Lately, most of us have been far more attuned than usual to matters of health, caring for our loved ones, and planning for when things go sideways — and on this week’s show we’re tackling all of the above.

For example, what do you do when you’re facing your own health issues at the same time that money is tight? How do you manage when you have a sick child at home, work responsibilities to juggle, and a marriage to maintain? On top of that, how many hours in the day are required to navigate our seemingly impossible, labyrinthine healthcare system, and make it out the other side without losing your mind, going into debt, or both?

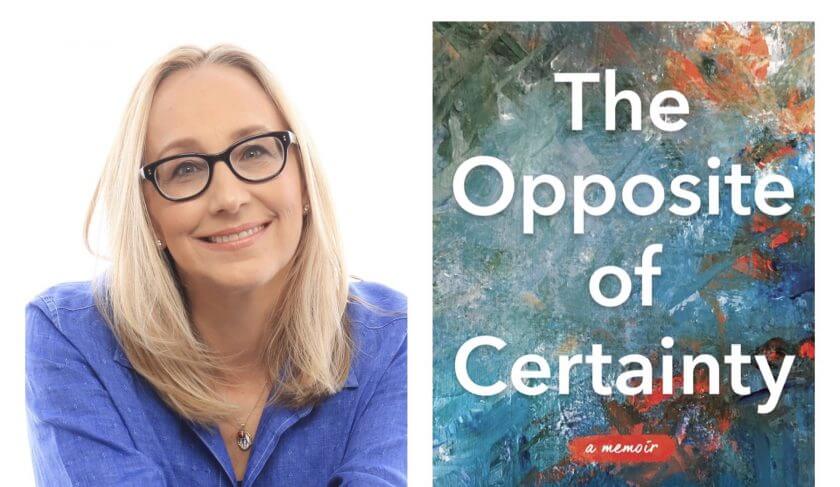

Our guest today has walked a mile — many miles — in those shoes, and she wrote a book about her experience. Janine Urbaniak Reid is the author of “The Opposite of Certainty: Fear, Faith, And Life In Between,” in which she shares her story as the mother of a son with a brain tumor, and her journey to discover hidden reserves of resilience, humor, and faith that looked nothing like she thought it would.

Janine opens up to Jean about her health and family journey that inspired her to write her book, and how she “came through the impossible intact.” She also dives into the topic of resiliency as it relates to tackling health struggles, and living through times of turmoil like these, when so much is uncertain. She opens up about how one can live through (and eventually come out the other side of) tough times with a positive attitude, and tells us what we can all do to “live a life you don’t hate, in circumstances you do.”

She also gets real about what it was like navigating our country’s healthcare system when she had a sick child — her son Mason, who is now 23 — and some of the more frustrating things she dealt with. She talks about the sickening feeling you get when a bill arrives in your mailbox that you know will be impossible to pay. “It’s unbelievable, the number at the bottom of the bill,” she says. “It’s like, ‘Is that even a real number?’ I’ve never even seen such a large number on a bill. Luckily, we had good insurance, and I was able to navigate that path, but we’re all so — like I say — we’re all so vulnerable.”

Janine discusses some of the tactics that she used to get answers to hospital billing and insurance coverage questions. (Hint: Be nice, and keep excellent records documenting who said what, and when they said it.) To tackle her family’s medical responsibilities, Janine says she wrote countless letters, and the number of hours she spent on the phone was almost a full-time job. Throughout this process, she learned how to be proactive in choosing insurance plans, and the importance of asking a lot of questions.

Janine also discusses how to keep your mental, emotional and financial reserves up when you’re facing all-consuming health concerns. She acknowledges that the advice to “live one day at a time” can be a struggle, and she says she eventually learned to ask herself a question that helped her live in the present: “Am I okay right now?”

To stay positive through it all, Janine maintained her friendships, often via text and email when she wasn’t able to see people face-to-face. She says little messages from friends were a bright spot in her day. Sometimes, when we have a friend who is suffering, we want to reach out, but we aren’t always sure what to say. Janine had clear advice on that: “There is nothing they need to say. There is this illusion that there’s some magic phrase to say to someone going through a hard time, but there really isn’t. I just want somebody to reach out and say, ‘Hey, I’m here if you need me.’”

In Mailbag, Jean and Kathryn tackle a question from a woman who is eager to ask for a raise at her job since she’s taken on additional responsibilities, but she’s unsure how coronavirus will impact her prospects for a pay increase — she’s looking for guidance on how to ensure she’s compensated fairly. We also hear from a listener who is considering refinancing her home, but is worried about managing the competing priorities of retirement savings and childcare. Lastly, in Thrive, if you think your parents’ financial situation may have changed due to coronavirus, it’s time to sit down for a chat.

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416

Transcript

Janine Urbaniak Reid: (00:00)

It’s unbelievable, the number at the bottom of the bill. It’s like, is that even a real number? I’ve never seen such a large number on a bill. Luckily, we had good insurance and I was able to navigate that path, but we’re all so, like I say, we’re so vulnerable.

Jean Chatzky: (00:22)

HerMoney is brought to you by Fidelity Investments. Fidelity is committed to helping clients through any market conditions with financial planning and advice when you need it most. Learn more at Fidelity.com.

Jean Chatzky: (00:41)

Hey everyone. I’m Jean Chatzky. Thank you so much for being here with me today. I think about all of you, all of our listeners so often, and I hope that you’re staying safe and well out there. And I also think that lately we have all been more attuned, more tuned than usual, to health, to caring for our loved ones, to planning for when things go sideways, because things certainly have gone sideways. And on today’s show, we are going to talk about some of those things. We’re going to talk about facing your own health issues when money is tight. Managing when you have a sick child at home. Juggling work and all of those other responsibilities and P.S. a marriage to take care of. How many hours in the day are required to navigate this seemingly impossible healthcare system and make it out the other side without losing your mind, going into debt or both? My guest today has been there and done that. And while I don’t think she got the t-shirt, she absolutely did write the book. Janine Urbaniak Reid is the author of “The Opposite of Certainty: Fear, Faith, And Life In Between” in which she shares her story as the mother of a son with a brain tumor and her journey to discover hidden reserves of resilience, humor, faith, and bravery, that looked absolutely nothing like she thought it would. In her book, which is remarkable, she shares her thoughts on how to come through the impossible, intact, and even more in touch with our true selves. Janine, thank you so much for being with me today.

Janine Urbaniak Reid: (02:40)

Thank you Jean. It’s lovely to be here.

Jean Chatzky: (02:43)

Tell me a little bit about your book. You were mentioning before we got on our microphones, and I should just note, this is COVID time so we are all recording this from our individual homes. I wish I was face to face with you. But can you start by telling us a little bit about why you decided to get so personal with this book? Why did you decide to put it all out there?

Janine Urbaniak Reid: (03:08)

Well, the first time I wrote about our story publicly, my son’s brain tumor, I was motivated by the healthcare discussion in this country. I remember exactly where I was. Going to the grocery store, at an intersection. When I heard a politician talk about, very cheerfully, repealing the Affordable Care Act and blithely going over the protections for pre-existing conditions and lifetime limits on healthcare. I mean, my son was in the hospital for six months at one point. And during that time, the Affordable Care Act was passed. And in those moments, I was in touch with, we were insured through my husband’s business at the time. I was in touch with his administrator on a weekly basis to see how close my 13 year old was to reaching his lifetime limit on healthcare. So, this was very personal. This is policy was so personal and it was beyond me that anybody couldn’t really see that. So I went home and I wrote an op ed. I sent it to the Washington Post. There was a little back and forth and they published it. And it seemed to hit a national nerve that, you know what, our story is unique, but it’s also really not unique. That we are humans and we are vulnerable in these bodies. And boy, do we see this right now.

Jean Chatzky: (04:27)

Absolutely. And I’ve got to say, I related so much as a mom. My first child was born with a congenital heart defect. So, he’s had, he’s 25. He’s great right now, but he has had four open heart surgeries and that lifetime cap, when that came out as part of the Affordable Care Act, I was just so relieved because it was a worry that was on my mind for 20 years.

Janine Urbaniak Reid: (04:58)

Yeah. You understand. I mean, it’s when you’ve been exposed. I think about it like. Our family, going into this, we didn’t know we were living in uncertainty every day, but that uncertainty became exposed through a diagnosis. And then there are other families who have had that similar experience, who know what it’s like to look at these hospital bills with just, it’s unbelievable, the number at the bottom of the bill. It’s like, is that even a real number? I’ve never seen such a large number on a bill. Luckily, we had good insurance and I was able to navigate that path, but we’re all so, like I say, we’re so vulnerable and the world is uncertain whether sometimes and times like this it’s just exposed for all of us, one more time, about how do we navigate the unknown.

Jean Chatzky: (05:49)

Take us through, I know we could spend the entire podcast on the story itself and I don’t want to do that because I have other questions I want to ask, but take us through your story.

Janine Urbaniak Reid: (06:00)

Well, I was like a lot of moms in my community. I worked really hard. I had a great career and I brought those skills to motherhood. And I also came into it. I was a real perfectionist all my life. And in my work life, I tried to control every detail knowing, I used to joke, well, I know something’s going to go wrong. I can’t control everything. But if I control every detail, at least then I won’t be so thrown. Well, I brought that skill to my mothering too. And I believe our culture kind of supports this, that, as a mom, we just want to do everything right. We certainly do not want to do anything to harm our kids. So I just tried so hard to be so perfect and do everything right for my kids. And, lo and behold, we come upon a situation that I couldn’t anticipate, or certainly couldn’t control.

Jean Chatzky: (06:51)

The concept of having to be a perfect mother, you know, to deal. And it’s funny as I listen to you, one of the pieces of advice I hear myself giving during COVID times is to really focus on controlling the things that you can control and letting go of the other things, because I think that’s the way we become more resilient. Because trying to focus on things that we can’t control just kicks us to the curb every single time. So, as you met this out of control experience, how did you get through that?

Janine Urbaniak Reid: (07:30)

Well, it is a lot. Like you say, what is on my plate to do? What can I control? Well, I, as a parent, as I’m sure you had the same experience, I had to find the right medical team for my child. And so there was footwork to do with that. Now, where that footwork would get me, there’s that tipping point into obsession where it’s, what can I control, was Googling at bedtime. Googling at bedtime is not a good idea. There’s that tipping point to obsession. So, what was really important for me was to focus on what can I do and give myself full credit. And I think that’s really important in times of COVID. I’ve been publishing a book in this funny time, and I’ve been giving myself full credit for showing up for a couple hours to respond to emails. Full credit for those things that I can do. And then I put it back out there and I can’t possibly control how it’s received. I can’t control, with my son’s illness, I could get us in front of the right doctors. Would that cure him? It’s a bit of a complicated story there.

Jean Chatzky: (08:42)

When you look at the various healthcare hurdles that you faced along the way, how did you approach them in ways that those people who are listening, who are maybe dealing with COVID, but maybe also dealing with other things in their own lives, that we have or have not pushed pause on, what are your strategies for getting through the maze that is the healthcare system?

Janine Urbaniak Reid: (09:09)

Well, I’ve had to be very tenacious. I have had to make multiple, multiple calls. And I’ve been very aware as I’ve been because sometimes the insurance company’s first response is no.

Jean Chatzky: (09:24)

Yeah.

Janine Urbaniak Reid: (09:25)

And I’ve had to be very proactive in calling and asking for help. And oftentimes I can find an actually helpful person on the other end of the line. Once in a while, that person is not empowered to help me. But I kind of try to ingratiate myself with that person on the phone. I will do anything for my kid, right? But I really do ask for help. I think that’s across the board really important. And I am very proactive in choosing insurance plans and asking a lot of questions. And that’s one of those things. What can I control? I can ask a lot of questions. I can be prepared for that worst case scenario. And hopefully it won’t happen as far as buying the level of coverage I need.

Jean Chatzky: (10:12)

In terms of sort of working your way up the ladder at the insurance companies themselves, I actually had the experience at one point of calling the president’s office at our insurance company, because I was so frustrated that I couldn’t get the answers to my questions. And I wouldn’t suggest that for everyone, because you never know exactly what sort of reception you’re going to receive on the other side. But in terms of tactics, are there things that worked particularly well?

Janine Urbaniak Reid: (10:45)

Well, not giving up worked really well. And you know what, Jean, I did the same thing.

Jean Chatzky: (10:50)

Did it work for you?

Janine Urbaniak Reid: (10:50)

Not so much. But my husband, recently too, was on LinkedIn trying to figure out who ran what division, you know,? It didn’t work so well, but I think the other important thing was to keep really excellent records of who said what and when they said that. So that really worked in my favor too. And to keep all my documentation. At one time, my son was denied coverage for an air ambulance ride. And the denial came from a Dr. House, like the fictional character.

Jean Chatzky: (11:21)

Oh my gosh, that’s unbelievable.

Janine Urbaniak Reid: (11:24)

Yeah. That they would be so like, oh, isn’t this clever and cute. When I’ve got a desperately ill kid. So I just followed that. I was like a dog with a bone in my mouth. There was no way I was going to let that go. So I just kept pursuing it. And luckily I’m a writer too. So I would write my letters. I’d write one letter after another. And eventually they actually did cover that.

Jean Chatzky: (11:50)

What was the investment of time and money like you and your family?

Janine Urbaniak Reid: (11:54)

Well, we were very fortunate that, at this point in my career, I had let go of my freelance work basically. And I was writing, but writing when I could write. So I had these three small children. So I was the parent who could put in the full-time job that was taking care of a very ill child and all the business that went along with that. For my husband, luckily he was with a company at the time that gave him some flexibility. Because at one point we actually moved to Houston to get treatment for our son Mason. And we were very fortunate and I was every day aware how fortunate I was, as other people, little children in the next room, in the ICU who didn’t have parents there those days because their parents had to go to work. I was very aware of how fortunate we were and we had resources and all of those resources went to that child at that time, which I have no regrets over that. I would do it all again.

Jean Chatzky: (12:57)

I have so many more questions about just balancing everything and keeping your reserves up. But before we get there, let me just remind everybody that HerMoney is supported by Fidelity Investments. For more than 70 years, investors have relied on Fidelity to help plan for their financial futures. And as always, when the unexpected happens, Fidelity is there to help you work through it with financial planning and advice for what you need today and tomorrow, helping to make it all clear. To see how Fidelity can help you and your family on the path forward, visit Fidelity.com. I am talking with Janine Urbaniak Reid, author of the new book, “The Opposite of Certainty.” Do you feel like, I mean, as I look at the title of this book, I feel like even though I know as an author who has written many books in the past, you put this title on this book a long time ago, do you feel like it’s the perfect book for the moment? Is that what you’re hearing?

Janine Urbaniak Reid: (14:04)

That is exactly what I’m hearing. And I almost feel like a Murphy’s Law, like the next book should be all is good and everything is for sure, to just put that energy out in the world. But yeah, I’m hearing that it is. I mean, the timing we couldn’t have planned. If my goal as an author is to use my experience to help other people, it couldn’t have happened at a better time. And I do really trust that synchronicity in the world. You never know when your story is going to be the most helpful.

Jean Chatzky: (14:37)

In fact, you tried to keep a positive outlook as much as you could, while you were going through it. You write about living a life you don’t hate in circumstances that you do. I mean, that sounds like life right now, but what does that mean to you?

Janine Urbaniak Reid: (14:54)

Exactly. Well, that’s exactly it. Well, what that means is that I added at a certain point in my journey with my son, we were in yet another hospital. It was another medical crisis. And I realized that I was waiting to catch my breath. I was waiting to actually live because it was so, so hard that everything was on hold, which is what you do. You do what you have to do. But at that moment, it became really clear to me that this is the life I’ve got. So I could no longer put off going for a walk. I could no longer put off just taking even short breaks. There was a turning point where I realized that I had to start taking care of myself, that it wasn’t humanly possible to go at the pace I was going. So what that looked like was learning, I’ve been really bad at this thing called living one day at a time. I always thought that was for people who didn’t plan very well, cause I’m very goal oriented and I used to make timelines for my projects and I’m very good at planning. Yet I was forced into it. And I feel like that’s what I’m being forced into right now in COVID times as well. And with any health crisis, my own, my son’s. You know, some days are so hard. I just have to slice it back to manageable pieces of time. Like how am I doing right this moment? Because often my fears are, how do I do two years of COVID? I don’t know how to do that, but what about right now? Am I okay right now? Well, you know what I am, I’m talking to you, I’ve got a cup of tea on my desk. I’m okay right now and I’ve had to really learn that that is not only enough. That actually might be the point, is to be present in this moment. Which of course I’ve resisted my whole life.

Jean Chatzky: (16:54)

Well you’re preaching to the choir. I know I’m exactly like that because you’re always looking at what’s next and for more. At least I am. The positivity is really, really intriguing to me. How do you keep, while you’re in the moment, from wallowing rather than being positive? I mean, I’ve got to say, in these COVID times, I’ve been pretty good. I’ve been pretty good at getting outside of my head even when my head really wants to be cranky. But sometimes it’s just hard.

Janine Urbaniak Reid: (17:36)

Well, and I think that is the key, you know, I have to say it’s hard when it’s hard. There’s, there’s this idea that I can just put I think gratitude, like, what am I grateful for in this moment? Even if I’m having a really hard time. Even if circumstances around me seem to be moving in on me and collapsing. Yeah, that helps me. It’s like first date though, that’s the first date. It’s like a veneer. Okay, I’m grateful. I’m okay in this moment or I’m grateful that I have coffee in the house or whatever it is. It can be something silly, but that kind of like veneer on top of what’s real, only it’s not a cure. What I need to do is say, you know what? This is really scary. And I have friends who we can do this together. And we end up laughing. This is really scary and it’s really hard, and this is what I’m afraid of. And I need to say that aloud to someone. And then I can move into a place where the real gratitude can take hold. And the real gratitude is, wow, I am safe in my home right now. That is so much.

Jean Chatzky: (18:44)

Yeah.

Janine Urbaniak Reid: (18:44)

That is so much. And then I can move on from there. But I always have to say what’s true.

Jean Chatzky: (18:49)

You mentioned your friends. I know that as you were coming through this crisis with your son, your health crisis, your own health crisis, simultaneously, your friends got you through. Talk to me about the importance of investing in those friendships.

Janine Urbaniak Reid: (19:09)

Well, it’s so difficult, right? Especially if you’ve got a job and you have kids and a spouse. There’s so many demands. So it can be easy to let go of those relationships. But I was so grateful that when things really did get so difficult in my life that I had people to call. And so what I’ve learned is, how I did that, I think is those relationships were braided into my life. I had routines with people. And even when things are really hard and my schedule is really busy now, I’m texting with friends a lot. And so we’re able to do this for each other and support each other, even when we can’t see each other, even when we’re each really, really busy, which means everything. It’s all I want is that connection. I think that’s also what’s been very difficult in this COVID time. It’s like, that is my basic human need I have an identified. I need that connection to other people. I need to know that you understand and that you care.

Jean Chatzky: (20:17)

Yeah, absolutely. It’s interesting. I found going through the many surgeries and procedures with my son that sometimes people want to reach out and they don’t know what to say. How do you give people permission to do that?

Janine Urbaniak Reid: (20:34)

Well, I think the first thing I would let them off the hook to know that there is nothing they need to say right. There is this illusion and I certainly had it for a lot of my life until my life got really hard, that there was some magic phrase to say to somebody going through a hard time. And there really isn’t. Really what I want in that moment when I’m so afraid and I’m so tapped out is I just want somebody to reach out and say, hey, I’m here if you need me. It means more. I say in the book that I tried to offer companion in those unknown places. And that’s what my friends did for me. That’s even what some acquaintances did. There were other people who were a little more in my face that I couldn’t really deal with. So I just didn’t. And I gave myself permission not to respond. But it was so important to me to be able to just have people just be with me and to be able to say again, yeah, it’s really hard. And can I bring you a sandwich?

Jean Chatzky: (21:36)

Yeah.

Janine Urbaniak Reid: (21:36)

Can I drop it off at the front desk? I can do that. Other friends would come by and we’d go for walks. Or even just the text to say, I’m thinking of you, sending you some love. It means everything.

Jean Chatzky: (21:49)

It does. Tell us about life now.

Janine Urbaniak Reid: (21:53)

Well, my son Mason is turning 23 tomorrow.

Jean Chatzky: (21:59)

Happy Birthday Mason.

Janine Urbaniak Reid: (22:01)

Thank you. And my kids are grown. Everybody’s doing pretty well. Mason is still struggling with this tumor. His tumor’s active one more time after a 10 year break, basically. So we are living it still. Yeah. So, life is often hard and yet I’m being forced again into that maddening, just for today. Just for today, you know? He’s downstairs with our great big Great Dane, and he’s doing some of his art projects for this class he’s taking. And just for right now, you know what, things are good.

Jean Chatzky: (22:43)

Well, we’re going to keep thinking really, really good thoughts for you. And I’m just grateful that you were willing to take the step and put all of this out there. I think you didn’t necessarily do it with COVID in mind, but it is helping an awful lot of people get through.

Janine Urbaniak Reid: (23:00)

Thank you, Jean. That means a lot to me. I appreciate it.

Jean Chatzky: (23:02)

Absolutely. The book one more time is “The Opposite of Certainty.” The author is Janine Urbaniak Reid. We will look forward to keeping everybody apprised of what’s happening with you and your family and having you back on the show again. And we’ll keep you in our thoughts.

Janine Urbaniak Reid: (23:22)

Thanks Jean. Take care.

Jean Chatzky: (23:23)

Thank you so much. You too. And we’ll be right back with Kathryn and your mailbag.

Jean Chatzky: (23:32)

HerMoney’s Kathryn Tuggle has joined me in the studio. And I say that as if we’re together in the studio. But of course we’re not in the studio. We’re at our own separate homes on these fabulous Yeti mics. Thank goodness for them. Thank goodness for technology. But I wish I wish we were together.

Kathryn Tuggle: (23:57)

I know. Well, I’m always with you in spirit.

Jean Chatzky: (23:59)

Thank you. Thank you. Me too you. And I got to say, that conversation was a little hard for me. I didn’t expect, and I guess I should have expected, but I didn’t expect to have all the feelings about what it was like and what it is like to deal with being in an uncontrollable situation with a young child, an older child. I mean your child of any age. When it’s your kid and you can’t control the outcome, it really hurts.

Kathryn Tuggle: (24:30)

Yeah. You know, you don’t often talk about what you went through with Jake, but I had that thought when Janine was talking that these conversations are probably tough for you. It’s so difficult to go through that with a child. When I was a little girl, just with a cold, I can remember my mom saying, I wish I could have it for you.

Jean Chatzky: (24:48)

Yeah.

Kathryn Tuggle: (24:49)

And I’m sure that those feelings are even more pronounced when it’s something more serious. That is life threatening. That you don’t know if your kid’s gonna make it. I can’t imagine.

Jean Chatzky: (25:01)

Well, and thank goodness, it sounds like Mason is, I understand he’s at a point again where he’s dealing with this. I hope that they will figure out exactly what they need to do for him and be as fortunate as we have been, because it’s just, when you’re in the right hands of the right doctors, you feel a hundred percent better almost immediately. But navigating the healthcare system is always a challenge. And it’s a challenge for people like me, and like Janine, who dig into really complicated details about things like insurance policies for a living. For people who don’t have that background, I can’t imagine how, how awful it is.

Kathryn Tuggle: (25:54)

Right. I feel like it’s the quintessential just adding insult to injury, right? Because you’re already dealing with something that could kill you. And then on top of that, you’ve got to spend half your day on the phone explaining your situation to 15 different people. It’s just demoralizing to have to go through some of those ghost conversations.

Jean Chatzky: (26:14)

Yeah. And of course not every insurance company, I don’t want to throw a ton of blame across the board. There have been instances where my insurance company has been an absolute pleasure to deal with. So it’s not that. It’s more the fact that you feel so helpless. And so it’s kind of like, and this is a really, really bad analogy, but it’s a little bit like the cable company, right? When your cable is out and you’re not a wiz with technology and you don’t understand which thing has to plug into which port in the box and the remote’s not working. Those are the things that drive me to tears because I’m used to being in control in my life as she is. And I think a lot of our listeners are exactly this way. We are used to being on our game. And so when the game changes, it’s just doubly hard.

Kathryn Tuggle: (27:25)

Yep. Yeah, absolutely.

Jean Chatzky: (27:26)

Yeah. But enough wallowing. Janine, thank you again for coming on. Thank you for writing the book. I am thinking good thoughts for Mason and I’m thinking good thoughts for everybody right now, who is dealing with COVID or any other health related ailment. And with that, let’s answer some questions.

Kathryn Tuggle: (27:44)

Absolutely. Our first question comes to us from an anonymous listener. She asks, hi Jean and Kathryn, I hope you and your families are well. My one year anniversary at work is this month and I was supposed to have my annual review where I plan to ask for a 19% raise. But there are a couple of issues. I work for a small non-profit that relies heavily on private investment from companies. With businesses being hit so hard due to coronavirus, there’s concern that donations to organizations like mine, will be cut out of their budgets. When I accepted my position, I was told I’d get access to an independent contractor who would do some work for me, but a few months after I started, she left and the position was never filled, leaving me to pick up the slack. I liked the work and I have the time to do it. But I later learned that there was a nearly $40,000 budgeted for that contractor position. That left me feeling like I should get a portion of that money since I was doing the work. I planned to ask for an additional $8,000 in salary and bring it up at my annual review. But I’ve been told by co-workers that everyone gets a 3% raise each year and there’s very little room for negotiation. It’s a huge disparity from what I want to ask for and I doubt my boss is eager to give me such a substantial raise when the full impact of coronavirus is yet to be seen. I care about the organization I work for and the people I work with. I don’t want to put the organization at risk by demanding too much and I realize that at times like these, I am lucky to have a job, but I also want to be compensated fairly. What should I do?

Jean Chatzky: (29:13)

So let me just get really honest here and acknowledge that I actually asked my husband for advice on this one. My husband Elliott has been an executive recruiter, an in-house talent scout. He was an in-house talent scout for the last almost 20 years of his career, so this was his bread and butter. This is what he did every single day. Although not in coronavirus times, but in many, many different scenarios. And what we came to was that I think as you go into your salary negotiation, the first thing you have to do is acknowledge that this is a tough time. Acknowledge that you understand that this is a tough time for the company. And I also would not raise the fact that you know that the contractor was going to be paid $40,000. I would just simply say, I was told when I took the job, which I really like that I would have access to this extra pair of hands. And the fact that I haven’t had access to that person means that this job has been considerably more work than it was made out to be when I joined the company. And for that reason, I believe that the work that I am doing entitles me to additional compensation. And I wouldn’t necessarily throw out a number at this point. I think if you go in and you ask for a 20% raise, in these times, it may land with a thud. At the same time, I don’t want to see you under shoot. So, I’d try it with no number first and see what your boss comes back with. If they come back with less than you were asking for, or less than you were hoping for, I would certainly ask them to do better. But I would hedge my expectations at somewhere around the 10% level. I think right now, asking for more than that is going to feel a little untoward. I don’t know. Kathryn, do you agree?

Kathryn Tuggle: (31:33)

I do agree. And I also think that you can’t sell yourself short and she doesn’t fully know what the impact will be to her organization. It may well be that they don’t take that much of a hit this year as corporations look to get a tax write off at the end of the year. So I think you can’t base those corporate worries off of what you believe is your value-add.

Jean Chatzky: (31:58)

Yeah. I think that’s right. And I would also make a really substantial list of everything that was not originally part of your job, but which was supposed to be part of that contractor’s job that you have taken on. Show them on paper, the value that you’ve added.

Kathryn Tuggle: (32:17)

I love that.

Jean Chatzky: (32:18)

All right, what’s next? And let us know what happens.

Kathryn Tuggle: (32:21)

Yeah. Please let us know how it goes. Our next question is also from an anonymous listener. She writes, hi Jean. Thank you for all the money wisdom you share with us listeners. It’s been a comfort, especially during these difficult times. I would love your advice. In 2018, I refinanced my federal student loans to a 10 year private loan with a 3.3% interest rate. Thanks to today’s lower rates. I can refinance again, but I’m not sure which option to choose. The remaining balance is $72,000. My options are number one, refinance for a 10 year term at 2.7%. Monthly payment would be $687. Compared to right now we’d save $164 a month and $5,100 in total principal plus interest over the life of the loan. Option two, refinance for a 15 year term at 3.1%. Monthly payment would be $502. We’d save 349 a month, but pay 7,860 more over the life of the loan. I’m 35 and my husband is 34. We have about $185,000 in retirement accounts and 160,000 in cash. We live in an expensive urban area and we’re saving toward a down payment, but not sure we’ll be able to afford a house anytime soon. Our AGI is $230,000 and my husband’s portion is 140,000 of that. I’m self-employed and my income could go down after we have children, which will hopefully happen in the next year or two. Is it a good idea to free up more money each month for flexibility for things like childcare, a down payment on a home, or to invest in the market? Or is paying less in interest better since right now we have the cashflow to max out retirement and save as it is. There are no pre-payment penalties, so we could pay either of these down faster and save more in interest if we want. I know we’re so fortunate to have this dilemma, but I want to make the right decision. Thank you for all you do,

Jean Chatzky: (34:10)

Boy. So these are good choices. They’re both good choices because interest rates are so low. And what I want other listeners hearing this question to take away is that if you haven’t refinanced your student loans, particularly your private student loans, or even if you refinance them once before, you should absolutely look into doing it again, because there is a lot of money to be saved. Because your financial situation and your life situation is a little bit up in the air for the next couple of years. You’re not sure if you want to buy a house. You’re not sure when kids are going to come along, I would split the difference. And by that, I mean, I would refi for the 15 year term giving yourself the lower monthly payment, but I would continue to make a larger monthly payment for the foreseeable future. It could be the 687 that you would have gotten if you refinanced for the 10 year term. It could be whatever your monthly payment is right now. You didn’t say what it was, but my guess is it’s a little bit higher because the interest rate is higher. And that will give you the ability to both save money, but also have flexibility down the road. We have talked a lot on this show about how you decide where you’re going to put that next dollar. And the fact that the return on your money when you’re paying down a debt is essentially the interest rate. So when you’re paying down a debt at 3.1%, that’s not a fabulous return on your money, especially if you could put it in a tax-advantaged retirement account where maybe you grab some matching dollars, or maybe you put it in a 529 for those future kids. You see where I’m going with this. So if in the future you have a better choice and that 3.1%, then you just back off and you make the smaller monthly payment on the loan. But if you don’t, you just get rid of it sooner rather than later. And I think reading between the lines with all the details that you laid out for me, that’s going to make you feel more comfortable as well.

Kathryn Tuggle: (36:39)

I love that advice. And I love seeing how often the answer to split the difference comes up in some of these answers that you offer people.

Jean Chatzky: (36:49)

Well, because it’s a little more art than science, I think. I mean, there’s definitely science in the numbers, right? If you were doing this by the numbers, you’d save more money by going with the 10 year loan because the interest rate is lower and you save more. But then that may not give you what you want in terms of your life and you may regret that decision. So go ahead and take the slightly higher interest rate, but preserve your flexibility.

Kathryn Tuggle: (37:21)

Love that.

Jean Chatzky: (37:22)

Thanks so much for the questions, Kathryn. You stay safe and take care.

Kathryn Tuggle: (37:26)

You too. Thanks, Jean.

Jean Chatzky: (37:27)

All right. See you soon. I hope.

Kathryn Tuggle: (37:29)

Yes.

Jean Chatzky: (37:29)

And in today’s Thrive, if you think your parents’ financial situation may have changed due to coronavirus, it’s time to have a chat. Financial conversations are crucial, particularly for adults in the sandwich generation, sitting between young children and aging parents, needing to ensure financial stability for both. A recent Haven Life survey of this group found 43% currently assist their parents financially or provide physical care. And nearly 60% expect to financially support their parents or in-laws as they continue to age. No, broaching money questions with family is not always easy, but it is important. You can start by sharing some details about your own financial situation. Then dive into questions. Perhaps start by asking if your parents have enough cash on hand to offer them spending and withdrawal flexibility in the months ahead. You should ask them about their savings situation. Even if you know they have a pension, as many pensions may be impacted by the recent economic turmoil. Once you’ve discussed their near term needs, find out where to locate any necessary estate planning or medical documents, and then turn your attention to longer-term planning for things like healthcare and long term care. Having an open dialog on finances today can help you get out ahead of gaps, find stress points, and even discover fraudulent activity. Unfortunately, coronavirus has brought out scammers in full force and seniors can be a very easy target. Knowing in advance where all the documents are, who’s advising your parents and how they’re managing their finances should give everyone involved peace of mind. Thank you so much for joining me today on HerMoney. Thanks to Janine Urbaniak Reid for joining us as well and sharing her incredible personal story. Her experience is one that so many of us can relate to, I know. If you like what you hear, I hope you’ll subscribe to our show at Apple Podcasts. Leave us a review. We love hearing what you think. We’d like to thank our sponsor, Fidelity. Our music is provided by Video Helper and our show comes to you through Megaphone. Thanks so much for joining us and we’ll talk soon.