Megaphone. Thanks so much for joining us and we’ll talk soon.