With “embrace equity” the theme of this year’s International Women’s Day, I found myself thinking of the myriad ways our society needs to do more of this. For example, we know that equity in financing is all about improving access to funding for women-run companies. Yet today, there are significant barriers that limit women’s ability to start or grow successful businesses: gender stereotypes, limited access to networks and discriminatory lending practices, among other things.

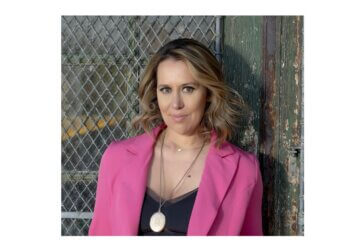

Leveling the financing playing field is my life’s passion, which is why on International Women’s Day in 2023, I launched an asset-based lending firm dedicated to financing women-owned and led businesses, JPalmer Collective. Here’s a look at why — and what we hope to accomplish in the years to come.

The Funding Gap

Just as there’s a gender pay gap, there’s a gender funding gap, and it’s massive. Since 42% of all businesses — nearly 13 million — are owned by women, and women started 49% of new businesses in the U.S. in 2021, it would stand to reason that the funding for these businesses would be commensurate. But almost three quarters of female entrepreneurs say they’ve experienced difficulty securing funding. Studies have shown that women are less likely to be approved for loans than men — just 32% of women who apply for business funds are approved. And women who do receive loans get a loan that’s an average of 33% smaller than their male counterparts.

SUBSCRIBE FOR FREE: Want more great (and free!) entrepreneurial insights? Join us! Subscribe to HerMoney today.

Women are also under-represented among both venture-backed entrepreneurs and VC investors, with companies founded by women receiving less than 3% of all VC investments, and women accounting for less than 15% of check-writers. Gender stereotypes often paint women as high-risk with less experience or less financial stability. Most money goes to businesses run by men; however, investors would be wise to bet on women-led startups. Because here’s the thing: the ones that do receive funding outperform male-run startups, and deliver more than twice the revenue per dollar invested!

Taking Risks

Another reason women receive less funding is that they’re more risk-averse. In many cases, caution can be beneficial; this instinct is just one of the many things that makes women excellent leaders. However, if you don’t take any risks in business, it’s very difficult to grow. We need to change the narrative to help women view risk as an opportunity to help their company reach its fullest potential, rather than something to fear. Women also tend to under-promise but over-deliver (which I admit is something I’ve experienced in my own quest for funding!) But moving forward we need to support women in being confident in their success, and eagerly sharing their accomplishments with potential investors and lenders.

Know The Alternatives

Because women are only more recently coming into our financial power, we haven’t had as much experience as men navigating the complex world of financing. One of the reasons I started JPalmer Collective is to educate women-led companies about the benefits of debt, either alone or alongside equity. Oftentimes, women are wary of taking on investors because it means someone else owns a piece of their company, and they must consult with them about decisions involving the business, and share their profits. (And if their ultimate goal is to sell, it also means they will need to share their payday.)

This is where debt comes in as a working capital option that may be preferable for many women, and can even work alongside equity investment. Unfortunately, all too often the risk-averse among us hear the word “debt” and think about drowning in credit card bills or student loans. But I’m here to tell you that debt is not a four-letter word. With debt, in the form of a line of credit, women can get the working capital they need, while also maintaining the control of their company and ownership of their equity (or at least more of their equity, if they also have investors). This way, women remain in the driver’s seat with their business’ decisions, and stand to retain more of their profits and eventual payout.

The Future of Financing is Female

Here’s the bottom line: Businesses can’t grow if they don’t have working capital, and businesses run by women should have the exact same opportunities for funding as those run by men. It’s time to make sure financing is female-inclusive, level the playing field and give women all the opportunities to access the working capital they need to succeed.

READ MORE:

- 4 Female Entrepreneurs On What Made Them Finally Start Investing

- 5 Women In Fintech Making History Now

- What Is It About ‘Female Only’ Spaces That Make Us Feel Empowered?

SUBSCRIBE FOR FREE: Life is the topic. Money is the tool. Let’s talk! Subscribe to HerMoney today.