At HerMoney, we love talking about your money — your investments, your savings, your money concerns, successes and questions. We dive into all of it, including how your money makes you feel. The intersection of money and happiness, and money and health — both physical and emotional health — is such an important topic. Because, at the end of the day, THAT is why we work — we build our careers and squirrel our money away so that we can live the lives that we want, and have the kinds of experiences and things that make us happy.

But what really makes us happy when it comes to our money? There are as many answers to that question as there are people on this earth. We know most of our listeners (you!) are saving for retirement, or you’re planning on getting started soon. We talk a lot on this show about how much money you’ll need, and we often cite Fidelity’s rule of thumb for successfully funding your later years — you should aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67.

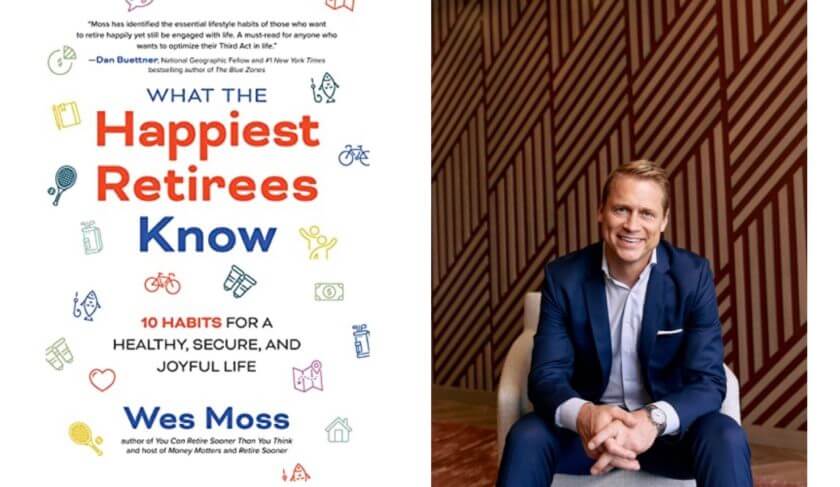

But those are just the numbers. What about the joy? What about the happy? To share that side of the coin with us is Wes Moss, CFP and managing partner at Capital Investment Advisors, host of the podcast “Retire Sooner” and author of “What the Happiest Retirees Know.” In his book, Wes shares that the happiest retirees have a minimum of $500,000 in liquid retirement savings, they’ve paid off their mortgage, they have multiple streams of retirement income, they have at least three close friends — and so much more. We dive into all of it.

We start by talking about what retirement really is these days — because many retirees are working part time, doing consulting work or volunteer work. We also talk about having various income streams in retirement — something that Wes’ research has shown can make retirees happy. We also talk about some of the “transformational habits” that the happiest retirees share, and the lifestyle choices they’re making to stay active, healthy, and joyful. (Hint: Exercise and friendship are two of the most important things!) And, yes, we “go there” with regard to sex — Wes shares the research on how often the happiest retirees are having sex.

We also break down why, during the most recent recession, retirees said they felt less stress overall than others demographics — What did they know that we don’t? Are there lessons we can learn? In Mailbag, we discuss starting to save for retirement in your 40s, and the best resources for young women just starting their financial lives (Hint: Our new HerMoney book, “How To Money,” is the perfect place to start!) And in Thrive, what to do if you know you’re going to miss a credit card payment.

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416