Have you heard of social security clawbacks? If you haven’t, it’s time to listen in to this week’s episode. Last year, one million Americans got a letter in the mail telling them the Social Security Administration had miscalculated their benefits. They had been overpaid, and now, the government wanted that money back within 30 days. How much money? In one couple’s case, it was almost $70,000 and in another’s, it was $52,000. It can take years – even decades – for the government to realize its mistake. It also doesn’t matter if it’s not the receiver’s fault, they still have to pay up — and pay up fast. Usually, within the month. The worst part of this is, if you refuse to pay them back, Social Security will stop paying you your earned benefit check until you do.

SUBSCRIBE: New episode drops every Wednesday! Subscribe to HerMoney on Apple Podcasts so you never miss the latest 🙂

Most of us don’t have $50,000 lying around ready to reimburse the government from a Social Security clawback. Especially when we’re retired or nearing our retirement years, every dollar counts. So, how do you prepare ahead of time if you’re one of the million people who got these letters, and is there a way to fight the system?

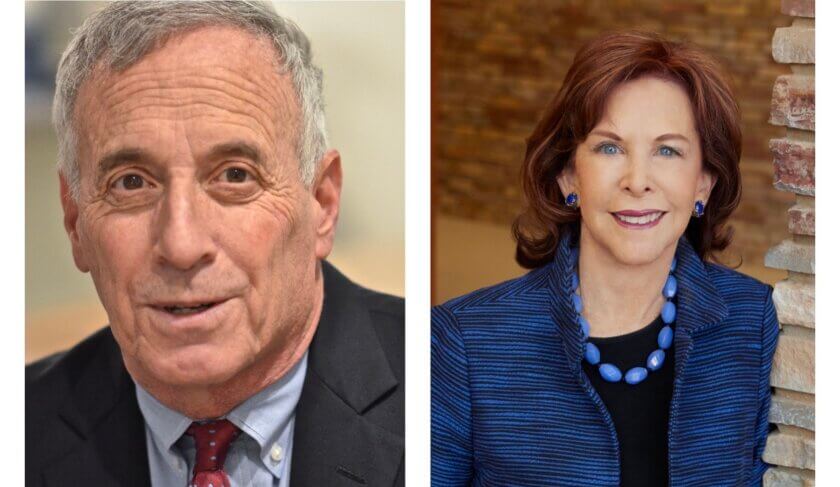

In their new book, “Social Security Horror Stories: Protect Yourself from the System and Avoid Clawbacks,” Larry Kotlikoff and Terry Savage advise using software to run the calculations and determine your payment before you apply for Social Security benefits. Terry Savage says you can use software to determine not only what your benefit should be, but also whether or not you should wait a few extra years to collect.

LISTEN: Everything Women Need To Know About Social Security

If you’re already receiving Social Security benefits, running the numbers yourself can give you a much-welcome heads up if you might be headed for a clawback — but also if you’re being underpaid. “A friend of mine has outlived three husbands,” Kotlikoff says “Her first husband was a very high earner but she never realized that she could collect a divorced widow’s benefit. And so she’s probably lost a million dollars in benefits because she didn’t know.”

Listen in to hear Larry and Terry’s advice on how to maximize your Social Security benefits, and the best next steps if you receive a Social Security clawback letter from the government.

MORE ON HERMONEY:

- HerMoney Podcast Episode 374: How To Fix Our Retirement System

- The Retirement Plan Entrepreneurs Need

- IRA vs. 401(k) — What’s The Difference?

Join the HerMoney community! For the latest episode drops and financial news-you-can-use, subscribe to our newsletter at Hermoney.com/subscribe!

This podcast is proudly supported by Edelman Financial Engines. Let our modern wealth management advice raise your financial potential. Get the full story at EdelmanFinancialEngines.com. Sponsored by Edelman Financial Engines – Modern wealth planning. All advisory services offered through Financial Engines Advisors L.L.C. (FEA), a federally registered investment advisor. Results are not guaranteed. AM1969416