It’s been a crazy year for interest, feds, banks, and mortgage rates. Thankfully, we’ve avoided a recession this year – about 61% of economists say it’s probably not going to happen in the next 12 months. But still, things are a bit scary.

And while it’s not nearly as bad, most of us can remember how scary the 2008 financial crisis was. It was the worst economic crisis since the Great Depression in 1929. People called it a “perfect storm” — a combination of predatory lending targeting low-income homebuyers, excessive risk-taking by global financial institutions, and the bursting of the United States housing bubble.

SUBSCRIBE: New episode drops every Monday! Subscribe to How She Does It on Apple Podcasts so you never miss the latest!

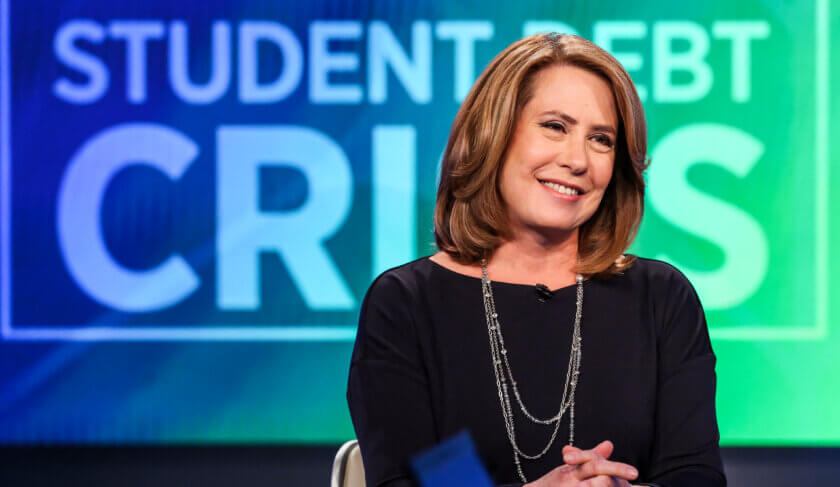

Sheila Bair, the former Chair of the FDIC who helped navigate us through our last economic crisis doesn’t think what happened in 2008 would ever repeat itself: “The broader banking system is not reflective of bank management more broadly. That’s not to say there won’t be more stress in the banking system, there will be,” Bair says, “As interest rates are going to stay higher for longer we need to accept that that’s going to put further stress on banks and the deposit funding. So banks and supervisors need to be on their toes.”

Bair was recognized with a Kennedy Profile in Courage award for her early warnings about the sub-prime lending crisis and for fearlessly criticizing both Wall Street’s and the government’s management of the subsequent financial meltdown. “We stood up for the little guy,” Bair says. “We identified with Main Street and we really pushed hard for loan modifications as well as depositor protection. We weren’t trying to bail out banks. We didn’t like the bailouts. We tried to curb them, and we were successful in some of that. But the public recognized that was because of our singular focus on the little guy.”

Now Bair’s main focus is on a great series of books called “Money Tales” that teach children about investing and money management early in life. Sheila Bair says the main piece of wisdom she hopes to impart is that people in financial services are in the business of making money. “They want to make money off of your credit card. They want to make money off of your bank account. They want to make money off of your loan,” Bair says. “Kids need to understand that this is your money. You worked hard to get this money. Hold on to it.”

MORE ON HERMONEY:

- The Eight Best Food Swaps To Save Money During Inflation

- Your Finances Need A Check-Up. Here’s How.

- Time To Shop: Holiday Gift Sets We Love For 2023 (All Under $100!)

More money news when you need it! Get the latest and greatest updates on all things investing, budgeting and making money. Subscribe to the HerMoney newsletter at Hermoney.com/subscribe!

This podcast is proudly supported by iShares. BLACKROCK and iSHARES are trademarks of BlackRock, Inc. or its affiliates (together “BlackRock”). The information provided in this communication is solely for educational purposes and should not be construed as advice or an investment recommendation. Any opinions expressed do not necessarily represent the views of BlackRock. BlackRock is not affiliated with HerMoney