New research conducted by HerMoney Media and Principal Financial Group reveals a difference in confidence levels between female and male small and midsized business owners (SMBs) when it comes to their outlook for the overall economy, confidence in money management, and attitude toward risk. The research also revealed that women business owners are more focused on driving good employee experiences and outcomes than men.

The 2023 State of Women survey from HerMoney, which included more than 500 owners of SMBs, found that nearly half (46%) of female SMB owners are feeling cautious about the U.S. economy over the next year, compared to just a third of male SMB owners (35%). However, this difference isn’t translating to how they feel about their own financial situations. For example, 42% of female SMB owners and 48% of male SMB owners feel optimistic about their personal economies over the next 12 months. (Check out the first release of findings here, which showed that the gender gap is still very real in workplace financial wellness programs.)

Gaps in Financial Confidence

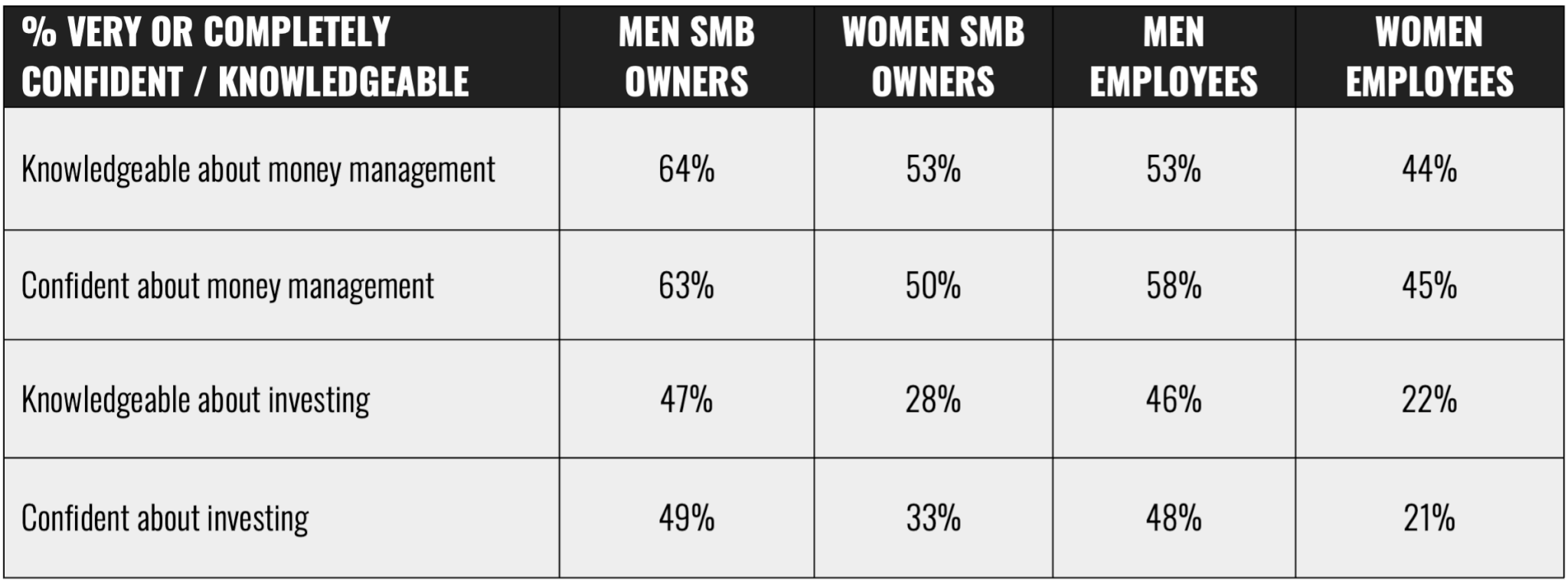

When it comes to assessing their own knowledge and confidence about money management and investing, male SMB owners feel much better than female SMB owners. In fact, when examining this trend with an earlier HerMoney survey of employees, for all measures on levels of financial knowledge and confidence, the ranks are as follows: male SMB owners, male employees, female SMB owners, and female employees.

“You need a certain amount of knowledge about basic money management in order to successfully run a business day-to-day,” says HerMoney CEO Jean Chatzky. “Yet, the fact that women business owners rank their own financial knowledge and confidence at or below the level of male employees is just another piece of evidence showing that women are not giving ourselves credit for the work we’re doing on an ongoing basis.”

The breakdown of most confident to least confident is as follows:

Taking Risks And Navigating The Future

Male SMB owners are also much more likely to take risks with their money compared to women. In the event of an economic downturn, nearly half (49%) of women SMB owners would hold tight, but only a third of men (36%) said they would do the same. Moreover, male SMB owners are much more likely to double down on their investments than female SMB owners (25% vs. 9%).

“Access to capital is important, especially during times of increased market volatility. The good news, and something we continue to hear from businesses, is that they’ve built up cash reserves,” says Amy Friedrich, president of benefits and protection at Principal. “Another trend we’re seeing is the move to cultivate connections within their local business communities. It’s important for small and midsized business leaders to find peers and trusted professionals who can help them navigate the road ahead. As they take care of their finances and employees, if a downturn does occur, they will benefit from the support in an established network.”

Women Business Owners Focus on Culture

Employees value workplace flexibility and purpose-driven work. The State of Women 2023 survey found that female SMB owners are more cognizant of this trend, rating higher than men the importance of a positive work environment (75% vs. 62%), focus on mental health and well-being (52% vs. 42%), and opportunities for advancement (50% vs. 41%) to employees.

However, when it comes to supporting employee financial wellness, female SMB owners are less likely to offer a financial wellness program (56% vs 36%), the most likely reason being they believe they have too few employees to justify a program (66% vs 55%). Men are more likely to cite cost (25% vs 12%). The majority — 77% — of employees surveyed feel it’s important to focus on financial health and well-being in the workplace, compared to 69% of SMBs.

“When times get tough, the businesses that I see perform the best are the ones that have the greatest sense of purpose and a clear mission,” says Friedrich. “During a crisis, employees can feel reassured that you and your business stand up for something. Given the economic pressures and financial stress affecting Americans, employees are saying they expect their companies to empower them in all aspects of their lives — emotionally, mentally, and financially.”

ABOUT THE STUDY:

The 2023 State of Women is based on an online study conducted in August 2023 among 510 small and midsize business owners and 900 women and men ranging in age from 18 to 75 who are employed full-time at small and midsize employers, with access to either health insurance or a retirement savings plan as a benefit.

READ MORE:

- The Gender Gap Is Still Very Real In Workplace Financial Programs

- The Gender Pay Gap, Revisited

- No, We Can’t Control Every Aspect Of The Financial Gender Gap, But We Can Take Charge Of These Three Things

JOIN US! Our best money and life advice delivered to your email box for free each week. Subscribe to HerMoney today.

About Principal Financial Group® Principal Financial Group® is a global financial company focused on improving the wealth and well-being of people and businesses. In business for more than 140 years, Principal® helps customers plan, protect, invest, and retire, while working to support the communities where they do business, and build a diverse, inclusive workforce. Learn more about Principal at principal.com.